Surviving A Bear Market

Surviving A Bear Market

By Katie Gomez

Whether you’re a new trader or have been trading all your life, if you can’t learn to trade in different market climates you won’t survive. Given that the last few months have been a consistent bear market and we’re possibly leading up to another market crash soon, you will need to adapt your trading to persevere. Surviving a bear market is not easy, it will require you to flip your mind upside down and change your perspective. You cannot simply wait around hoping the bull market will return and lead you back out—you have to do the work yourself now to make it out of the market alive.

If you are a novice trader unfamiliar with market jargon such as bull and bear market, don’t worry. Traders have coined the phrases bull and bear market over time to compare how the market changes to how these animals act in nature. For instance, the bull market is a buyers market, when stocks are bought low in the dip and pushed up (just as bulls create movement by getting under things and pushing them up using their horns). On the other hand, a bear gets things moving by smacking things down (like berries from a tree) with its paw. Therefore, in a bear market, the stock prices are being smacked down the moment they rise high, making it nearly impossible to buy (which is where we are now).

Instead of waiting for the bulls to take back control of the market, you must learn to adapt and survive in the bear or you might sink. The first step to survival is learning to read moving averages, look back in the rearview mirror, and see where the average stock price has been over time. If you want to move forward and create a new path to guide you safely out of this, you must first look at the footprints in the sand.

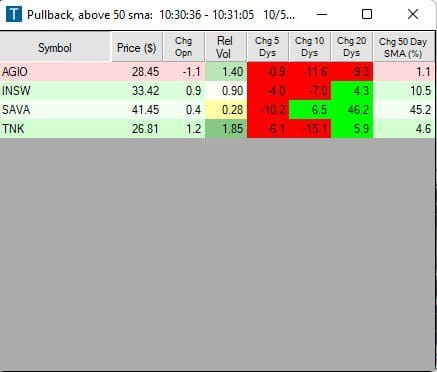

The most common moving averages viewed are 10-day, 20-day, and 50-day, as shown in the image above.

The 10-day moving average (shown in green): fast spikes, a short time frame, and more dramatic results.

The 20-day moving average (shown in red): still spikes in data, but slower paced.

The 50-day moving average (shown in blue): smooth, long-term increases, holding a steady incline.

The 50-day is the moving average you want to look at to keep track of your stock price when looking back in your rearview mirror. This moving average is a barometer that measures the general health of a stock or an index. Above the blue line indicates a healthy stock price, while below the line is considered unhealthy or more commonly referred to as “guilty until proven innocent.”

Buyers want to see stock prices above the key moving averages to know it is a safe bet. These moving averages act as an area of interest (AOI) because once the prices rise to that area of interest, the sellers (bears) are waiting to smack it back down again. In other words, the stock is making a bear run.

So how can I survive this bear market? Is the market going to crash? What will happen to my portfolio? These are questions running through all our minds right now; no one feels at ease. However, you can either choose to give in to the paranoia and relinquish control; or you can choose to learn how to survive and fight like crazy to do so.

The first thing you have to do is turn off the noise. Traditional and internet media make it difficult for a trader to get out from under the heavy weight of others’ opinions. While it is helpful to be connected, this is a time to focus on your portfolio and how you can save it—no stock reporter will change that. If you let the market run your life 24/7, it will ultimately consume you and leave you feeling defeated and vulnerable. That said, continue living your life with less noise, and understand that this is all temporary.

Once you arrive in a calmer headspace, you are ready to take back control and learn the secret weapon to survive this bear market, short selling. If you are unfamiliar with short selling, it is time to learn this secret weapon and how to broaden your horizons. Think of it like using a backhand in tennis, changing the result of the game by changing your approach.

