Navigating the Stock Market: Insights from Trade Ideas

Navigating the Stock Market: Insights from Trade Ideas

Oct 19, 2023

Hello there!

This is Barrie Einarson from Trade Ideas, delivering today’s edition of our most sought-after series, ‘What Makes This Trade Great’. Today, though, we’re shifting gears a little. Instead of focusing on a specific trade, let’s turn our gaze toward the overall market activity, specifically the S&P 500 represented by SPY. Feel free to explore my Home Page, where you can acquire Trade Ideas scanners at a discounted price of 15% using promo code BARRIE15

A Closer Look at SPY

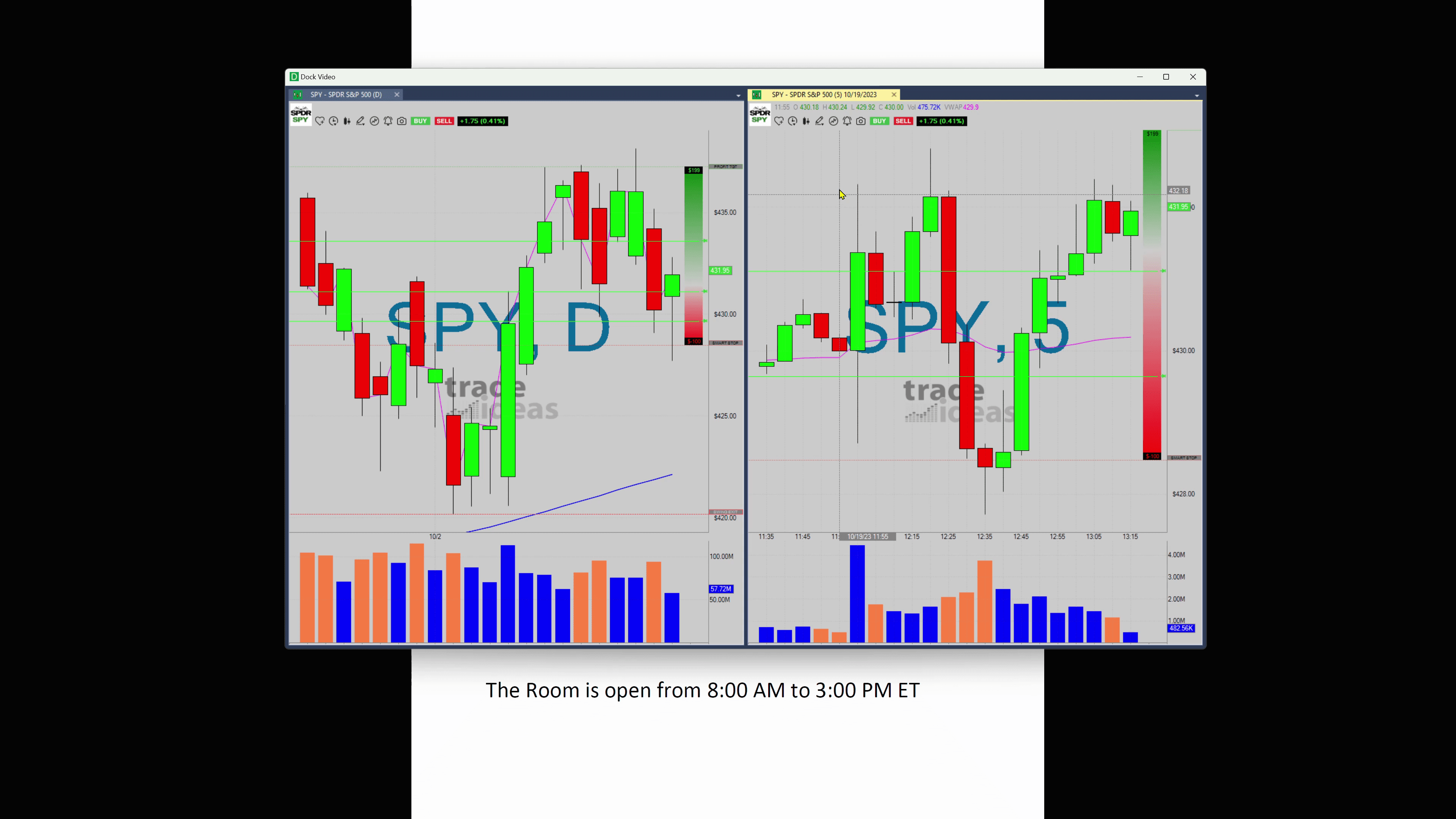

We can’t ignore the elephant in the trading room today – the rather drastic movement in the SPY (S&P 500 Index). A lot happened today, all kicking off around midday, coinciding with Jerome Powell’s chats. Quite strange, considering it’s not an FOMC (Federal Open Market Committee) day.

Normally, we witness such volatile action on the FOMC day – typically the third Wednesday of each month around 2 p.m. But today was different and merited a closer look.

Let’s analyze the five-minute chart of SPY. Around 12 pm, when Chairman Powell started talking, there was a significant reaction. The SPY had a big pop-up. Then it settled down, showed another spurt of bullish sentiment followed by a complete collapse for about 15 minutes. And just like a yo-yo, we are now back up again.

Just like the trade markets, the point here isn’t entirely crystal clear. It’s a convoluted form of action and reaction, clouded by global factors, individual perspectives and large-scale market sentiment. But what’s important is to pay attention to such instances.

A trade market like today’s is a perfect tutor in disguise. Its erratic behavior may seem challenging but is filled with lessons of patience, observation and prompt action

The Impact on Individual Stocks

Now imagine yourself in a position in a stock that tends to follow market movements, ponder upon the implications of such unpredictable market activity. Specifically, if you have your skin in the game with big names like Meta or Amazon, today’s SPY movement would have been incredibly hard to navigate.

Staying in these trades could be a challenge considering the extreme volatility. So, as an alternative, you might have chosen to wait it out – another strategy, equally beneficial, if not more. It is rare for the SPY to exhibit such action when it’s not an FOMC day, making today a sight to behold.

The Lesson for Traders

What can traders take away from all this? Simple. Keeping an eye on the charts, specifically SPY, can be immensely helpful. While many of the stocks we discuss at Trade Ideas generally fly under the radar and are not too affected by overall SPY movements or market dynamics, it’s beneficial to have a SPY chart up and running when you’re in any trade.

On days like today, it aids in keeping track of market sentiment and understanding the general direction the market trend is heading in. This knowledge could guide your trading decisions, providing you a solid backing in forming your trading strategy.

Well, that’s about it for today! Always remember, no matter how unpredictable and volatile the markets may seem, there are always insights to gather, lessons to learn, and strategies to form.

Looking forward to delving deeper into the trading world tomorrow. Until then, it’s back to the trading room for myself. Have a great evening!

Use Promo Code SPOOKY25 for 25% off

Test Drive Nov6-20: https://go.trade-ideas.com/SHjz