Trading Insights: October Market Trends and Analysis

Trading Insights: October Market Trends and Analysis

Hello, traders! Andy here from Trade Ideas, bringing you the latest insights into the spooky market we’re experiencing this October. Happy Halloween to you all!

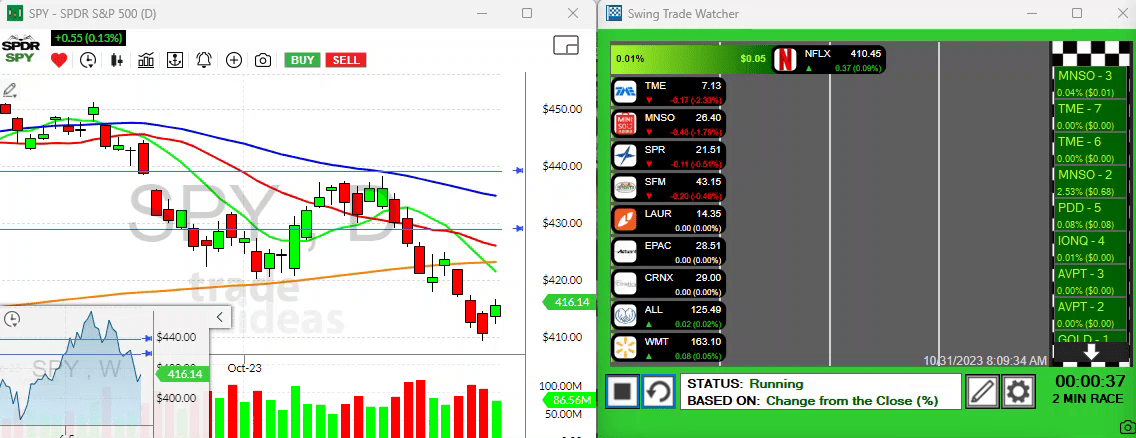

To give you an idea of the current market we’re dealing with at the end of October, we did notice a bit of a bounce in the market yesterday. However, the headwinds above us have now transformed the 420 level back into a resistance level, thanks to the downward sloping moving averages.

Projecting Market Movements

We might see a bounce over the next couple of days into this level. The key issue to monitor at this stage is whether we can get back above that 200 day.

It’s essential for you traders to comprehend one thing: you don’t need to always be in action. Yes, I repeat this often but it’s crucial to remember that cash can also be a position.

Now, let’s delve into some specific setups.

Current Market Setups

I have to admit, I’ve been trading very circumspectly currently. My portfolio size is incredibly small in this fluctuating market but let’s navigate through what’s catching my eye currently.

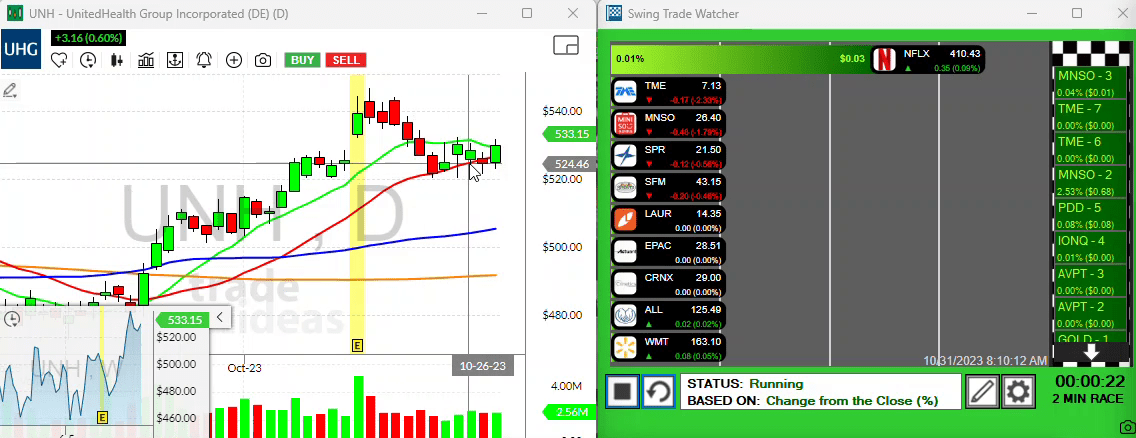

Today, I’ve been keenly observing a couple of insurance companies namely, UnitedHealth Group (UNH) and Allstate.

UnitedHealth Group (UNH)

UNH, for instance, is setting up nicely. You can see it had earnings a couple of weeks ago, then pulled back to its 20-day line. The promising thing to note here is that it is now trying to bounce off this line. A good sign here would be its ability to close above what we call the ten period moving average.

Allstate

Next, let’s have a look at Allstate. The pattern it’s following is very similar to that of UNH.

It’s remarkable how, with the widespread use of trading algorithms these days, these sectors are creating figures that resemble each other closely.

Biohaven Pharmaceutical Holding Company Ltd. (BHVN)

Another stock to keep an eye on is BHVN. This stock has been kind of levitating up here for a while. Clearing the 28.72 level would be excellent, but I’ve put an early price alert as my strategy.

Other notable mentions: Microsoft and Netflix

There are a couple of big ones to keep track of as well. Take Microsoft for instance, post earnings, it pulled back and held its 20 period, bouncing again. Similarly, keep an eye on Netflix displaying strength by holding up above all its moving averages.

In conclusion, my sage advice would be:

“Keep it tight, don’t feel obligated to take action if the market doesn’t seem right.”

Stay tuned same time, same place, for our next trading discussion. Until then, take care, be patient and careful with your trades. Bye!