The Potential Squeeze Play: Goose’s Earnings Stir the Market

The Potential Squeeze Play: Goose’s Earnings Stir the Market

First up, Goose rocked its earnings yesterday and stirred up a boatload of float interest. Keep your eyes peeled on this one! A potential squeeze might be brewing if it jumps above yesterday’s peak. I hinted at this possibility yesterday, and I’m doubling down on that today. Goose might just spread its wings if it soars past that crucial high, so let’s stay on top of this one.

(DKNG): Poised for a Power-Up?

DKNG has been chilling at its monthly highs, barely breaking a sweat. If you haven’t already, you might want to slingshot an alert up there. Mine already hit the target. Set that alert just a notch above yesterday’s high and brace yourselves; DKNG might just leap into action.

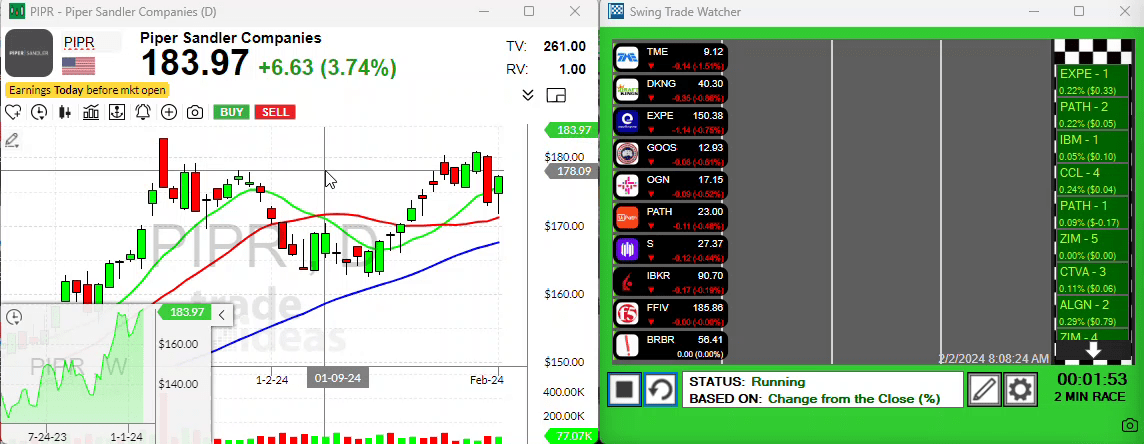

Piper: Gearing Up for a Gap and Go?

Next, let’s talk about Piper – not the cheapest stock out there at $183, but it’s more than its price tag. Fresh off its solid earnings, it’s jumping gaps straight to all-time highs. I’ve been buzzing about these “gap and go” scenarios, and Piper’s setting the stage for just that. A stock to keep under your watchful eye? Absolutely. But remember to tread carefully; those earnings plays can get wild.

Trading Giants: Amazon and Meta on the Radar

And of course, we can’t sidestep the behemoths – Amazon and Meta. I’m letting you in on a secret: I’ve got a bit of Amazon stashed away, and I’m holding tight to see which way the wind blows. Don’t turn a blind eye; these giants can sway the market.

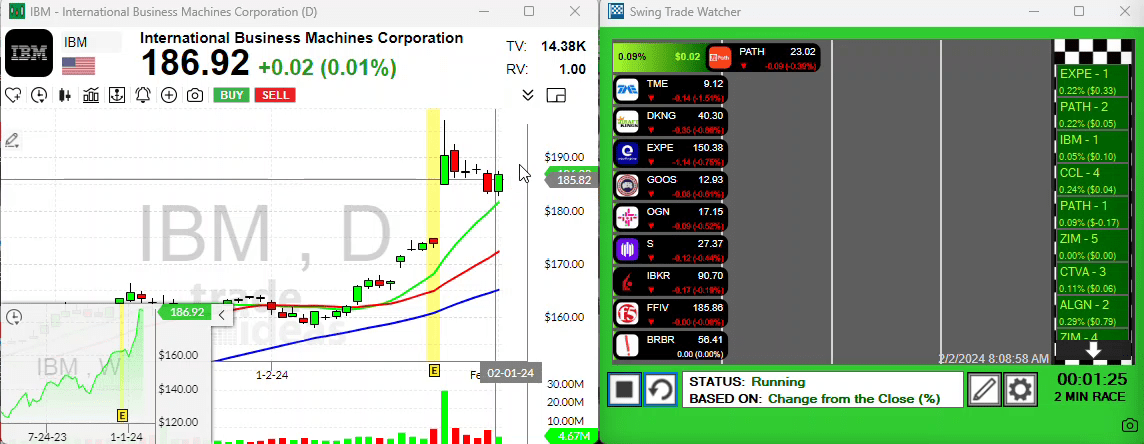

IBM: The Tech Titan at a Tactical Junction

Talking about swings, have you charted IBM’s trajectory lately? Post-earnings, it’s slid back some, cozying up to that ten-period moving average. If you’re up for it, keep an eye out for a potential pullback at that line. Setting the alert? That’s a personal call, but I’m planting mine close to a five-day high.

OGN: Poised for Breakout?

Lastly, let’s not skip over OGN. This stock is sketching out one heck of a pattern, ripe for a breakout. But that’s not all. Cast your eyes a bit further back, and you’ll catch sight of some stubborn resistance zones. OGN could be prepping for a grand escape, so keep it under surveillance.

Alright, folks, that wraps up today’s trading tips. Remember to run a tight ship, especially when the seas are choppy. We’ll catch up on Monday, but until then, trade smart and stay nimble. Bye for now!

Remember to infuse your trading with the insights shared today – let the lessons be as dynamic as the market itself. Just as we maneuver through the stock seas, pay attention to the waves and, more importantly, to the subtle currents beneath. Until our next rendezvous, keep those trades close and those strategies closer. Here’s to making waves in the trading world!