Harnessing the Allure of Investment in Argentinian Stocks

Harnessing the Allure of Investment in Argentinian Stocks

Nov 20, 2023

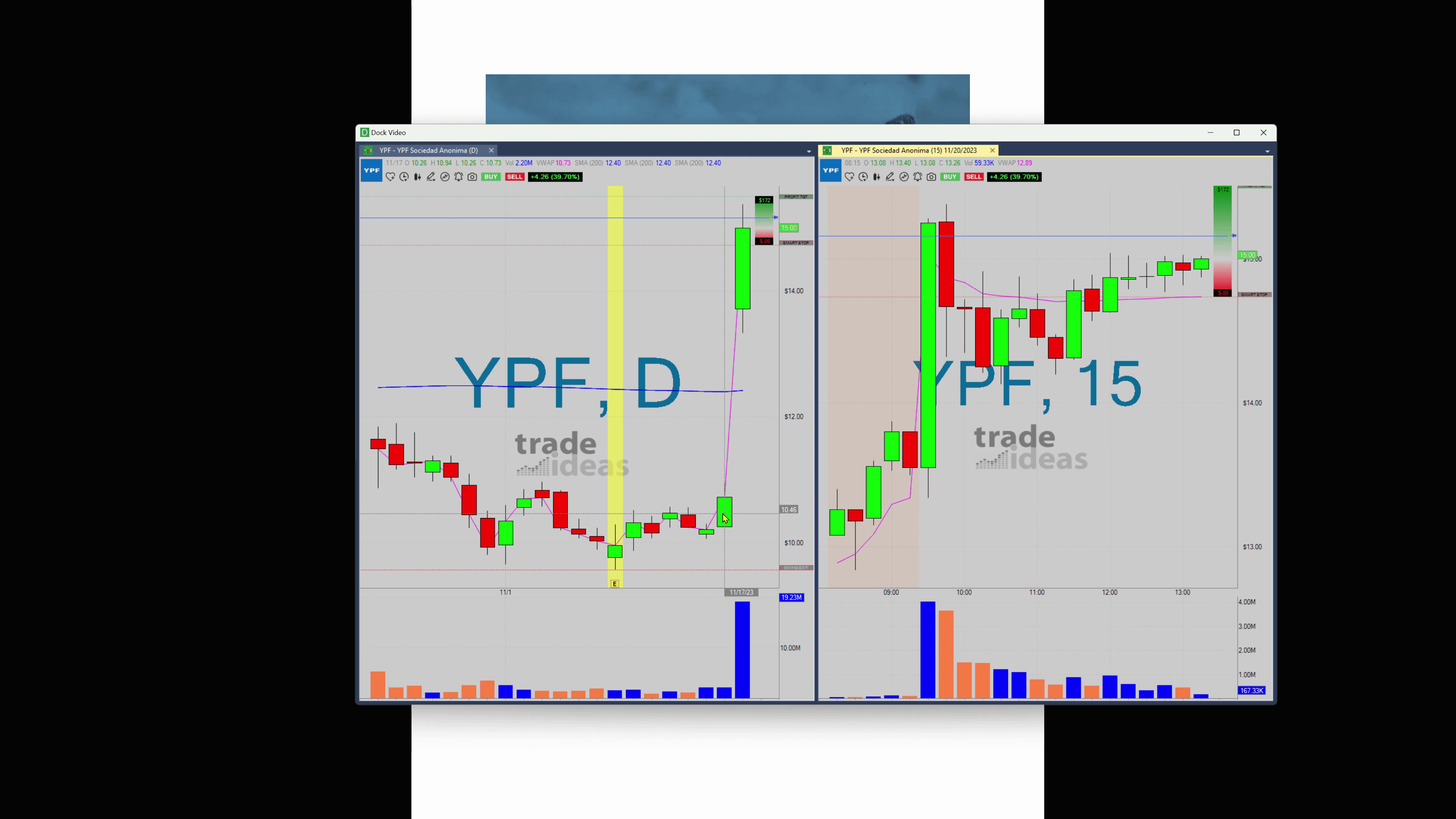

Hello there, Barrie Einarson here from Trade Ideas casting a spotlight on the fascinating dynamics of the stock market. In this edition of ‘What Makes This Trade Great’, we delve into the unique market movement observed in one of Argentina’s stocks, specifically YPF. Feel free to explore my Home Page, where you can acquire Trade Ideas scanners at a discounted price of Use Promo Code BARRIE25 to save 25% off

A Brief Introduction to YPF

For those unfamiliar, YPF is an Argentinian-based stock that has recently experienced significant volatility. For those who have somewhat explored the vast Elysian fields of international stocks, YPF might not be a new name.

“YPF, as a stock, is not completely unfamiliar to us, or to seasoned traders. We’ve seen it appear on our radar a few times for various reasons, this time though, its surge has been nothing short of astonishing!”

Riding the Wave of Elections

Interestingly, this unusual rise of the YPF stock coincided with recent elections in Argentina, leading to an astounding leap by 39%. Given the fact that YPF has nearly 400 million shares in the float, this achievement is no small feat. It demonstrates the pervasive impact of political events on the stock market and more importantly, the opportunities these events may present to investors.

