#Taking A Stock Both Ways: The Incredible Potential of Dual Directional Trading

#Taking A Stock Both Ways: The Incredible Potential of Dual Directional Trading

Nov 28, 2023

Hey there, this is Barrie Einarson from Trade Ideas bringing an exciting edition of “What Makes This Trade Great”. Today, I have a fantastic example of how one can make money both ways on a stock. Let’s get right into it. To Subscribe: https://go.trade-ideas.com/SHQ

Use Promo Code BARRIE25 for 25% off

#Unleashing The Power of Dual Scans: The Case of Cabba

You may be wondering what the “both ways” mean. Well, the buzzword here is, you guessed it, “Cabba”. If you’ve been following my blogs or have been in the trading room with me, you know that I strive to enlighten traders about significant opportunities that can emerge when we see the appearance of the same stock in two distinct scans.

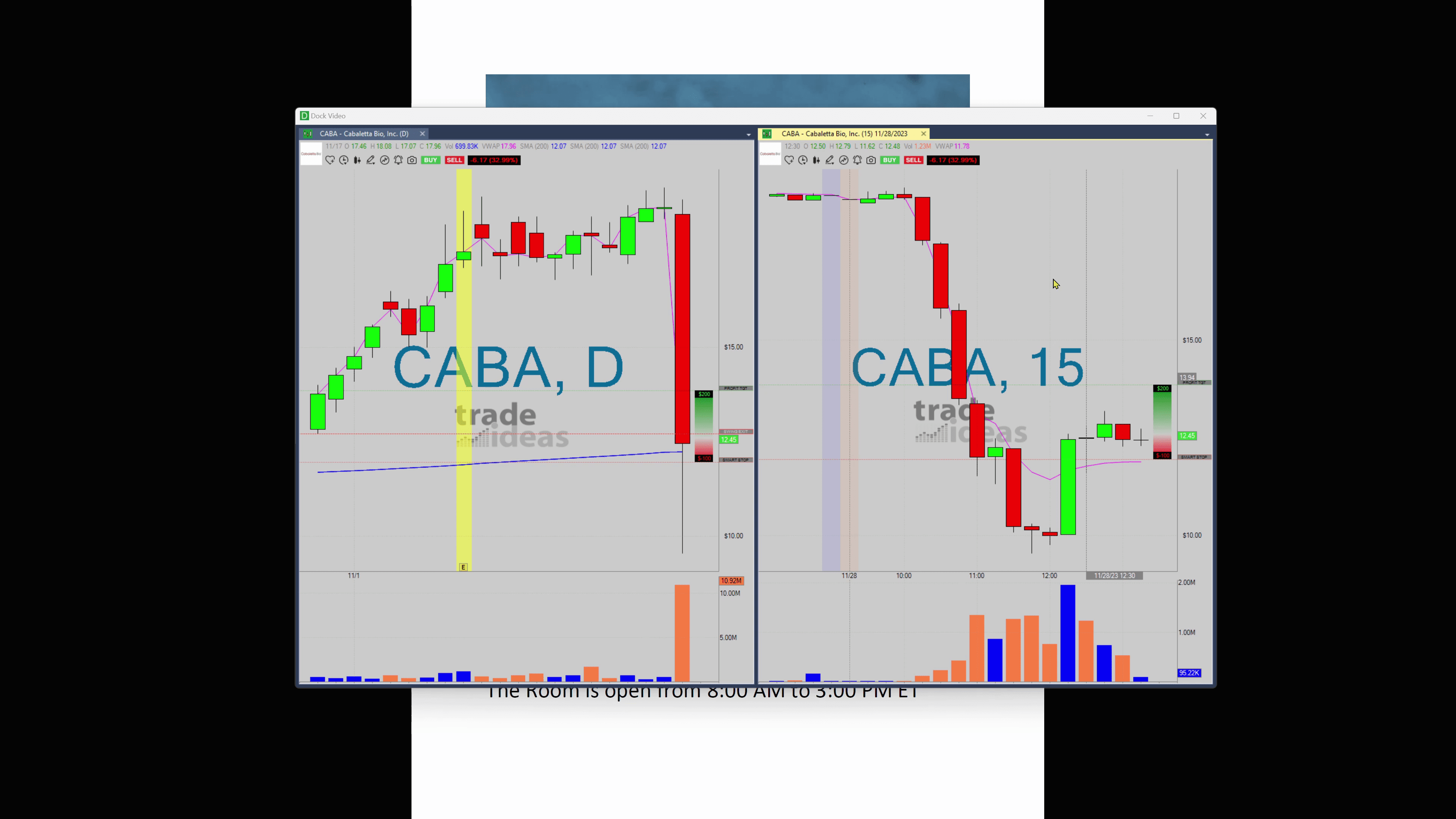

On this occasion, Cabba emerged in my ‘Abnormal Option Activity’ scan and the ‘Ten Day Daily Breakdown’ scan. This repetition is not something to dismiss lightly; it’s a clear indication that the stock is one worth paying attention to.

Just for context, let me share with you the timeline of what transpired. Our story starts at 11:16 Eastern time. The plan was simple yet valid: short Cabba once it taps the 1150 price point.

Incredibly, what happened after the alert was that this value shot up, all the way down to 1050. That is a jaw-dropping $2 drop!

Here, I’d like to highlight:

If you see a stock that makes it to both the ‘Abnormal Option Activity’ and ‘Ten Day Daily Breakdown’ scans, don’t ignore it. Pay close attention.

Subsequently, our fellow trader, Pepe from the trading room, brilliantly combined both scans. This saves you from having to check each scan separately, thereby facilitating a more efficient identification of promising stocks.

##The Advantage of Identifying Rebounds: Trading Room Illuminations

However, the journey didn’t just stop there. Shady, another member in our trading room, keenly observed that Cabba was set to make a bounce. And bounce it did, after his alert at around the 1035 mark.

This isn’t some negligible bounce we’re discussing! We are talking about a rally tremendous in nature. The implication here is simple yet profound. There’s potential for profit on both ends of the spectrum. You can earn profits short-selling when the stock dips and then earn again from the bounce or rally.

Imagine how great it would be to witness these movements all live in real time. That’s exactly what you would’ve experienced if you were in the trading room with us.

##Conclusion

That’s it for me today, traders. It’s been a delightful adventure, highlighting how one can make a killing on a stock going both ways- the short and bounce sides. Always remember to make the most out of your trading tools. In this case, simultaneous scans can act as your secret weapon to maximise your profit.

Let’s head back to the trading room where the real magic happens. Have a great evening and see you tomorrow for more illuminating discussions on trading. Bye!