A Deep Dive into Trading Duolingo Stock

A Deep Dive into Trading Duolingo Stock

Oct 23, 2023

Hello, everyone! Barrie Einarson here from Trade Ideas, ready to share some insider trading tips with today’s edition of “What Makes This Trade Great?” Instead of our usual roster of trades, I’m spotlighting something that piqued my interest – Duolingo (D-U-O-L). Prior to proceeding, feel free to explore my Home Page, where you can acquire Trade Ideas scanners at a discounted price of Use Promo Code OVERTHETARGET for 30% off

What is Duolingo?

For those of you who may not have heard about it, Duolingo is an impressive platform where you can learn a multitude of languages. Whether you are an English speaker wanting to learn Spanish, Chinese, or any other language, Duolingo is a fantastic way to get started. Now, as a full disclosure, I should confess that I myself am a frequent user of Duolingo, so perhaps there’s a touch of bias in my enthusiasm here!

The Google Announcement Impact

Earlier this week, specifically on Thursday, Duolingo’s stock took a significant blow due to an announcement from Google hinting at their intent to break into the language-learning market. Naturally, this news sent shockwaves through Duolingo’s stockholders, leading to a chaotic trading day on Thursday.

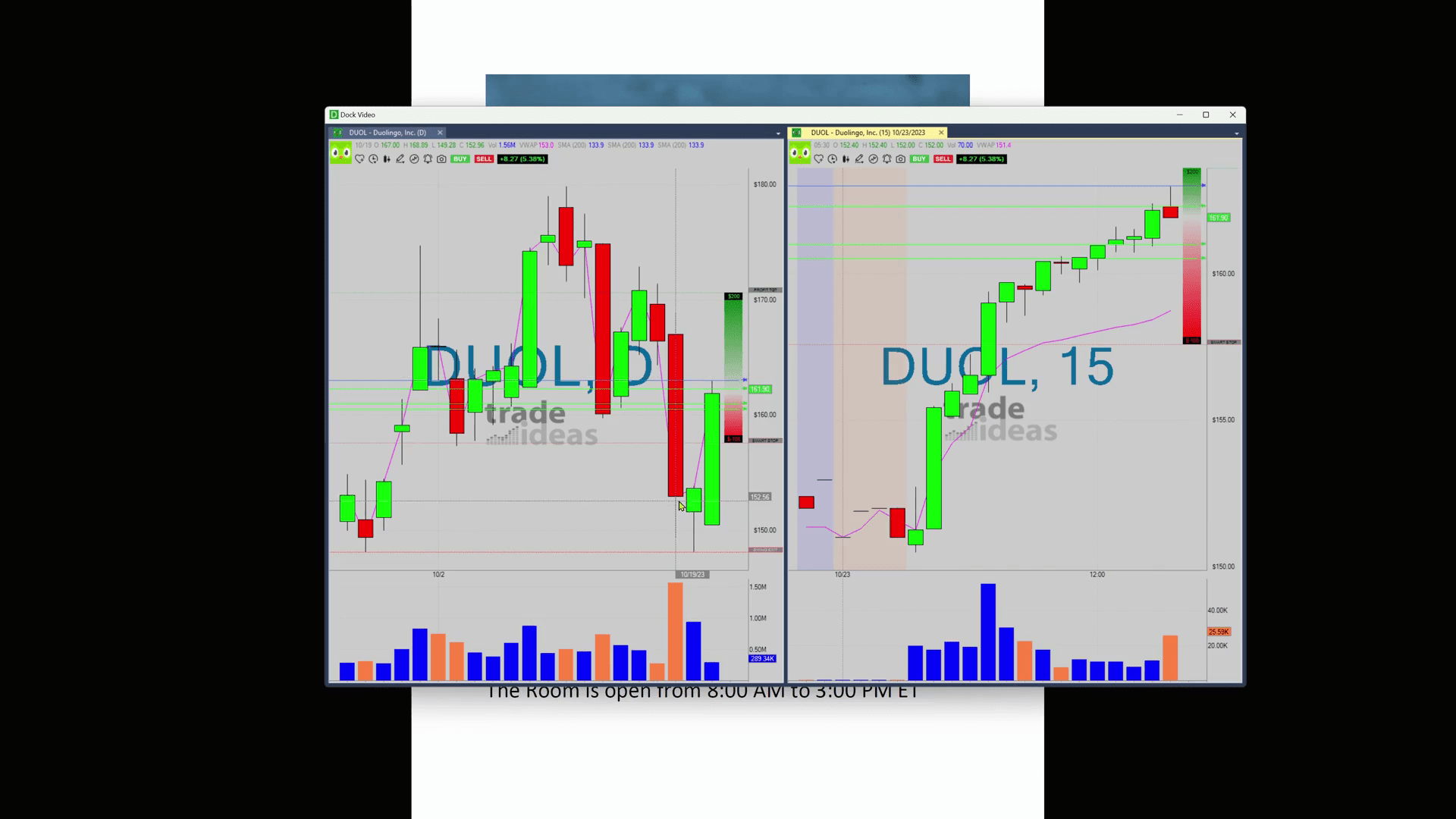

Here’s a representation of that debacle:

However, I wasn’t ready to hit the panic button just yet. Duolingo, in my opinion, is firmly established with a concrete user base. Furthermore, they offer a free version of their product, which adds an appealing edge against competition.

The Unexpected Bounce

The next day, Friday, something interesting happened. Despite the previous day’s unfortunate event, Duolingo’s stock held its ground. An observant trader might have noted that if the stock could surpass the 154-point mark, a promising bounce could occur. Much to the delight of those who held on, that’s precisely what transpired. Consequently, the stocks vaulted almost straight up.

While you might argue that the uptick may have been aided by a general resurgence in the market, there’s a stronger case to be made that Duolingo’s stock still has room to grow. Maybe even all the way back up to where it all started, hovering around a healthy 169 points.

Here’s how the turn of events unfolded:

A Promising Outlook

To add to the positivity, some analysts are predicting even loftier goals for Duolingo. Optimistic targets of $188 and $195 are bandied about, making this an enticing prospect for anyone interested in investing.

As the week ended on this promising note, it made me reflect on the principle of trading what I know and trust. Granted, it’s a strategy that’s not frequently put to use but in this particular case, it turned out to be a very successful endeavor.

So here’s hoping this nifty little trading story from my end inspires you to look into trades that might seem unconventional at first but end up being rewarding in the long run. Until next time, happy trading, ladies and gentlemen. Have a fantastic day and see you tomorrow!

Use Promo Code OVERTHETARGET for 30% off