Unleashing the Power of AI in Trading: A Case Study on CUTR

Unleashing the Power of AI in Trading: A Case Study on CUTR

Jan 9, 2024

Hello, fellow traders and enthusiasts! Barrie Einarson here from Trade Ideas, presenting you with a fresh edition of “What Makes This Trade Great.”Today, we will dissect a particularly juicy trade involving CUTR that showcased the finesse of our Artificial Intelligence and my ten-day daily breakout strategy.To Subscribe: https://go.trade-ideas.com/SHQ

A Double Feature: AI and the Combo Scan

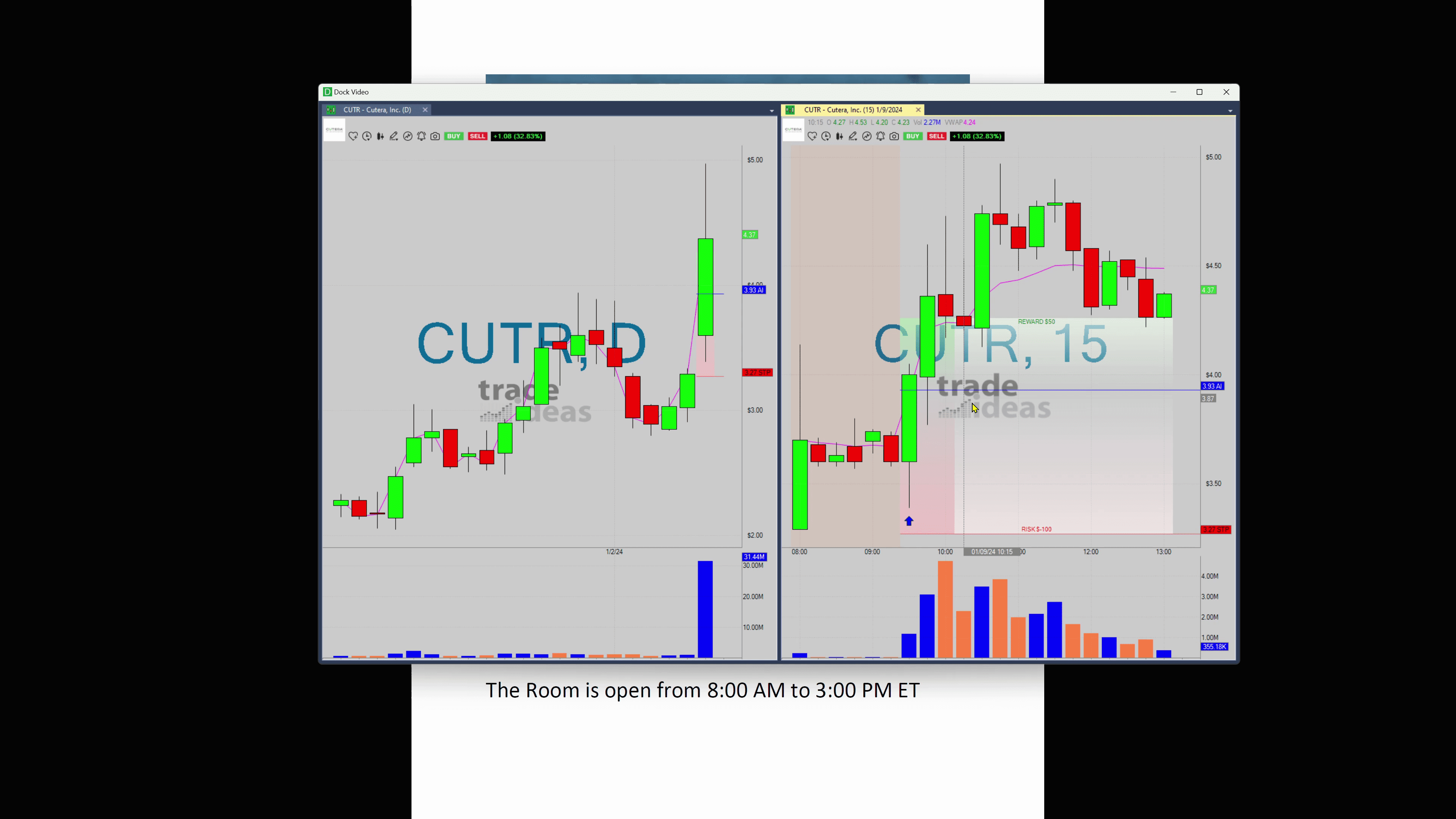

CUTR caught our attention in more ways than one, marking its presence both through our AI and, a bit later, via the ten-day daily breakout—which is part of what I like to call the combo scan. This isn’t just about one tool or strategy leading the way, but rather a symphony of analytical prowess.

Let’s break down the numbers that make this trade a standout. CUTR was flagged at $3.93 by our AI system—a level that, as it turns out, offered a prime entry point. Here’s the golden nugget: there’s often not an immediate need to jump into a trade. Whether it’s an alert from our AI, a finding from my scans, or even your own investigative digging, patience is usually rewarded. Taking the time for a bit of analysis can often yield a better entry price.

The Entry: An AI Alert at $3.93

“`// Example pseudo-code representing an AI alert for a potential trade (AI_Scan(Stock: “CUTR”) && BreakoutPattern(Days: 10)) {Alert(“Potential Trade Opportunity at $3.93”);}“`

Following the alert, CUTR exhibited a slight pullback—giving traders who hadn’t already acted the chance to step in. Remember, the financial markets are not always about who’s the quickest on the draw but also about who’s the smartest on the entry.

The Rally: Soaring to $4.73 and Beyond

Continuing with our tale, after the pullback, CUTR didn’t just recover—it soared, reaching a zenith of $4.73. That’s not merely a price increase; it’s a testament to the efficacy of AI in trading. For those who secured their position at the AI alert price, the returns were substantial in percentage terms.

“Trading isn’t just about catching the wave; it’s also about riding it just right. And CUTR? It was a surfer’s dream.”

Taking Profits and Holding On

The savvy trader knows to take profits at opportune moments. In CUTR’s case, this would have meant potentially selling some shares at that $4.73 peak. But what if you held on? The stock continued its upward trajectory, nearly hitting the $5 mark.

For those who had the foresight or fortune to ride the wave from the beginning—or even those who caught on a bit later—the gains were nothing short of spectacular.

Happy Trading. See you all tomorrow.