Navigating Market Setbacks: A Trader’s Insight

Navigating Market Setbacks: A Trader’s Insight

Good day, traders! It’s Monday, February 5th, and Andy here with some fresh trade ideas despite a slight retreat in the market.

A Glance at Today’s Markets

Notably, we’ve got a minor gap down today, but let’s not get caught up in the size of the dip. The real deal lies in the setups sprawling across the board, which makes selecting a killer trade a little bit like looking for a needle in a stack of needles. Decision paralysis, anyone? Well, let’s slice through the confusion.

Watch List Spotlight: IWM’s Silent Moves

Before we delve into specific stock setups, there’s a bit of a silent player to keep your radar on – the IWM. While the Russell 2000 index hasn’t made waves just yet, it deserves a squinty eye. I won’t bore you with charts right now, but a word to the wise: if IWM starts toppling like a poorly built Jenga tower, it might just drag the big players down with it. So, keep a tab on it.

Trading Strategies and Stock Setups

Now, let’s roll up our sleeves and dive into the setups lighting up our screens.

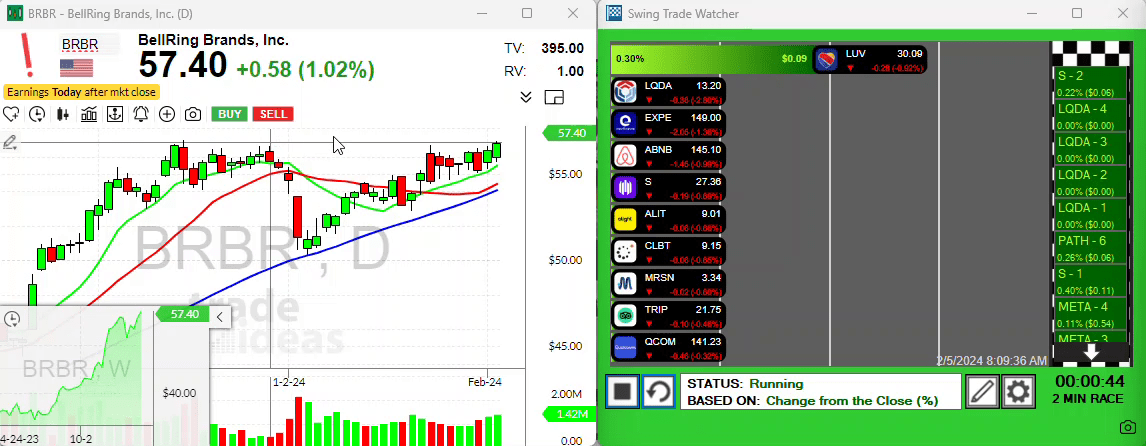

Bubbling Up: BRBR

Firstly, we’ve got BRBR caught in a dance with its ten period moving average, as cozy as two lovebirds in a nest. But here’s the twist – it’s nudging an all-time high and is showing a bullish signal with a gap up this morning. There’s potential here for BRBR to take flight, so eyes peeled for that upward swoop.

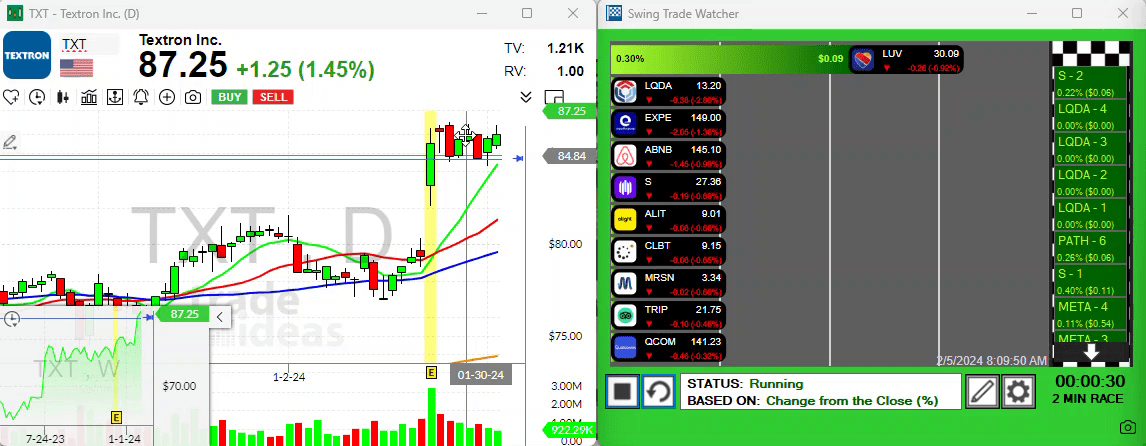

TXT: Sideways but Hopeful

Next up, Textron (TXT). Post-earnings, this stock has been doing the horizontal mambo, coasting within a defined channel. However, it’s peeking its head up with a gap up today – a sign we could be on the cusp of a grand breakout. We’ll want to see some solid volume to confirm that this isn’t just an empty promise.

