Stock Market Insights with Andy: Trade Ideas for Nov 7

Stock Market Insights with Andy: Trade Ideas for Nov 7

Hello traders! Andy here with some mid-week trading insights for you. Let’s start by assessing the current market scenario and understanding where the opportunities lie. We’ll then move on to some strong-performing sectors and individual stocks that we believe hold potential.

A Birdseye View of the Trading Market

The trading market on the 7th of November, a Tuesday, highlighted some interesting trends for us to dissect.

Following a major move above all our key moving averages, the market successfully held the 50-period moving average. Significantly, as seen in the trading candlestick pattern, a doji was formed.

For the uninitiated, a doji is a critical indicator. When it appears in an uptrend or downtrend, it signals that the buyers and sellers are in equilibrium, indicating a potential change in market direction.

There’s a lot of congestion around the 437 level. Interestingly, we can consider this as a pivot level – a point that is used to define market trend direction. However, market fluctuations can affect this level, and we must see if it can get through and stabilize at 437.

Despite these assessments, the market is dynamic, and it’s not about blindly following the momentum. The key here is seeking setups and not expending energy and resources chasing the market.

Patience, prudence, and perspicuity are our trader’s trifecta.

Especially with the tech earnings, several of them have been demonstrating the ‘gap and go’ pattern – creating potential trading opportunities.

Sector Focus: Insurance

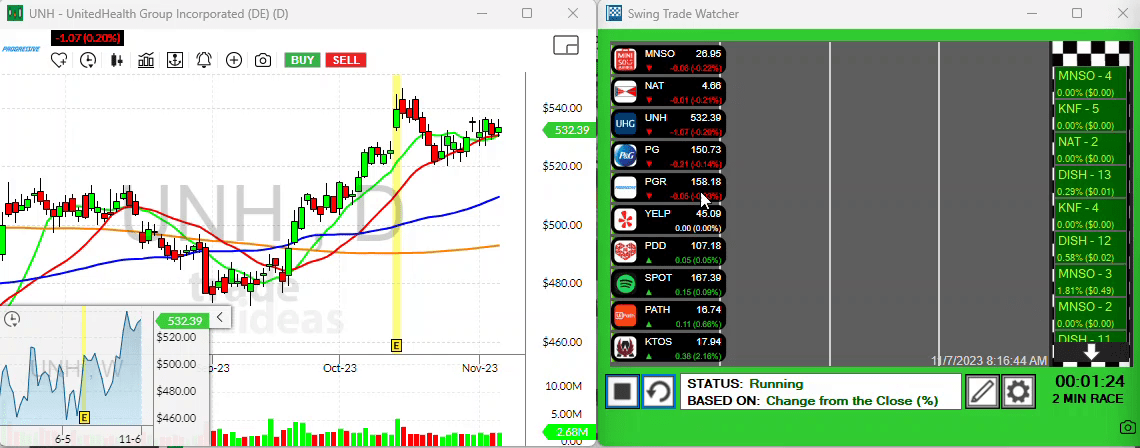

A couple of insurance stocks, namely Progressive and UNH, are currently set up promisingly.

Progressive is holding up very well with an attractive setup. In the past few weeks, it has essentially been channeling – moving between two parallel lines of support and resistance. The potential move to keep an eye on is one above the 160 level.

“Just set a price alert and forget it” – this is the simple yet effective strategy we often practice.

UNH, a more directly health and medical insurance-related stock, also displays encouraging signs. With a clearly defined ceiling over the last five or six trading days, we set a price alert at that level and observe its performance.

Spotlight on Spotify

Beyond the insurance sector, Spotify is another stock that has been catching our attention. With earnings released a few weeks ago, Spotify experienced a noticeable gap up. Following this, it took a step back, holding the 10 and 20 moving averages. The stock still maintains the 10-period moving average, potentially signaling a move above the 170 level.

Although there are quite a few more earnings plays on my radar for the day, they are largely big gappers. Hence, it requires careful observation of their trading patterns before jumping in.

Conclusion

In conclusion, market timing and movement play a crucial role in any successful trading strategy. To echo a baseball metaphor – keep your game tight, wait for the right pitch to come, and make your move when the time is right.

Stay tuned for more trading insights, and until next time, happy trading!