In fact, the sweeping wave did not just raise YPF to the surface but also saw nearly every Argentinian stock making an upsurge. It’s a clear reflection of the wide-reaching radiating effect a singular event has, stirring the seemingly calm waters of stock markets without much warning.

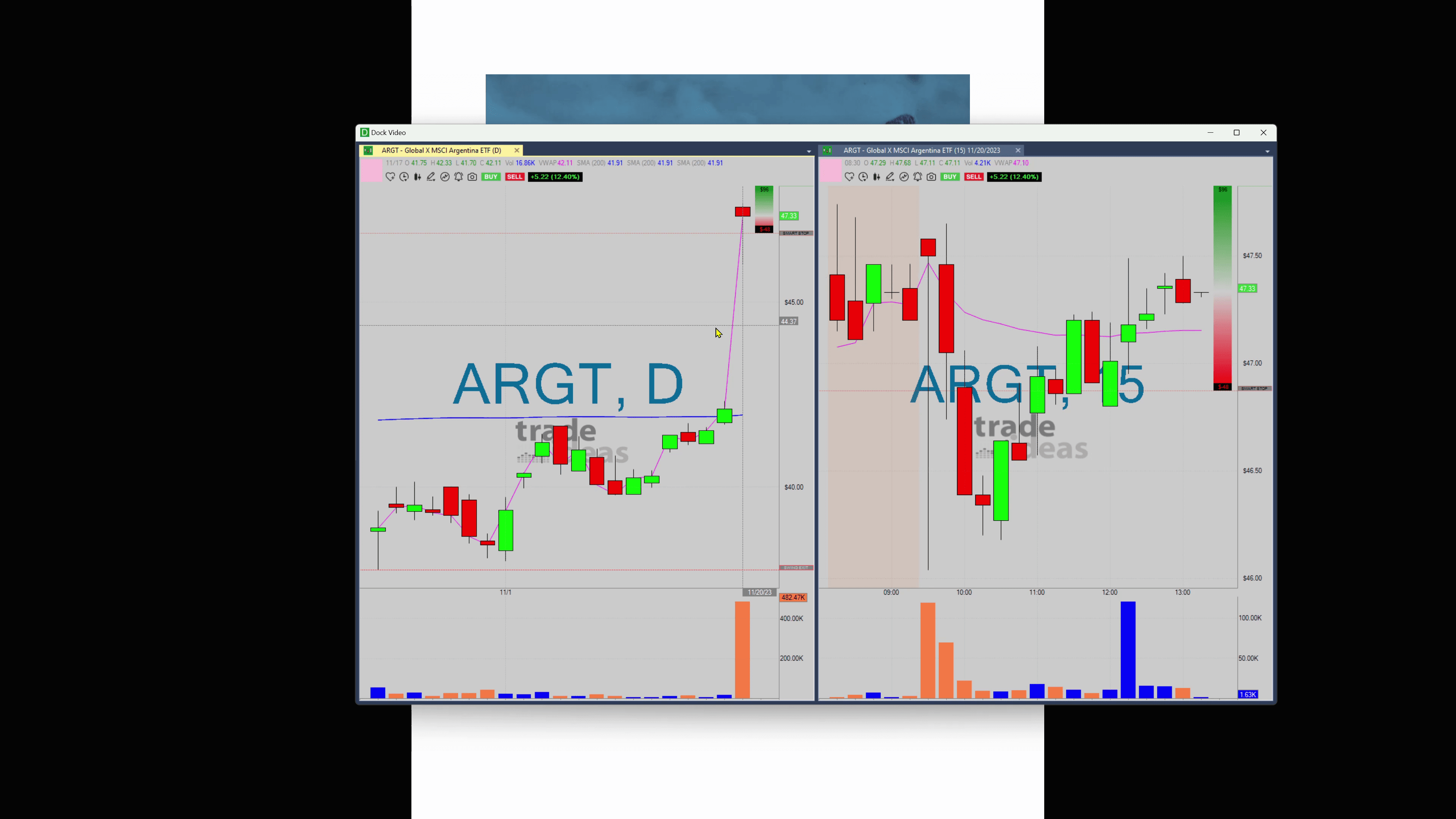

The Argentina ETF Landscape

If you’re keen to peek into the future and speculate on what might happen next with Argentina’s stocks, consider tracking the country’s ETF ARGT. This is another instrument that marked a notable upswing following the elections, registering a growth of 12%.

Although these metrics are appealing, I urge you to act with caution. While summising the possibility of follow-through the next day, it’s crucial to consider the holiday factor. Some might ponder holding onto these overnight, though I personally advice against it due to the inherent uncertainty.

With this brief exposition into Argentina’s stocks, especially YPF, I hope to have sparked your curiosity towards the intersection of political events and stock market behavior. It throws light on not just the volatile nature of the market but more so on how knowing one bit of information about current events can present a world of investment opportunities.

So, hold onto your seats and let’s see where this ride takes us. As always, we’ll be here to break it down for you. Have a great evening and expect to hear more from this exciting world of stocks tomorrow.

“Investing is not only about choosing the right stocks, it’s also about understanding and following the ever-changing dynamics of the world around you. It’s about turning the winds of events to your favor.”