Bulls Charge Wall Street: Stock Market Outlook for November 9th

Bulls Charge Wall Street: Stock Market Outlook for November 9th

Nov 9, 2023

Hello, Traders! It’s Andy here at Trade Ideas whispering trade secrets your way! It’s Thursday, November 9th, and let me tell you – the bulls have definitely been the team to watch lately, steaming ahead and creating an upward gap in the market. We are riding a powerful wave of momentum here, so hang onto your hats!

Reading The Momentum

As traders, we always keep an eye on momentum, evaluating whether it’s time to ride the wave or step back to calmer waters. The last couple of weeks have been all about the bulls, with an impressive market strength that can’t go unnoticed.

However, we’re now approaching a potentially critical level. The market is well overextended, pointing to caution in the face of increased volatility. Despite the rush, patience is always a virtue in trading. It might be tempting to jump in head first, but remember:

“In trading, the quickest way to make money is not by rushing in, but by waiting for your perfect setup.”

Speaking of setups, I want to share some potential entry points in a couple of stocks that I’ve been tracking.

Stock Setups to Watch

PATH: Solid Prospects

PATH is promising, gapping up close to a potential breakout level. This stock might have a bit of catching up to do compared to other Arc stocks, but the potential seems impressive.

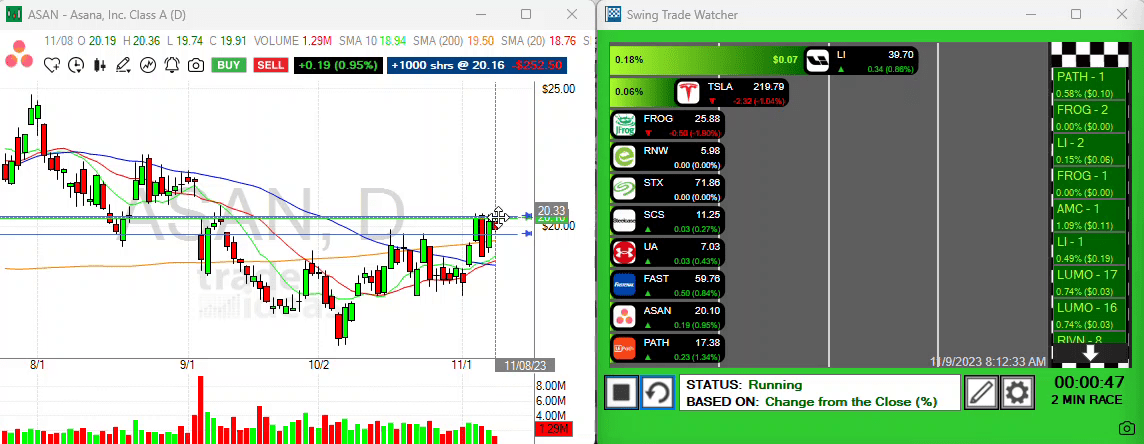

ASAN: Clear Momentum

Next on the list is ASAN. It presents a similar chart to PATH, floating above all its major moving averages. If it can surpass that five-day high, I’ll definitely be adding more to my portfolio.

CSC: A Beautiful Setup

Turning our attention to CSC, we find a beautiful setup that’s hard to resist. It’s recently hit its 20-period and 10-period levels and then bounced off, indicating a possible surge. Keep an eye on the 1140 level with CSC as well.

TSLA: Ever The Contender

Never to be ignored, Tesla is still on my watchlist despite a minor gap down today. If it can cross yesterday’s high, especially the 226.50 level, we might be looking at a significant upward price movement. Our electric darling may yet catch up with the rest of the heavyweights.

AL: Rising Dawn?

Lastly, let’s take a look at AL. It’s going up early morning, hinting at a potential strike at the 387 level. However, be wary of hot pursuits and high-level buying; they often result in sharp pullbacks.

There you have it, folks – a lineup of interesting setups to keep an eye on. There are always more on the horizon, of course. The trading world is a lively one, and the key is to keep learning, watching, and acting when the time is right.

So, stay sharp, stay focused and let’s make the most out of these trade ideas. Until next time. Happy trading!