Searching for Trading Setups in an Overextended Market: An Insider’s Perspective

Searching for Trading Setups in an Overextended Market: An Insider’s Perspective

Hello trailblazing traders, Andy here, your trusty guide into the landscape of trading. Today, on this not-so-cold December 20 morning, we’re going to take a deep dive into the market trends and the quest of finding good trading setups in an overextended market.

The Overextended Market Conundrum

First off, I must candidly admit, as a fellow trader, the task of finding good setups is becoming increasingly challenging. With markets becoming overstretched, it feels like walking a tightrope. We are indeed witnessing a slight pullback this morning although it hasn’t brought about a significant change. So, here we are, tirelessly trying to spot those elusive setups.

Building Your Watchlist

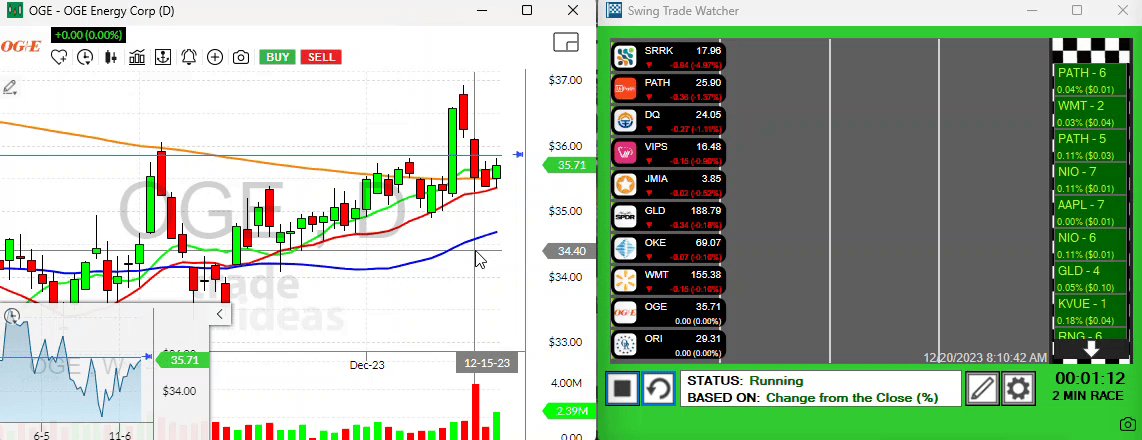

Here are a few stocks that have caught my eye:

- Srrk – I quite like how it has exhibited an impressive movement without a significant pullback. The stock transitioned into a near sideways movement. Now, a price level to watch out for is 20, which it struggled to cross. My advice would be to set your price alert. I always prefer having a head start to evaluate and react in time. While I don’t currently own any of this stock, Srrk firmly holds a spot on my watch list.Note: Always remember to keep an eye on your alerts and react swiftly to market movements.

- Path – This has stayed on the watchlist for quite a while. I’m invested in this one and am on the lookout for a break above the 26.50 level. It might prompt me to add to my position, of course, considering the larger market implications.

- Walmart – I think Walmart deserves your attention. While there’s a pullback, it’s not exactly a bottom-fishing scenario. We are still around 13% shy of the all-time highs. Interestingly, I did go in half-size yesterday and conjecture that if we can cross the 156 level, we might be heading towards the 50-period moving average. So, for those eyeing non-extended stocks, Walmart is worth watching.

- Oge – The stock exhibited an impressive move, experienced a pullback, and is now seemingly on a rebound. It’s holding above its moving averages which is a good sign. For action, consider a push above yesterday’s high. Be cautious! If it breaks and closes below the 20 level, it’s my cue to exit. Thus, it’s pretty low risk.

Tap into Trade Ideas

To keep track of all my setups in real time, I’d recommend subscribing to Trade Ideas. It’s a great tool to have at your disposal for catching these insights live.

And with that, we wrap up for today. I wish you all a fantastic trading day and remember, empower yourself with knowledge and let your instincts guide you.

See you tomorrow, and until next time, happy trading!