Trading with Earnings: The Case of Wolf Inc.

Trading with Earnings: The Case of Wolf Inc.

Oct 31, 2023

Hello there, avid traders and curious investors! Your go-to trading expert Barrie Einarson here, bringing you the latest insights with Trade Ideas. Today, let’s walk through a recent trade that caught everyone’s attention and made many rethink their earning-based trading strategies – the curious case of Wolf Inc.Prior to proceeding, feel free to explore my Home Page, where you can acquire Trade Ideas scanners at a discounted price of Use Promo Code BARRIE25

Wolf Inc. – A Steep Decline and a Surprise

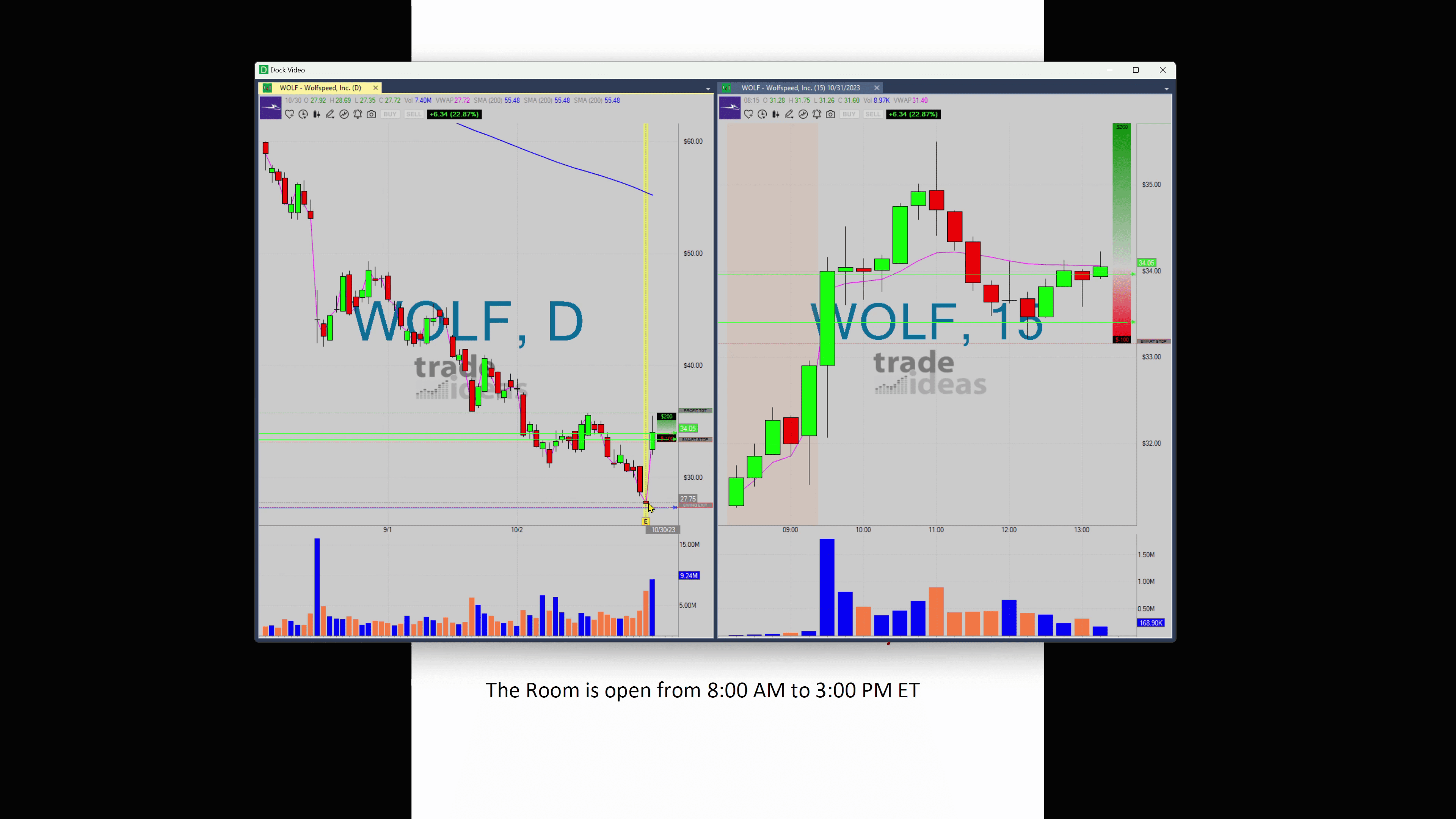

Wolf Inc.’s trend had been largely predictable—for months, the price had been on a gradual yet consistent decline. The decline seemed promising enough to bet against the stock.

At its peak, the stock had been valued at $60, but over the months, it had sunk below all expectations. And in the days leading to their earnings announcement, Wolf Inc’s stock hit an unprecedented low.

Many were left wondering—how good could their earnings possibly be? More importantly, could the announcement of their earnings change anything for a company whose stock was spiraling downward? Little did the naysayers know, that this earnings report was set to be quite the turning point.

The Day of Earnings

Requests were trickling in. The market was abuzz with speculations. Some had faith in a miraculous recovery, but the odds seemed to heavily favour a further downfall.

But then, came the earnings! And it wasn’t what the market was expecting.

What matters isn’t just if a company is making money; sometimes, it’s more about how much money they’ve stopped losing, or simply how their future outlook seems to be improving.

Where skeptics saw a downward trend, optimists saw potential. While it didn’t mean the company was suddenly flush with finances, the implications of their earnings couldn’t be ignored.

The Unexpected Turnaround

Despite all expectations, there were traders who held on to Wolf’s stocks through the earnings, perhaps predicting that the price would journey even farther south. That’s the challenge of playing earnings—it’s a gamble.

Personally, I never play earnings. Never. Instead, I wait for the stock to have earnings, then make my move. I focus on the reaction. The reaction in the market after the earnings announcement paints a vivid picture.

This is where Wolf really caught us by surprise. The reaction to Wolf’s earnings announcement in the pre-market was positive. You still had ample time to adjust your strategy, considering the unexpected jump in the stocks.

At one point, you could’ve boarded the Wolf train at $32, and before the price took a nosedive, it rose all the way up to $36! That percentage move was enough to change many an investment portfolio overnight.

Although I played Wolf on a short down here, the purpose of today’s tale was to show the potential curveballs the market can throw. Perhaps a stark reminder that the market’s reaction, more often than not, doesn’t cater to our preconceived notions.

Closing Thoughts

Keeping a pulse on earnings announcements and the ensuing market reaction can help us better understand the sometimes unpredictable nature of trading. Sometimes, when a stock is perceived to be at its worst, it’s simply preparing for a surprise turn-around.

And remember, while earnings are important, more crucial is the market’s reaction to the earnings – place your bets accordingly.

Our discussion of Wolf Inc. draws to a close here, but we’ll reconvene tomorrow with more trading insights and conversations. Until then, keep trading smart, and have a great evening! Here’s to more such intriguing adventures into the fickle world of trading!