Trade Ideas for Early December: Market Watch and Stock Picks

Trade Ideas for Early December: Market Watch and Stock Picks

Dec 1, 2023

Hello traders, Andy here! I’m back with fresh trade insights as we delve into December. It’s the start of the month and I’m eager to discuss various stock setups that caught my attention this week.

A Look At The Market: Riding The Moving Average

Yesterday, December 1st, the market showcased an impressive performance. Right on the close, an incredible ‘stick save’ occurred, a striking bounce off the ten-period moving average, wrapping up the day with somewhat of a spinning top nestled inside that red bar inherited from the day before.

For those unfamiliar with the term, a ‘stick save’ refers to a situation where a potential market downgrade is promptly countered by rapid buying, thereby offsetting losses.

As we step into the weekend, we see a slight pre-market downward gap – perhaps a reflection of profit-seeking as the week winds down. But let’s shift focus to key stock setups to keep in your sights.

Breakdown of Stock Setups

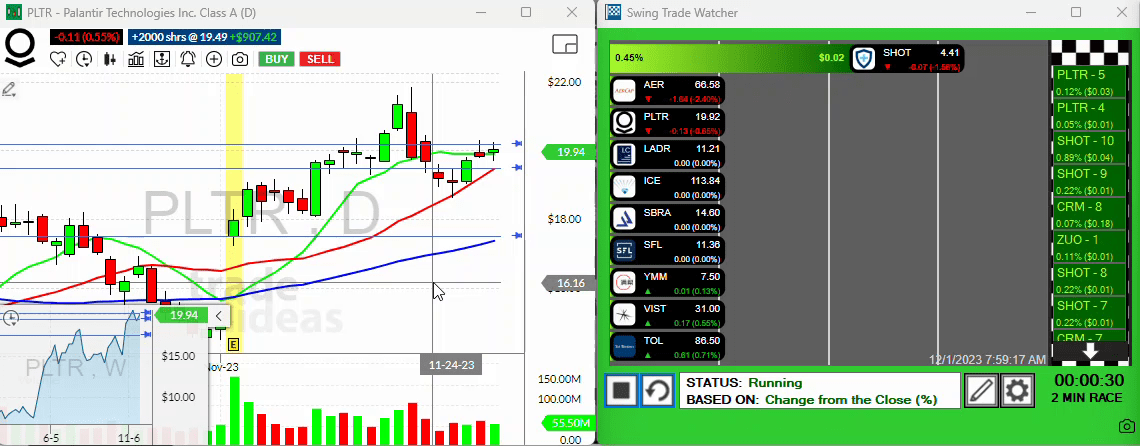

PLTR: Ascending Potential

First up on the list is Palantir Technologies Inc., symbol “PLTR.” This stock has showcased a promising setup. Full disclosure here, I’ve got some stakes in this one.

Checking the chart, we can observe it’s brushing its ten-period moving average subtly, hinting at an upward momentum. It flaunts a fresh three-day high and, striding back a bit, a six-day high. Establish a price alert on this two-day high and keep a close eye on any significant activity with PLTR.

ARK Stocks: Moving Up The Path

Next one to highlight is the bundle of ARK stocks, one in particular with a notable journey is “Path.” Earnings were reported yesterday and the results were impressive, to say the least. It earned the title ‘Trade of the Week,’ deserving enough that I held onto some overnight.

YMM China Holdings: A Green Bar in The Red Economy

Talking about “YMM” let’s navigate to China. It’s been a tough ground, indeed. But amidst the hardship, YMM has shown potential worth exploring. A remarkable green bar was followed by a retreat, then a battle with the ten-period moving average.

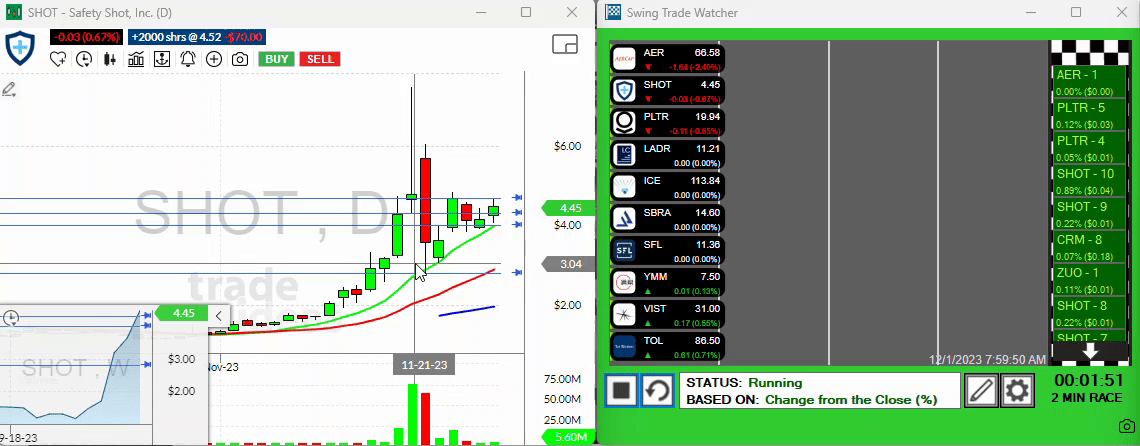

Moving on, keep an eye on “SH.O.T”(ShotSpotter) as well. It’s a stock more suited for momentum traders given its volatile nature. That said, it’s presented an attractive setup. Benchmark a price alert if it manages to step beyond yesterday’s high – SH.O.T might just have more vigour up its sleeve.

Finally, wrapping up with Brookdale Senior Living, “BKD.” It’s been showing a couple of incremental pushes higher, now looking to play tag with its ten-period moving average. With a price alert set above yesterday’s peak, BKD appears to be in a favorable position.

That about wraps it up for this lively Friday. Our focus today was majorly upon the setups present in the market and we indeed found a few. There are more opportunities if you know where to look. Wishing all traders a productive weekend and remember: Stay vigilant, stay informed, and let’s make some profitable trades!

See you bright and early on Monday. Until then, happy trading!