A Deep Dive Into Trade Ideas for the Emerging Stock Market

A Deep Dive Into Trade Ideas for the Emerging Stock Market

Welcome, traders! Andy here, your market analysis sidekick and guide on this exciting journey of trade ideas. It’s already the 28th of November and, just like we expected, we’re still watching the S&P 500 Index (also known as the Spies) on its remarkable run. So let’s dive deep into the current trends and get equipped with some potential trade setups for the potential explosive up move.

Understanding the Current Market Position

Over the past few days, this uptrend seems to be a bit winded, hinting at the market reaching its saturation point. Although we are experiencing a bit of fatigue at these levels, it’s also evident that we’re not really hitting any major pullbacks. So, let’s keep our fingers on the pulse and see how the situation unfolds.

Spotlight on Potential Trade Setups

Today, our spotlight shines on some stocks that are carefully aligning for an optimistic ascension. These setups are primed for potential significant upward movement.

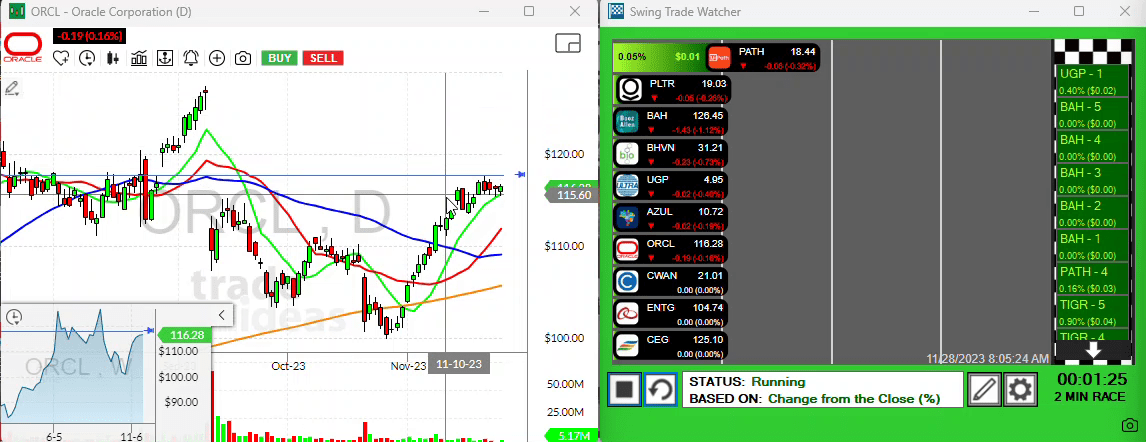

Oracle Corporation (ORCL)

First in line is the old school legend, Oracle. This tech titan’s recent price movement sheet shows a promising setup.

Poring over the last few trading days, you’d notice a trend around the 10-period moving average—Oracle has been hovering at this level and bounced off nicely. I’ve set a price alert at around $117.50; crossing this threshold could signal a possible jump. Roaring above this level will steer us into the gapping regions, where two substantial gaps stand, promising even more considerable price jumps.

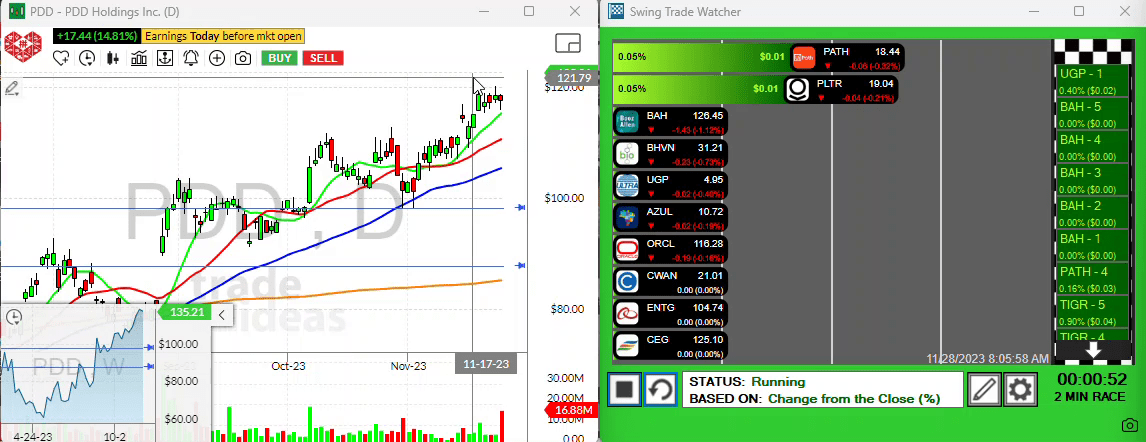

Pinduoduo (PDD)

Next in line for a spotlight is Pinduoduo, an exciting earnings play.

