Do the Doable: Essential Tips for How to Keep Stock Trading Simple

Do the Doable: Essential Tips for How to Keep Stock Trading Simple

By Katie Gomez

The overwhelming turnover rate of stock trading as a career begs the question, “Why do so many people give up on trading?” The answer is simple: they are doing too much too soon, with the expectation of immediate gratification. Like anything in life, slow and steady wins the race; our consistent efforts create the biggest successes in stock trading and investing.

We currently live in a generation of people stuck in an endless cycle of overworking themselves and experiencing burnout. Working smarter, not harder, has become a platitude in recent years because everyone says the former is the key to success. However, it seems like no one really explains how to achieve that state. The key to working smarter, avoiding the toxic cycle of stress and burnout, and consistently improving as a trader is to do the doable.

When You Are Just Beginning

When starting in the market as a trader, it is easy to become overwhelmed by the sheer amount of information, data, and strategies. Endless books, courses, and forums can cloud your process instead of clarifying it when beginning to trade stocks. That is why keeping it simple early on is critical. Furthermore, if you overwhelm yourself by diving head first into high-risk, high volatility, you essentially sign your own exit slip. When we force ourselves to meet specific quotas or build portfolios comparable to those we know or see on social media, we lose the opportunity to actually create a foundation for a healthy and profitable financial future.

Doing the doable means simplifying your approach to stock trading to implement it into your life more seamlessly. Doing the doable involves streamlining your stock trading approach for a more seamless integration into your life. Instead of trying to speed up the process and accomplish everything at once, doing the doable sets you up for consistent success and decreases your run-ins with burnout. Here are some tips to help you filter out the noise and simplify your trading today.

Start Small

Resist the urge to trade dozens of different stocks right away in a quest to diversify. Real diversification comes from having a balanced portfolio of uncorrelated assets, not just having a lot of holdings. When first starting, focus on just 1 or 2 stocks you thoroughly research and understand.

