Evaluating Your Trading Strategy:The Importance of the Equity Curve

Evaluating Your Trading Strategy:The Importance of the Equity Curve

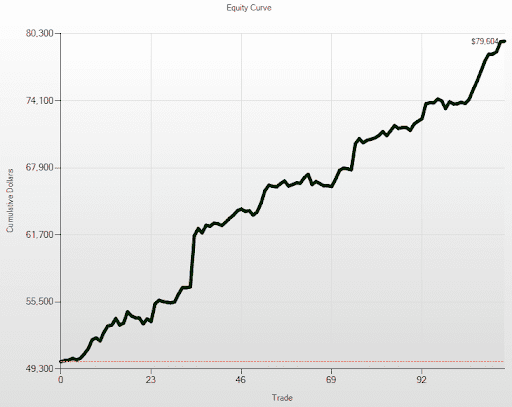

When determining how well a trading strategy is likely to perform in the real world, there’s no better measure than the equity curve.

While many traders focus on individual performance indicators such as the annual return (CAGR), Sharpe ratio, Profit Factor, or even Expectancy, these single-number metrics can’t capture the full picture.

The equity curve provides a visual representation that conveys a wealth of information at a glance. It allows you to intuitively understand:

- How consistent will the strategy be?

- Will the drawdowns be deep and prolonged or shallow and brief?

- What will the strategy’s best-performing days be like?

Simply put, great traders recognize that the trading experience can’t be reduced to a single number.

Here’s the equity curve of one of the strategies I trade on a daily basis:

Interested in evaluating your own strategies? Check out how to use the Trade Ideas OddsMaker to generate your own equity curves.

Dave Mabe is a trader and the CTO at Trade-Ideas. He helps traders make more money by improving their strategies.

You can also sign up for Dave Mabe’s personal newsletter here: davemabe.com