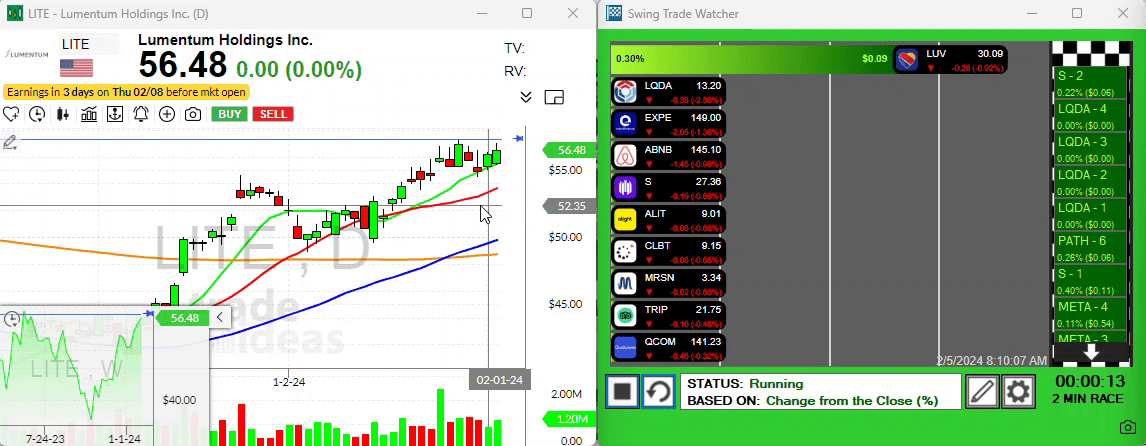

LITE: A Pattern of Potential

Moving on to LITE – the chart is showing a glorious uptrend, cradled nicely by that ten period moving average. It isn’t clear how much firepower is behind this one, but the setup is as tantalizing as a perfectly ripe fruit just out of reach. Keep an eye on a breakout past the $57.30 resistance for a potential feast.

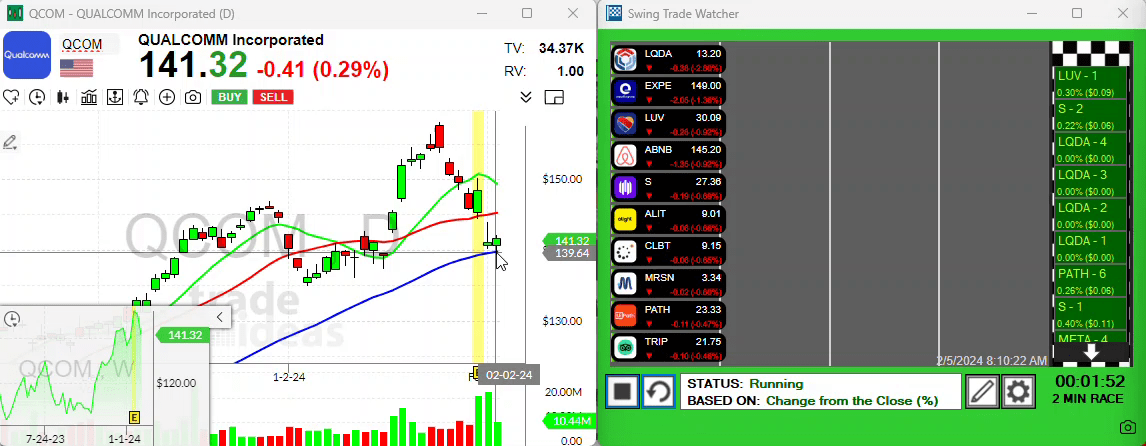

Pullbacks Worth Pulling For

While we’re on the hunt for momentum, let’s not snub a couple of enticing pullbacks. Qualcomm’s recent retreat to its 50 period average culminated in a bottoming tail on Friday – traders, that’s like a green flag at a go-kart race. A nudge above Friday’s high? And we might just be onto a runner.

Google’s Glimmer of Hope

And we can’t wrap up without a nod to the tech giant, Google. After a Friday that saw more mood swings than a drama series, it pulled a closing act above its 50 period moving average. Now that’s what we call a compelling cliffhanger. A reversal might be brewing, so keep your trading fingers nimble.

Conclusion: The Trading Continues

There’s plenty more to gab about, and if you’re a trade ideas enthusiast, be sure to sweep through the other golden nuggets on my list. That’s all for today. Gear up for an action-packed week, and let’s tackle the markets with the ingenuity of savvy traders.

Remember, the trading world is full of twists and turns – but armed with the right insights, we can ride the waves with confidence. Catch you in tomorrow’s dispatch. Happy trading!

Looking for more trading strategies, market insights, and real-time setup ideas? Don’t forget to subscribe and stay in the loop with market trends and opportunities.

This blog post is suitable for Substack subscribers who are invested in market trends and trading strategies, leveraging a casual tone consistent with the transcript and the laid-back yet informative style that fits the trading community. The post provides both insight and actionable advice, inviting readers to stay tuned for future updates.