A Deep Dive into the Shot Stock: An Unusual Liquidity Opportunity

A Deep Dive into the Shot Stock: An Unusual Liquidity Opportunity

Nov 21, 2023

Hello everyone, this is Barrie Einarson from Trade Ideas, and welcome to today’s edition of ‘What Makes This Trade Great’. Today, we will be diving deeper into Shot, a stock that has caught my eye recently. I’m sure you’re keen to find out why I think this stock is interesting, so let’s dive right in! Feel free to explore my Home Page, where you can acquire Trade Ideas scanners at a discounted price of Use Promo Code BARRIE25

Don’t Leave the Market without Your Shot

So, who (or what) is Shot? If you’re not familiar with the story, then hold tight as you’re in for quite a ride. Shot claims to have developed a beverage that can lower blood alcohol content and provide enhanced clarity. Not a vaccine or an injection, we’re talking about a drink here, a potential game-changer in the drink industry, particularly during the holiday season when celebratory toasts may get a bit out of hand.

Shot is planning to release this beverage on Amazon and their home site just in time for the festive December rush. Given the unique concept behind the product and its timely launch, all eyes are on Shot.

Despite its compelling story, Shot has not been an easy intraday trader. It can exhibit some wild swings, which certainly adds to the excitement of trading it, but also raises the stakes.

What You See in the Scan

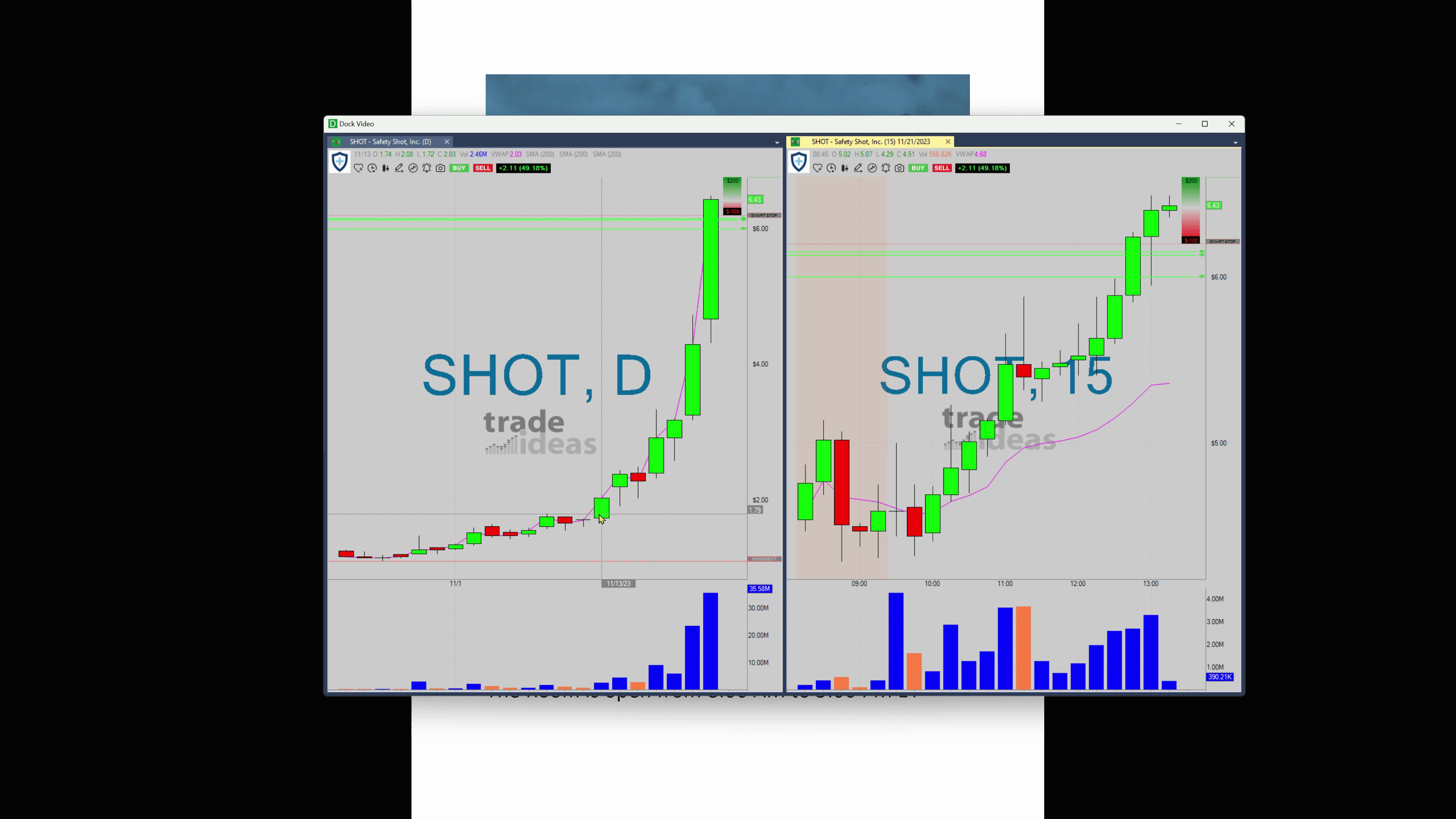

One of the tools that has proven particularly valuable to me when navigating the unpredictability of Shot is the ten-day daily breakout scan. I admit I could’ve noticed this earlier. But when Shot hit 507, even though it had already moved a bit, it caught my eye.

This method of scanning can expose potential breakouts that could yield successful trades. It’s all about timing and getting in while the momentum is building. But where is Shot heading? That’s hard to say.

To Finance or Not to Finance

At some point, it would seem logical for Shot to undertake a financing round. After all, the company doesn’t have much capital and is currently losing money, so leveraging the surge in their stock price from about $1.30 to $6.50 seems wise. If they don’t raise funds now, when their stock is buzzing, it would be a totally missed opportunity.

So there you have it – that’s the story of Shot. I find it a fascinating prospect and I am even contemplating buying some of their product just to see what the hype is about. I’m not a regular drinker, but I’m quite excited to see if their claims hold any water (or should I say alcohol).

That’s it for today. Don’t forget to drop your comments and your thoughts on Shot. Let’s continue to stay on top of the trading maneuvers together in our next session. Have a great evening and see you tomorrow.