Spotting Trading Opportunities: A Peek into the SPDR S&P 500 ETF

Spotting Trading Opportunities: A Peek into the SPDR S&P 500 ETF

Hello, traders! I’m Andy with Trade Ideas, and as of November 20, a Monday morning, I’ve been heavily scrutinizing the performance of the SPDR S&P 500 ETF (SPY). Let’s dive into its recent movements and explore where potential trade opportunities lie.

Track the SPY: An Unexpected Continuation

Given the previous several weeks of strong performance — almost a month’s worth in fact — I was banking on a pullback by now. However, the resilience of the SPY caught me off guard. There is an interesting double-top pattern forming that is well worth paying attention to. I’ve even set up a price alert at that level. Will we be testing this in the coming days? Only time can tell.

Let’s serve you a dose of reality: we’re not quite seeing robust pullbacks. But the market is constantly on the move, and new opportunities are always around the corner.

Identifying Potential Trades: A Closer Look

Among my selected setups this morning was AI. This wasn’t a random pick — it was the chosen ‘Trade of the Week.’ Moreover, it made it to both my and Steve’s lists, which makes it all the more promising. Keep your eyes peeled for a likely move back above 30.

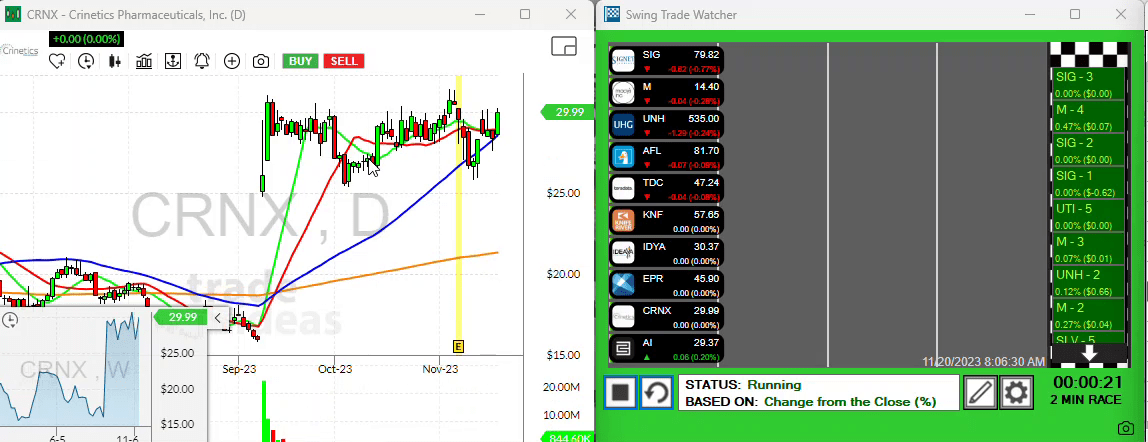

There’s also potential awaiting in CRNX. It has been hovering around certain levels for a while now — mainly due to news-triggered movement. Currently, it seems to be stuck in a channel pattern. For it to be a good buy, it needs to break out of this channel. As a strategy, you could set a price alert at the high of the channel and ‘set it and forget it.’

Casting an Eye Over China

China-based companies might just offer some rewarding plays as well. One such firm is TAL Education Group. This stock has been showing remarkable strength recently. I predict that a move above the rounded-off figure of 9.85 could kickstart an open gap and rush off before you even know it.

Turning toward earnings-driven plays, let’s zero in on YY Inc. It’s a China-based tech company delivering mixed performance — exciting for some, daunting for others. Its price has been fluctuating wildly, but within a dollar range. Play size accordingly, but keep an eye open for a potential breakout above the 7.58 level post earnings release.

Tread Lightly

While it’s exciting to consider potential trades, remember that the markets seem a tad overextended and a pullback isn’t yet evident. Exercise caution. This is not a point to lose everything you’ve worked for thus far. As we always say:

“Keep it tight. Protect your capital. Wait for trades that match your strategy.”

Enjoy your trading day! I’ll be back with more insights tomorrow. Until then, happy trading!