Making The Right Trades Even When The Market Skyrockets

Making The Right Trades Even When The Market Skyrockets

Nov 14, 2023

Hello there, it’s Barrie Einarson from Trade Ideas, back with another, fresh-from-the-trenches edition of ‘What makes this trade great!’

So, what’s the scoop for today? We’re diving into an unconventional day of trading that’ll show you how you don’t always have to swim with the current and how sometimes, going against the flow can yield the best results. Go to Barrie’s Home Page: https://go.trade-ideas.com/SHQ

Use Promo Code BARRIE25 for 25% off

The Unexpected Trading Day

Picture this: The market is having a field day. It’s one of those days where it absolutely takes off. All triggered by the 8:30 CPI number, which ignited a rally that seems never to wane. Despite a tiny hiccup here and there, the market keeps moving higher and higher.

At this point, you’re probably thinking, surely, I capitalized on this upswing and made all my trades on the long side. Well, that’s where your guess veers off the mark. Buckle up, because my most profitable trades were from the short side. Yes. You heard me right.

We all know the adage “The trend is your friend.” But, friend or not, sometimes you have to bet against the crowd to claim your profits.

The Profitable Short Trades

Among my best trades were ones from my ten-day daily breakdown. Specifically, I picked Hercules Offshore Inc. (HROW) and New Energy Power Corp. (NPWR). There was also one unrelated to my ten-day breakdown: Sea Ltd (SE).

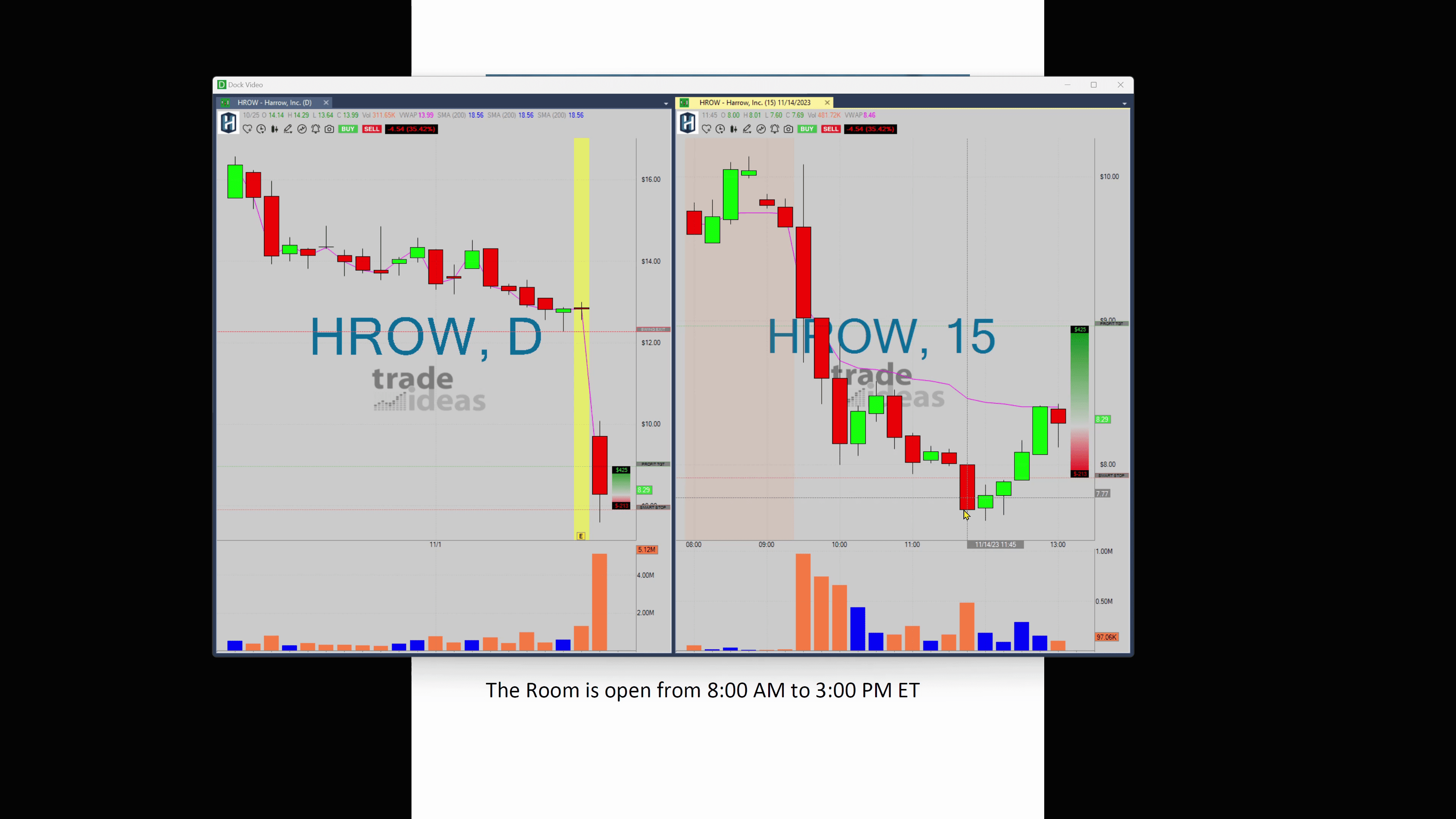

A Closer Look at the HROW Trade

Let’s delve a bit into the HROW trade. Apart from being an earnings play, one key attraction this trade held for me was its All-Time-Low status.

At 9:40, the alert from the scan I’m sharing swung into action. We’ve got HROW trading at 929. And then…

It bangs down to 799 without even blinking! You’d agree the percentage move is massive. Then, it pulls up a bit, but wait a minute, gravity soon kicks in, taking it all the way down to around 760. Captivating, isn’t it?

The Draw of All-Time-Lows

“Stocks making all time lows hold a certain charm… be it driven by earnings or some other bad news.”

Why does this allure me so much? It’s a mix of pragmatism and taking advantage of basic investor psychology. If a stock is at an all-time low, and to top it off, it’s an earnings day, who’s going to invest with the hope of a miracle? Sure, a few might bottom-fish hoping for a turnaround. But realistically, what are the odds? They aren’t going to announce groundbreaking news the day after posting dismal earnings. So we’re back to the question – what’s going to prop this stock up?

The Takeaway

Here’s what we can take away from this. Sometimes, it pays to divert from the beaten path. A soaring market doesn’t necessarily mean you stick to long plays. Always keep an eye open for opportunities that others may have overlooked. In this case, it was stocks in an uninterrupted freefall that presented a golden opportunity.

That’s a wrap for now! As we delve deeper into the nitty-gritty of the trading world, remember that each trade holds a lesson. I’m heading back to the ‘room’, and I can’t wait to share more with you tomorrow.

In the meantime, here’s to making every trade count!