With a pre-market gap up of about 15%, PDD makes for a compelling albeit tough prospect. Exhibiting a clean setup going into earnings, it’s worth considering for a potential “gap and go” trade. However, I’m generally wary of chasing stocks already up 15-20%, so might be interesting to see if a pullback occurs and how it trades over the first 30 minutes.

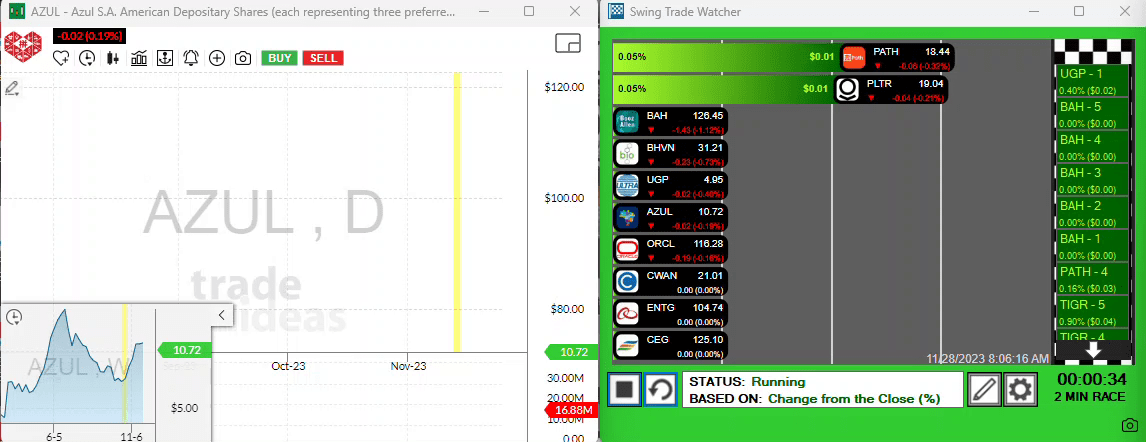

Azul (AZUL)

Moving on to Azul, the strong setup indicates a promising trade opportunity.

This stock exhibits a sturdy structure post-earnings (marked in yellow), though it seems to be moving in a choppy sideways manner. Tracking its 10-period moving average, I’m looking for a potential explosive move upwards.

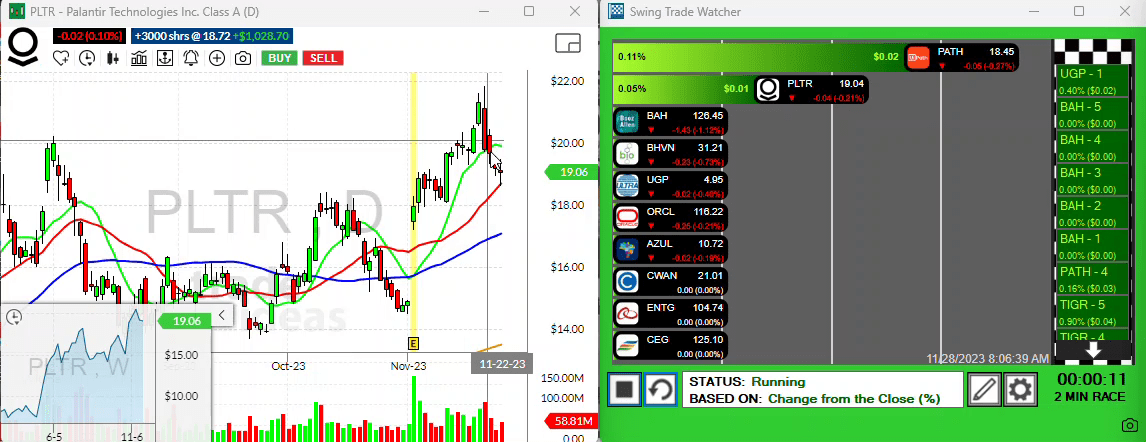

Palantir Technologies (PLTR)

Last but not least on our list, Palantir Technologies is a stock I’ve enlisted for a pullback play.

Simply put, a pullback play involves buying after a decline in hopes of profiting from an ensuing upward move. I bought PLTR off the 20-period moving average yesterday and have been watching it take its course.

During this event, I managed to get my bid around $18.70 I believe and been watching it closely.

To sum up, that’s all for the day folks! Keep your eyes on these possibilities and remember, always stay disciplined and strict with your risk management. We’ll catch up again tomorrow to analyze and discern more opportunities from the market. Until then, keep it tight and happy trading!