Trading in the Age of AI: Navigating Risks, Seizing Opportunities, and Upholding Ethics

Trading in the Age of AI: Navigating Risks, Seizing Opportunities, and Upholding Ethics

By: Katie Gomez

Have you ever experienced that uncanny feeling when advertisements seem to know exactly what you’ve been discussing? This phenomenon is a result of ubiquitous cameras and listening devices that now strive to predict your spending preferences. Companies discreetly install facial recognition cameras in stores, malls, and cities to record your facial expressions and real-time reactions without obtaining your consent.

Our world is increasingly resembling the reality TV show Big Brother, with vigilant AI surveillance permeating our lives through algorithms in social media apps, computer bots, and facial recognition software. This digital tracking, while transforming society, has particularly profound implications for the lives of stock traders. This article delves into the pervasive impact of digital tracking and how traders can adapt to thrive in this evolving landscape.

The Rise of Facial Recognition

From TikTok to texting, technology has infiltrated our lives more than ever. Smart cameras, employing AI, continually enhance their ability to recognize faces and emotions. Advanced machine learning algorithms analyze footage to classify age, gender, race, and emotion, which is then used to track happiness levels in different product areas. Meanwhile, the data collected by the apps and accounts you sign up for is compiled into detailed profiles about you.

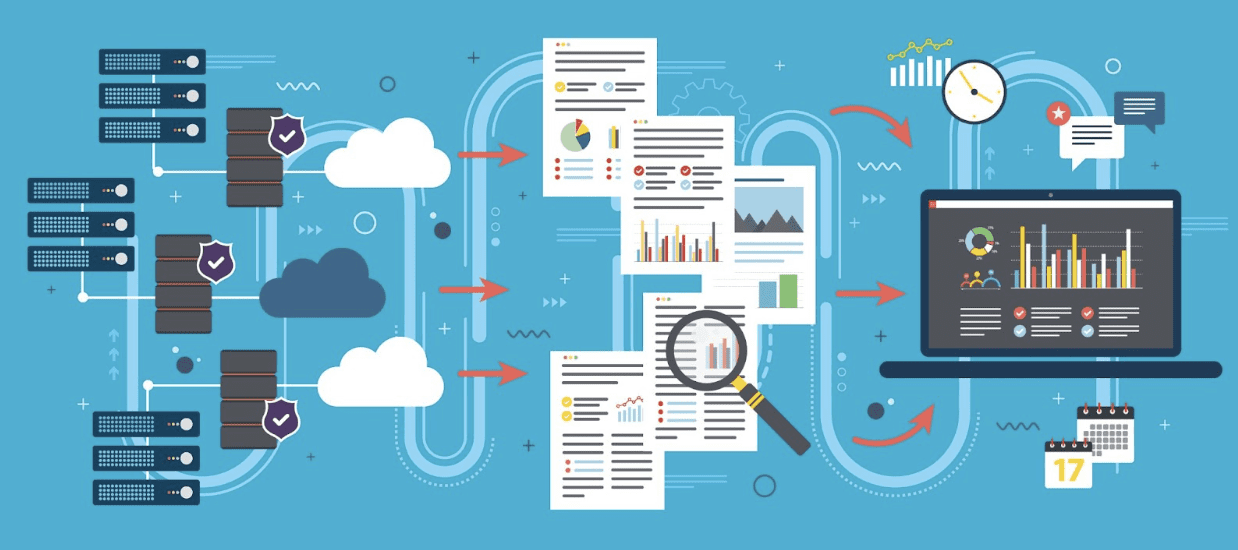

Investing apps are now seeking to leverage these data mining trends to optimize portfolios. New algorithms could recommend stocks by assessing facial reactions to earnings calls instead of relying on traditional financial metrics. While this adds excitement for newer, younger investors, it also raises concerns about the concentration of power in Big Tech and financial institutions controlling data algorithms and machine learning models.

Despite the promises of an efficient and engaging market through data intelligence, it is crucial to incorporate privacy protections and transparency safeguards. Granting select entities access to our personal lives poses ethical risks and can lead to a slippery slope.

Data Harvesting Becomes Big Business

Beyond public tracking, every app and website you sign up for or log into collects personal data, creating secret profiles on you. This leaves individuals vulnerable to data brokers selling information for micro-targeted ads or products. Even critical decisions like loan eligibility are now influenced by data mining algorithms rather than human evaluation.

Trading apps, designed to assist everyday investors, are also undergoing transformation. The same data intelligence revolution shaping shopping and Instagram Ads is reshaping investing. These apps may optimize stock or crypto promotions based on users’ past clicks and personalities.

This software demands traders become hyper-aware of their stock research, recognizing how search engine algorithms potentially shape their portfolios. Additionally, AI software can redirect market sentiment by amplifying stock recommendations based on the activities of large groups or sectors, influencing traders to follow trends.

Impacts on Retail Trading Decisions

Traders need to adapt to the future of AI and facial recognition to thrive. Understanding the manipulation of information by these programs can help traders benefit from the opportunities presented. Despite the intrusion, these technologies provide powerful datasets for current algorithmic trading systems to predict potential price movements.

Every smart device user is vulnerable to AI monitoring, including CEOs of top-earning companies. Facial recognition software can monitor CEOs’ reactions as they announce earnings, providing insights before traders decode transcripts. This democratizes market information, bridging the gap between retail traders and the elite 1%.

The Evolution/Future of Facial Recognition

As machine learning models incorporate diverse alternative data, such as satellite imagery, wearable health readings, web traffic, and search trends, they expand the signals with potential stock predictive power. Discovering correlations between emerging data sources and asset prices could drive profitable new trading strategies. However, control over model development concentrates informational power, requiring fairness and accuracy.

With little precedent, trading is undergoing a machine learning transformation. The future of facial recognition software and AI in general is expansive, potentially overhauling global finance. While data intelligence promises efficiency, the risks to privacy suggest cautious progression.

In Conclusion

With great power comes great responsibility. The next generation of traders has the opportunity to navigate a transformational investing advance. However, there’s a duty to critically examine these systems for transparency and ethical operation. As traders, we must ensure ethical viability by addressing biases, data security failures, and emerging issues. AI needs human guidance to uphold moral concepts such as privacy, fairness, and shared prosperity. Navigating the rapidly evolving markets in the new data paradigm requires thoughtful and considerate decision-making.