The Power of Abnormal Option Activity Scans: A Tale of a Successful Trade with BLBD

The Power of Abnormal Option Activity Scans: A Tale of a Successful Trade with BLBD

Dec 12, 2023

Hello, folks! It’s Barrie Einarson from Trade Ideas. I’m back with another installment of the ‘What Makes This Trade Great’ series, and today’s star of the show is BLBD.#BLBD- What Makes This Trade Great!!

To Subscribe: https://go.trade-ideas.com/SHQ

Use Promo Code BARRIE15 for 15% off

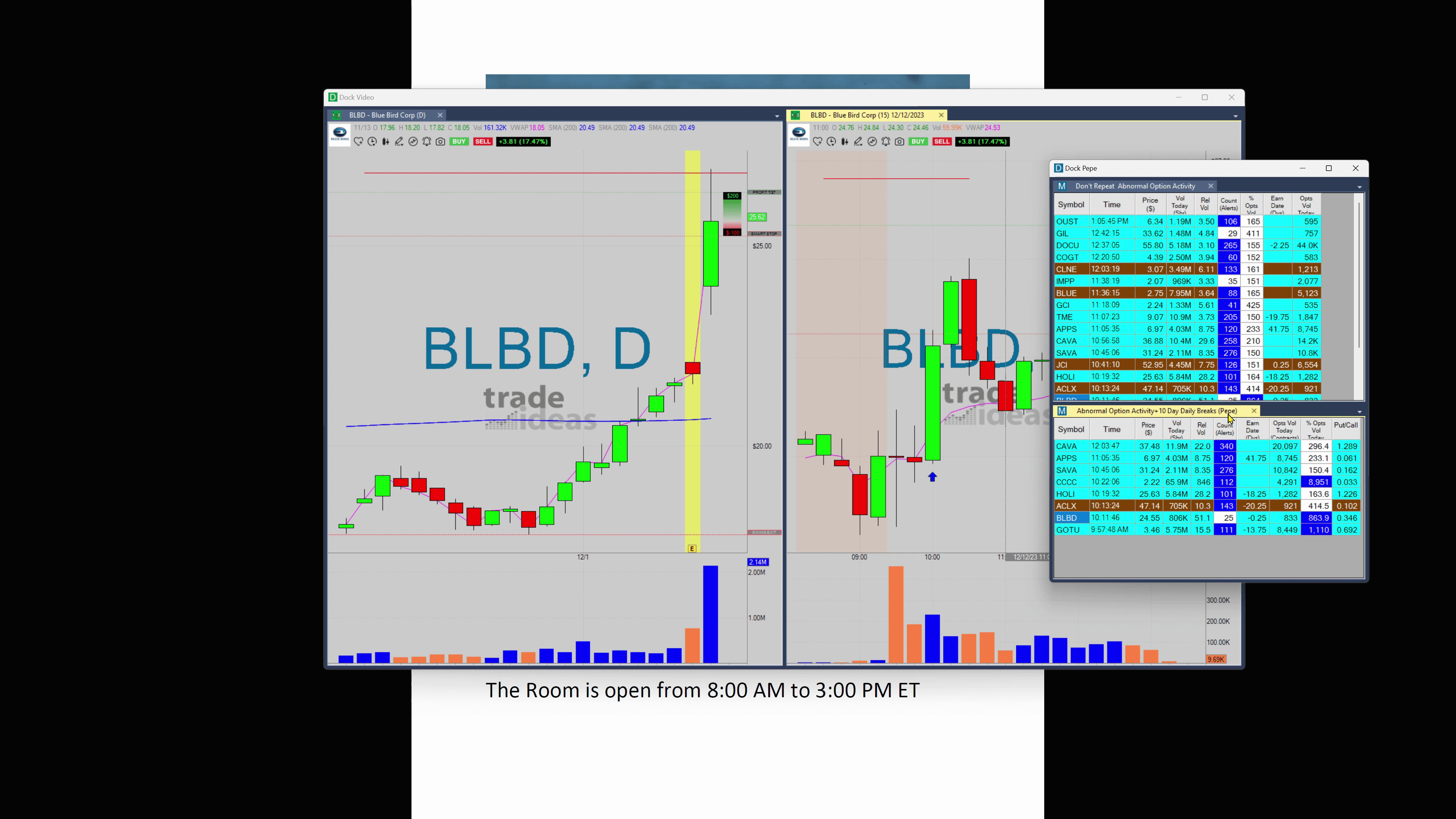

Truth be told though, this segment is not just about flaunting a successful trade. Instead, I consider it an opportunity to discuss an exciting, new, and maybe even historically new endeavor of mine: abnormal option activity plus the ‘ten-day daily breakout ‘ scan. Maybe, just maybe, this is going to be a part of my trading playbook for… well, the rest of my career.

A Tale of Successful Trade

So why this sudden affinity for scans, you ask? It all started when Pepe, a genius member of our trading community, put together this combination of individual scans. Let me clarify, just because you get an alert, the outcome isn’t set in stone. You just don’t blindly pile into every trade from an alert.

But I must say, this genius combination of scans that Pepe created worked. Here’s the proof: this worked, this too, and so did this one!

What I want to showcase today though, is the BLBD trade. We got the alert right here; to go long, the alert was at $24.55. Unbeknownst to me at the time, it was an earnings play. Imagine my delight when I saw that before it pulled back at all; it surged from $24.55 all the way up to almost $26. That’s around a $1.50 move in a quick span!

The Art of Trading Alarms

The VWAP at that time was around $24.60. Up for a piece of advice? You can always set or reset the alert. The original alert was at $24.54 – $24.55. Resetting it around the VWAP area could be a strategy: reset it as it moves back down. Now, I will not tell you that I knew with absolute certainty it would execute this way. But guess what? It did.

This tactic actually turned this into a better trade. To put it in perspective, the original alert moved from $24.55 before it pulled back at all, all the way up to $27.

The golden rule of the market? Expect some pullbacks. So, yes, eventually it did pull back a bit.

As I always mention, think of alerts like a watchlist. Missed it the first time? Set a price alert at maybe a VWAP or a moving average that you like to see it pull back to, or maybe right at the original alert price. There are myriad ways to trade those alerts throughout the day and trust me, it’s delightful!

Guys, as trade enthusiasts, we should be continually learning, adapting, and taking in whatever the market throws at us. Embrace it and make it work for you.

I hope you find this post helpful. As always, I encourage feedback and dialogue. Let’s all learn and grow together!

Stay tuned as I acquaint you with more such trades, tips, and much more when I get back into the room. Hope you have a rewarding day in trading.

Here’s to seeing you tomorrow!