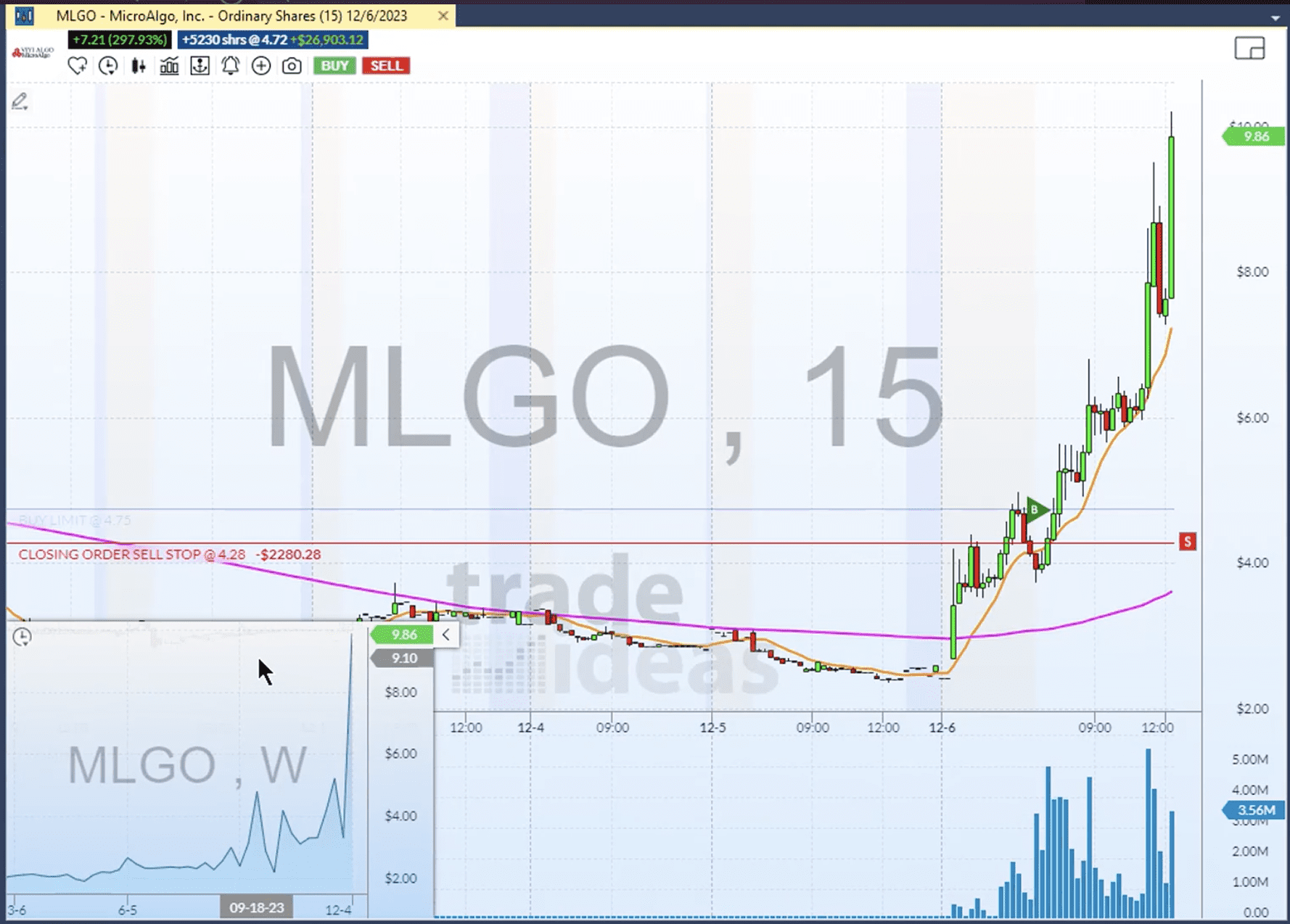

Master Chart Basics

At first glance, technical analysis charts seem filled with obscure patterns and indicators. But in reality, charting is essentially support, resistance, trends, and volume. Learn to identify key levels and zones where buyers or sellers may enter. Avoid overloading your portfolio or your senses.

Focus on One Strategy

There are countless trading strategies, from day trading to swing trading to positional trading. Don’t hop around constantly between different methods as a beginner. Stick to a single strategy like swing or positional trading and get good at it through practice. The more consistent you are in sticking with your strategy, the more you gain foundational qualities that make a great trader.

Set Stop Losses

Using stop losses may be one of the simplest yet most powerful things you can do to manage risk, especially when getting started. Stops automatically limit losses by exiting positions if a stock falls below a defined price level. It’s an easy way to implement discipline.

Review Performance Periodically

Setting aside time periodically to review your trading performance is essential for identifying what’s working and what’s not. But don’t analyze trades daily when you’re new, as that can lead to emotional overreactions. Stick to weekly or monthly reviews.

We often complicate matters by adhering to a predetermined timeline or specific expectations about how things should unfold. By shifting our focus solely to the content or the “what,” we alleviate stress and urgency. Sure, as we see in the stereotypical versions of traders in movies such as Wolf of Wall St, we associate success with constant work, 20-hour days, intensity, and passion; the brightest flames often burn out the fastest. The less glamorous side of success is the long road, starting slow, building a foundation, learning new skills, and continuously growing as time passes.

In conclusion, trading does not have to be overly complex, especially when starting to build your foundation. Simplify the variables and stick to the essentials. This simplified mindset and process establish positive habits that support your long-term growth as a trader. It may be less exciting, but it does not lead to burnout. Following these tips, you are less likely to quit after failure, and you are likely to reap much more consistent rewards.

Invest what/when you can, learn when, risk when, and re-evaluate when you can. Shifting your mindset from aspiring to be a stock trader to seamlessly integrating stock trading into your life reveals that it’s not as intimidating and intense as you once perceived.

Learn how to work smarter, not harder and compartmentalize your trading journey at Trade Ideas today. Our new software is now on sale, for an additional 15% off use the promo code KATIE15.