Trading Ideas for a Changing Market

Trading Ideas for a Changing Market

Hello, traders! It’s Andy here with the latest trade ideas. November 30 marks the last day of this month and it sure has been an exciting ride for us in the world of stocks. Today, I will be sharing my insights on the market, discuss a few notable stocks, and my take on where they might be heading.

A Recap of Recent Market Events

Let’s start with the SPY, where we recently experienced the first red-bodied candle in quite some time. If you aren’t too familiar with candlestick graphs, a red (or black) candle essentially symbolizes a ‘down day’ where the closing price is lower than the opening price. It signifies selling pressure or bearish sentiment in the market.

This candle looked a bit like a spinning top or a doji, indicating a potential reversal or indecision in the market. Following this, we saw a close near to the lows, hinting at increased selling and potentially lower prices to come. However, we’re observing a bit of a gap up today, possibly boosted by some earnings releases.

Finding the Needle in the Haystack: Stemming from Earnings

Indeed, finding solid setups in the current market environment has been a bit tough. However, we did spot a gem in the form of Path, which turned out to be our trade of the week.

We’ve held onto this one for a good few days, and it has rewarded us with a decent two-day move. We’ll need to watch this one closely over the next few days as it will be releasing its earnings soon.

Another category I have been finding interesting setups in is the Ark stocks. I’ve been increasingly focusing on these and I think you should too.

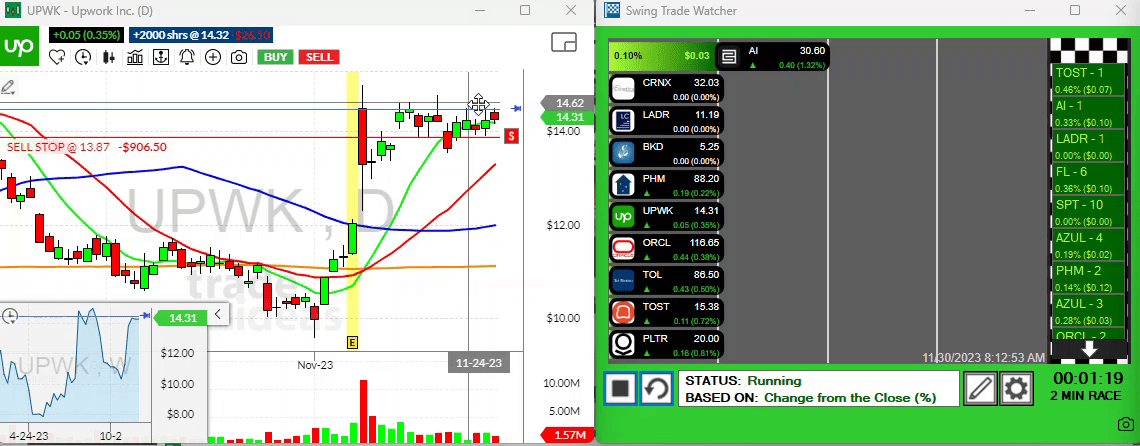

Key Stocks to Watch: Upwork & Co.

Let’s talk about Upwork. This is one that I’ve been holding onto for a while now. If it manages to break through its recent five-day highs, there might be potential for a decent upside. It’s been flirting with the $14.50 level, so that’s a price point to keep an eye on.

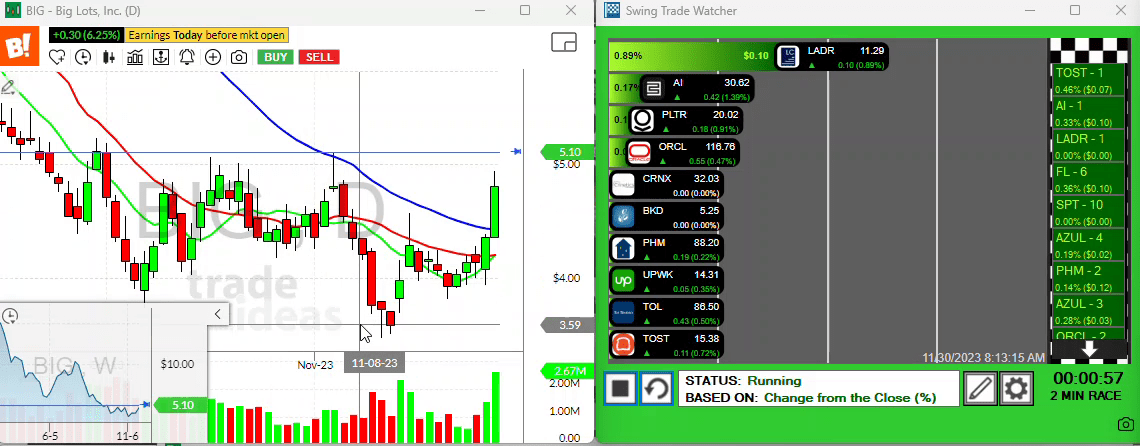

Big Lots is another interesting one, especially as an earnings play. Despite mediocre earnings, it’s currently gapping up above a key pivot level. As it stands, it has a high short float of 30%, implying there’s potential for a short squeeze here.

BSKD is another one that’s caught my eye. After an explosive move over three days, it’s now hovering around its ten-period moving average. I’ve set a price alert on this one, and so should you.

A Glance at Ark Stocks

Asan and AI PLTR are other stocks I’ve been watching, guided mostly by price alerts set at their respective two-day highs. Given the bullish trend in the Ark stocks, these could see some serious movement if they stay ‘enflamed’.

But as with all trading, remember to stay cautious and flexible. There could be more opportunities out there that I might have missed, so keep an eye on the AI stocks on your radar as well.

Wrapping Up and Looking Ahead

Time always seems to fly when talking about stocks. Though I wish we had more time to delve deeper, I’ve got both eyes on some of the AI stocks, mainly AI and PLTR, as they might spark interesting opportunities in the coming days.

Remember, keep your trades tight and always stay alert in this ever-changing market. We’ll catch up again tomorrow with new insights. Trade safe, everyone!