Trading Talk: Market Recap and Setups for October 24th

Trading Talk: Market Recap and Setups for October 24th

Hello traders, Andy here with your latest Trade Ideas update. It’s Main Street vs Wall Street time as we take an in-depth look into the state of the market on Tuesday, October 24th. Scoop up your data engines; we’ve got a lot to cover!

Market Recap: Get Your Price Without Chasing

Foremost, our eyes are peeled on the SPY (S&P 500 ETF) which notably gapped up again early this morning. But don’t get rosy yet! It’s pertinent to note that we are still floating far below all our pivotal moving averages.

In yesterday’s trading, the market tried to scramble back above the 200 points mark, but unfortunately, we hit a brick wall. An ominous topping tail seems to have formed itself in the process. Chillingly, we are staring at the gap ticking right AB at that number presently.

In these murky market waters, it’s quintessential to stay patient and smart. Hasty moves can cost you – there’s no reason to chase price action haphazardly.

Keen on Setups with Potential

Alright, no time to dally, let’s dive deep into some exciting setups! It’s earnings season, and we have some notable companies on the line-up. However, caution is called as several stocks are experiencing quite high gains post good earnings, which may lead to a sell-off.

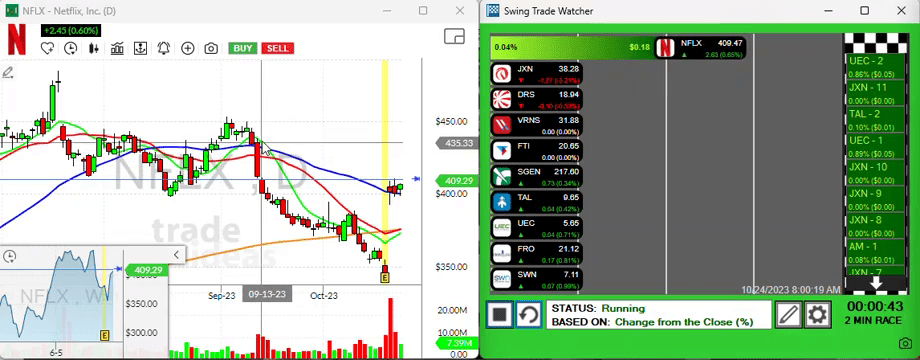

Netflix: Poised for a Strike

/

First up, we’re keeping tabs on Netflix. The streaming giant, which put out its earnings report three days ago, is holding up steadily around its three-day high.

One particular aspect that I find intriguing about this setup is the price alert. Should Netflix bust past this high, there’s a long bar set up with the next high almost $30 up the ladder. This could set us up for a smashing trade.

VRNS: Looking for Bar Reversals

Next on the menu is Varonis (VRNS), a setup quite similar to Lululemon (LULU) yesterday. After bouncing back above its ten-period moving average with a tail.Shout-out to LULU for that appealing little bar reversal yesterday.

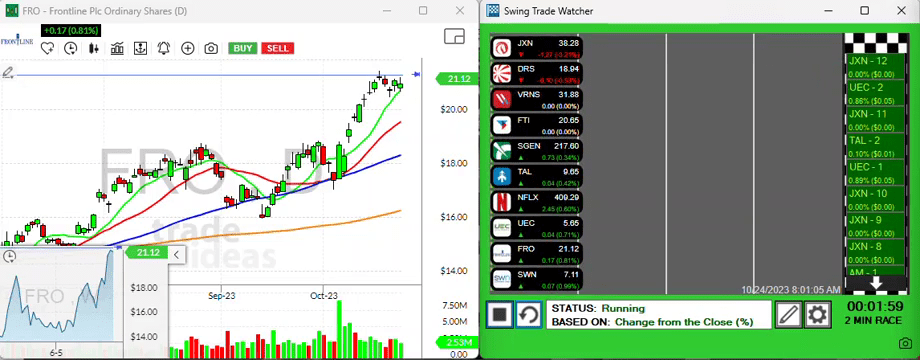

FRO and DRS: Spotting Strong Three-Day Highs

Freight companies continue to show strength, and we spotted FRO providing a very strong chart recently. Be on the lookout for a move beyond that 5-day high.

And lastly, watch out for Document Security Systems, Inc. (DSS). We have it on good authority that it’s above key moving averages, and we’re excited for a potential move past a three-day solid high.

And there we have it! Those are your market insights, updates, and trade setups for the day. Stay tuned for tomorrow!

As always, happy trading!