Ride the Market Waves: Charting Our Way in a Swaying Market

Ride the Market Waves: Charting Our Way in a Swaying Market

Hello, traders! It’s Andy here from Trade Ideas, and I’m stoked to guide you through the waves of this week’s market, captured on January 12th, a casual Friday. We’re here to decode what the charts are whispering and how we might dance with them in the coming days. So, let’s roll up our sleeves and dive into the world of trading, where chasing all-time highs is like chasing the horizon—always there, yet slightly out of reach.

The SPY’s Tease with Destiny

If you’ve been watching the SPY—the SPDR S&P 500 ETF Trust, you’re probably as intrigued as I am by how it’s shimmying close to all-time highs. It’s January 12th, and our weekly SPY chart is giving investors the side-eye, hinting at a romance with the 480 level, yet playing hard to get.

I mean, there’s a bit of a gap down today, but who’s to say by the end of this session we won’t see a flirty dance with 480? The anticipation is palpable, folks!

And here’s the dope thing about our charts—they’re agile like a cat. A quick hop and we’re in daily mode, still glancing at the weekly chart that’s conveniently thumbnailed. Keeping an eye on that 480, I’m setting a price alert because, trust me, if it inches there, you’ll want to be the first to know.

Scouting the Marketscape: Setups of the Day

Alright, onto the heart of the matter—the setups. Despite being a bit of a rollercoaster market, some stocks are just charming their way through with setups that deserve a double take.

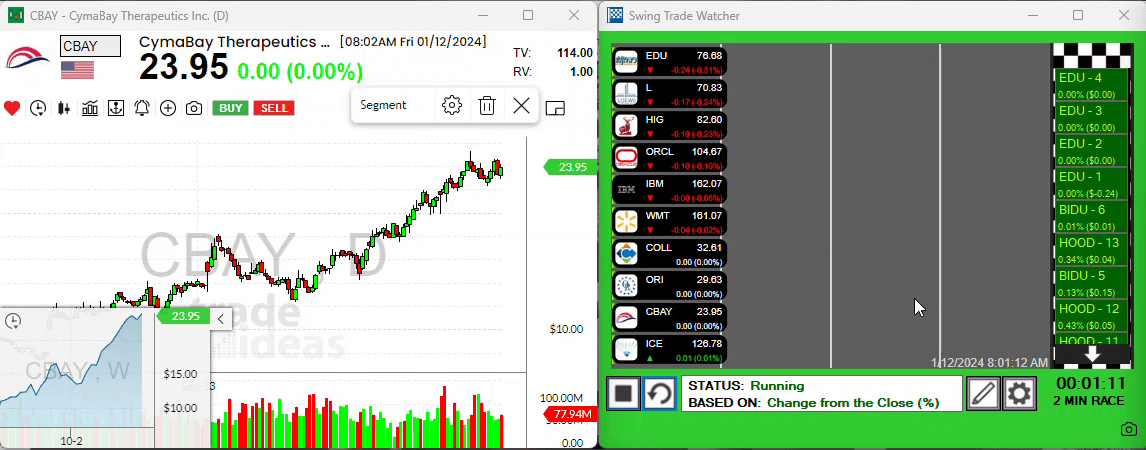

cBay’s Breakout Beckoning

First up: cBay. Let’s zoom in and appreciate this beauty. See the suspense building as it huddles below that three-day high? Our price alert here is a bugle call for when it decides to break through—don’t miss it.

Oracle’s Bounce-Back Potential

Next, we’ve got Oracle—a different play for those of you okay with courting stocks that have taken a step down from their highs. And get this: a tail formed yesterday, signaling it might be playing coy before reaching for January’s high. That low seems to be winking at us, hinting at a potential bounce. So, eyes peeled for a move passing through yesterday’s high.

ZIM’s Morning Glory

And then there’s Zim, basking in a 9% pre-market glow. I’m not gonna lie, I was all for this setup until that gap showed up, and now it’s giving me the jitters. But let’s stay sharp—if it pulls back, it deserves our attention.

COLL: A Portrait of Elegance

Spotlight on COLL! What a sight, riding that ten-period moving average. Aiming for a new five-day high above 33 could be your ticket to ride this trendsetter.

Set Sail for Trading Success

That’s a wrap for today’s market escapade. No worries if these also-rans aren’t your cup of tea—Trade Ideas is brimming with more potential gems. Exploration is the thrill of trading—keep your charts close and your insights closer.

Wishing you a lucrative close to the week, and may your trades be swift and your profits hearty. Catch you on the next wave come Monday. Happy trading, and to all a good weekend!

“Trading isn’t about predicting what happens next. It’s about reacting to what is happening now.” – The Trader’s Mantra

Stay curious, stay flexible, and most importantly, stay trading!