Market Analysis For Trading: The Weekly Rundown

Market Analysis For Trading: The Weekly Rundown

Hello, fellow traders! This is Andy with your mid-week trading strategies and investment ideas for October 25. The SPYs are showing a couple of weak attempts to climb and there’s really not much force behind the movement. Today, we’re gapping back down, going below the 200-day moving average.

While the market’s at play, we’ll see how the rest of this game unfolds. With earnings season here, I’ll be focusing on the stocks that have earnings over the next several weeks, keeping potential opportunities on our radar.

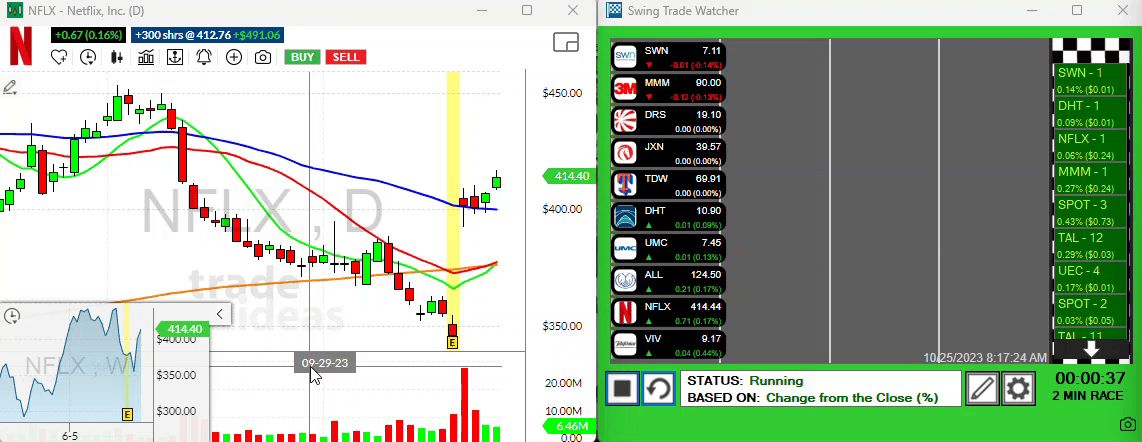

Striking Gold with Netflix

Netflix caught my eye yesterday. In fact, it was such an irresistible bet, I decided to buy. This media giant continues to make a place on my watch list today as it sits in an interesting position. There seems to be no resistance until we hit the next bar around $435.

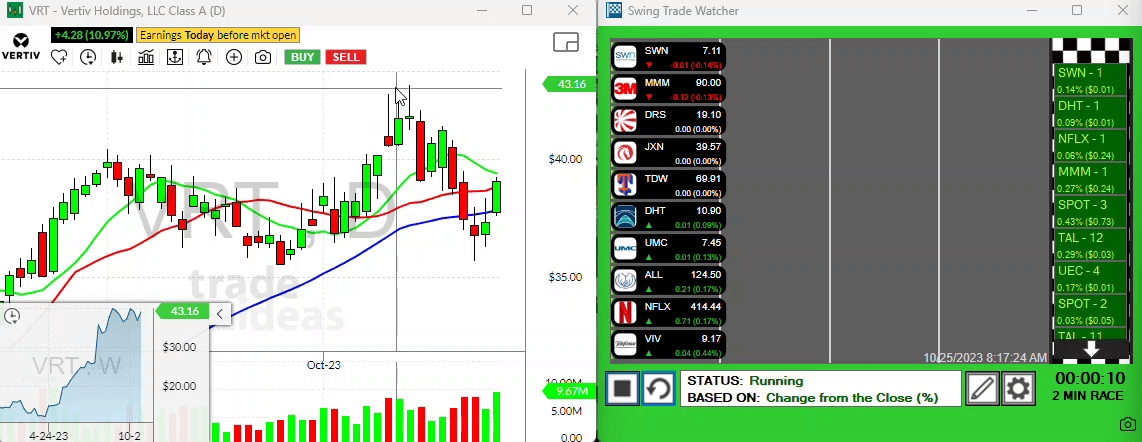

Earnings Gappers: LRN & VRT

A couple of stocks put on quite a show last night, leaping to all-time highs or at least yearly highs following their earnings reports. LRN is gapping up above the $46.40 level – a situation traders should definitely monitor for possible explosive gaps.

Another significant mover is VRT. Like LRN, it’s in a similar position, gapping above its 52 week (and possibly all-time) high. Their performances on these gap-ups over the last several years is quite impressive, to say the least.

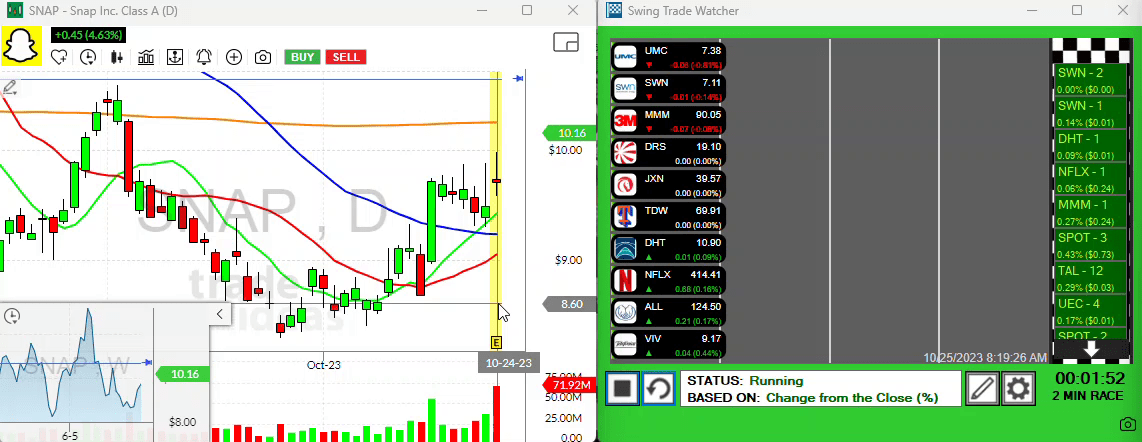

Lesser-known Opportunities: Snap & SWN

Snap has been a rollercoaster over the last several years, with brutal losses following earnings reports. However, it’s bucking the trend this time around and is actually gaining ground pre-market. Should it move above the $10.50 level, it could set off a nice swing trade, so traders may want to have this one on their watch list as well.

Now, let’s talk about SWN. It hasn’t been a pretty story for this one for quite some time. But, it had a nice volume bar recently and since then has retreated to its ten-period moving average, holding firm at its position. I’ll be watching SWN for a potential breakout above its two-day high, and have set a price alert in place.

That wraps up my trade ideas for today. There’s more to fetch from the market out there. If you have any concepts or questions, feel free to chime in. It’s a wonderful opportunity to learn from each other and navigate the market more adeptly.

So folks, have a profitable trading day. Remember, the market moves fast, so keep your eyes open and your minds even more so. I’ll circle back with more updates tomorrow. Until then, happy trading!