Trading Insights: Navigating the Movements and Profits as Earnings Pour In

Trading Insights: Navigating the Movements and Profits as Earnings Pour In

Hey there, traders! Andy here with some fresh trade ideas, and today I want to talk about the latest moves in the market. You might have noticed the SPY index finally breaking free from the last three days of seesawing – had a pretty neat surge on Monday, don’t you think? Personally, I grabbed the opportunity to pocket some profits at yesterday’s close. With a slew of big tech earnings on the horizon and some impactful economic data on the way, it seemed like the perfect moment for a little cash-out. A gentle reminder for you, too: never skip a good chance to secure those gains.

Let’s dive into today’s trade setups, starting with an intriguing contender: Parsons Corporation (PSN). There’s a lot going down with PSN, including some tailwinds originating from a strong sell-off, alongside a healthy dose of sidestepping. The key level I’m watching? That’s $66.80 – a breakout point that could shake things up nicely.

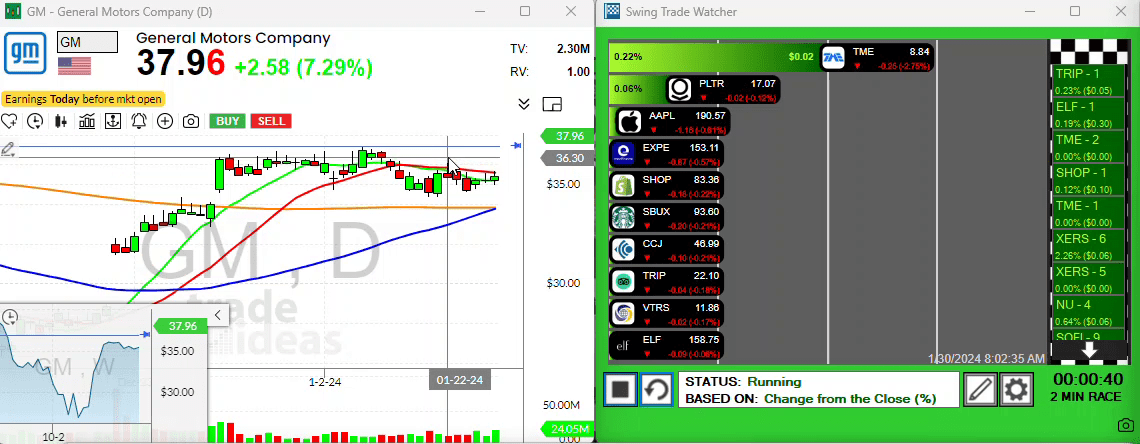

Ready for some earnings highlights? General Motors (GM) is my next pick, and believe me, there’s a lot to like here. What’s catching my eye is the pre-market activity pushing GM above a notable resistance zone. I’ve set my alerts for any pullbacks because if it snags at that level, we’re potentially in for a gap and go, ladies and gents.

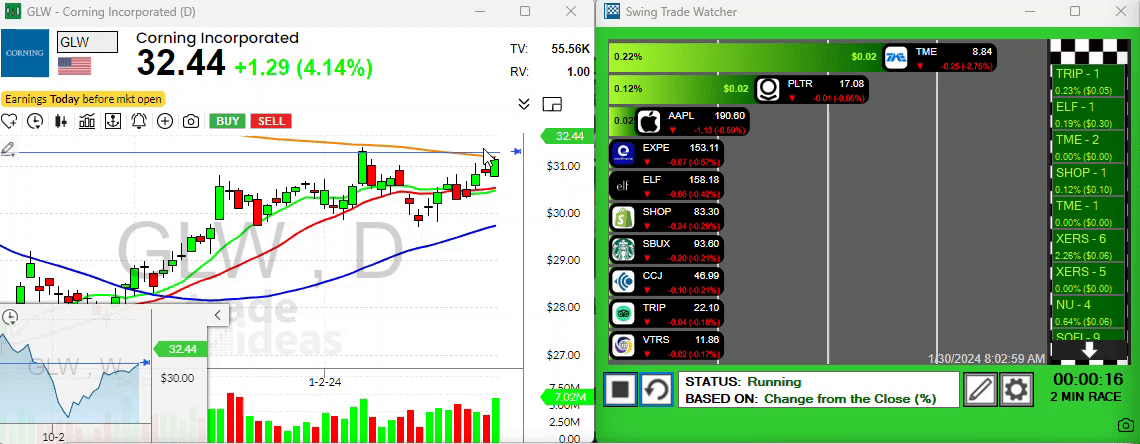

And in the same vein, Corning Incorporated (GLW) is marching to the beat of an old school drum but in a way that could spell profit for us. It’s not every day you see a stock leapfrogging over the 200-day moving average and a resistance line. I’ve tagged this one on my radar for any dips back to the 200-day on opening, so let’s stay sharp there.

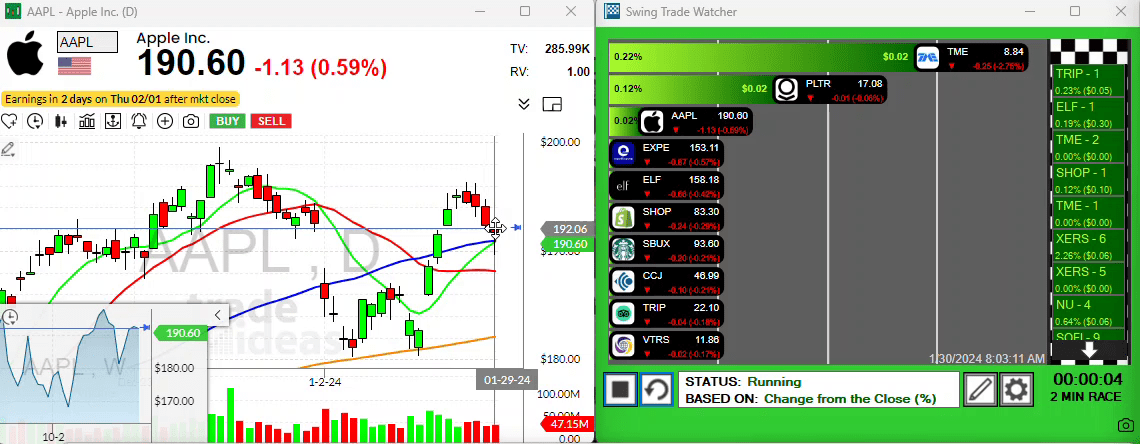

Apple – we’ve gotta talk about Apple. It’s always a crowd favorite and for good reason. Apple’s earnings are just around the corner, but even before those land, the stock’s managed a robust attempt to rally, strongly bouncing off the ten and fifty-period moving averages. What am I envisioning? A picture-perfect bar reversal above yesterday’s high seems ripe for the taking.

.

Finally, LiveRamp Holdings (RAMP) gets a quick shoutout. A quick nod to its ten-period moving average, which RAMP nicked yesterday before bouncing back – something to watch. The level to beat? $41.90.

Alright, traders, that’s a wrap for now. Keep your strategies tight and remember the mantra: take those profits before they disappear. Check back in tomorrow for another round of market-talk. Until then, take care and happy trading!