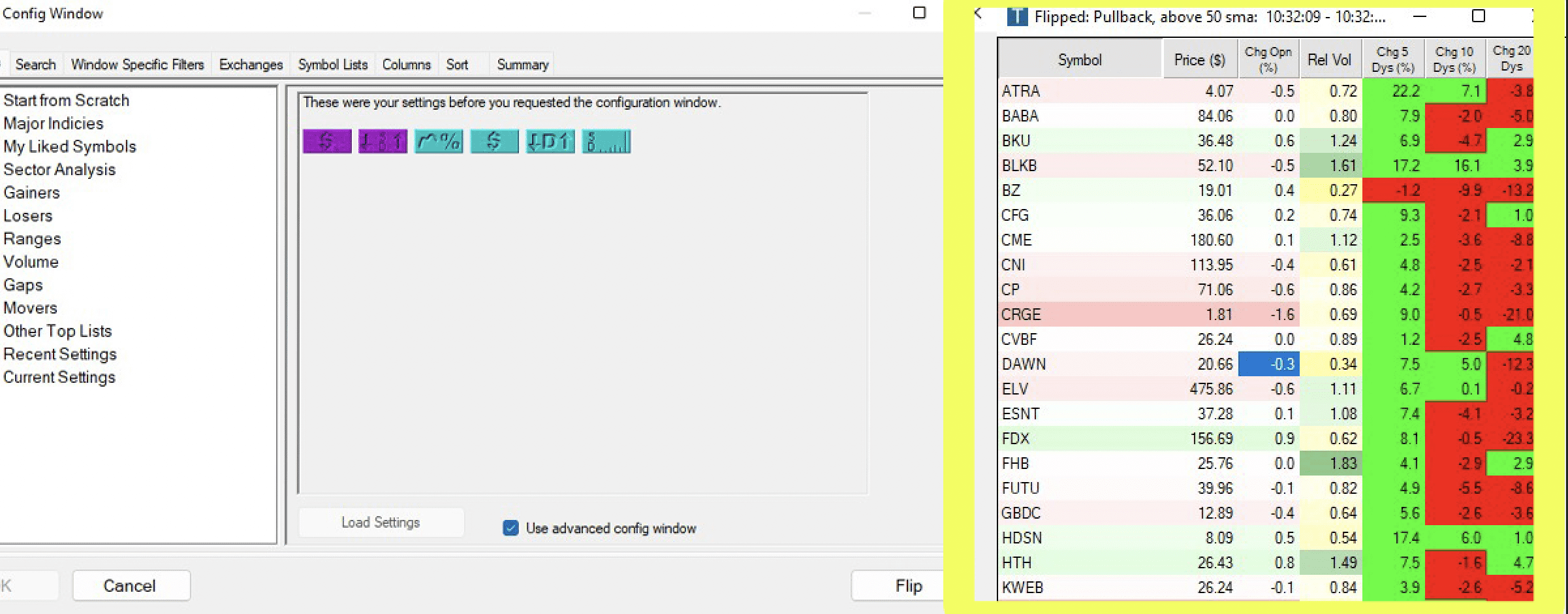

Unlike a bull market, the bear market is the worst time to buy low. You will have to shift your thinking upside down, from buying the dips to selling the rips. Sounds easier said than done, right? That is where Trade Ideas has you covered with their flip option, so you can flip the switch and expose yourself to a whole new realm of opportunity.

Scans you see with regular software are ones you would usually use in a bull market (buying the dips to push to price up), but that will not get you anywhere when trying to survive a bear market. As you can see below, there are little to no options to trade or buy (think bear market = bare).

The “flip” button flips it so you can short-sell in a bear market, showing you all these new ideas. Once you flip the scan’s strategy, you go from struggling to see inside from a tiny hole to busting down the entire wall. The flip button is the key to seeing an array of new possibilities of where you can now go by short-selling.

In conclusion, remember to regain perspective and remember the words of “this too will pass.” Even when it seems like there is no light at the end of this tunnel and the walls are caving in on you, know that this bear market will pass, and you will find your way through it.