What Makes This Trade Great: Analyzing LIFW Without News

What Makes This Trade Great: Analyzing LIFW Without News

Nov 6, 2023

Hello, everyone! Barrie Einarson here from Trade Ideas, back at it again with another edition of ‘What Makes This Trade Great‘. In today’s analysis, we are going to discuss a very peculiar case – the LIFW trade. Feel free to explore my Home Page, where you can acquire Trade Ideas scanners at a discounted price of Use Promo Code BARRIE15

The Mystery of the Trade

It’s no secret that we usually have an influx of news and updates in this highly digitized era. However, the fascinating part about today’s pick, LIFW, is that there was virtually no news or updates attached to this one, which is pretty uncanny if you ask me!

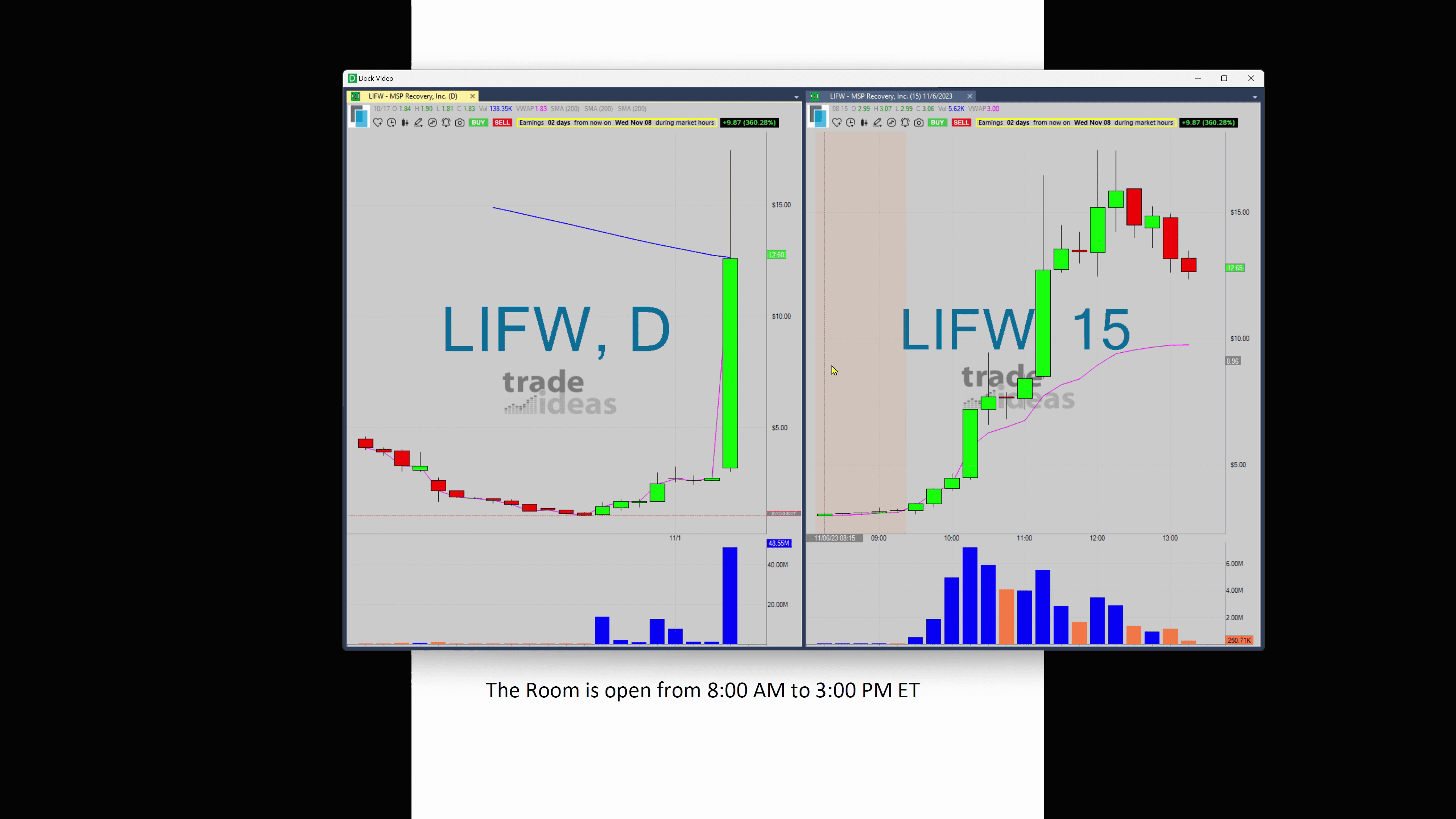

During the pre-market phase—which is represented by the tan area in the following chart—the stock was eerily motionless. Unlike its usual dynamism, the initial candle at 9:30 am showed a bit of movement, but that was it.

After that, the stock skyrocketed from $3.21 but the surprising part? It surged all the way upto $17.50, on basically no news!

Yes, you heard it right. No foreseen market factors driving the price, and yet, the upsurge. Quite a riddle, indeed!

“Investing should be more like watching paint dry or watching grass grow. If you want excitement, take $800 and go to Las Vegas.” – Paul Samuelson

Unraveling the Mystery with a Look at the 10-day Breakout

Now, this leaves us with the question, how did we spot it? The answer is very straightforward and simple.

The stock first caught my eye when my ten-day daily breakout at 10:03 am reported it. You might wonder that a half an hour post market opening at $4.45 was too late. But was it though?

Imagine giving up the initial rise in the stocks and then witnessing it explode from $4.45 all the way up to $16.56 before experiencing the next pull back. Sounds epic, right? That’s exactly what happened.

The Importance of High Abnormal Volume

Each stock has a personality, and studying this personality is key to successful trading. One such character is the volume of the trade.

The trade was accompanied by a high abnormal volume displaying a 22 relative volume. This indicates that the trade was experiencing 22 times the normal volume at this time of the day, based on its average.

This is not something that we can ignore. Higher the abnormal volume, higher the interest of traders, and when these traders start to move in, it creates purchasing pressure and drives the price up.

Conclusion

To wrap things up, we found a remarkable trade today at what seemed like a late time of entry only to reveal promising growth. This instance underscores the importance of two things: our ten-day daily breakout tool and paying attention to relative volume.

Several people in our trading room did profit off this trade and if you feel like you missed out, don’t worry! There’s a lot more out there awaiting discovery and who knows, you might be the next one to catch a big fish.

We’re now in our test drive phase. If you’re intrigued and want to learn more, check out the link for the test drive and sign up! There’s still time. Happy trading, folks! See you tomorrow with another enlightening market journey and until then, have a great evening!

Until next time, this is Barrie Einarson signing off. Bye!