The 5 Truths of Stock Trading

The 5 Truths of Stock Trading

Written by Katie Gomez

The stock market has evolved since the 18th century, so it will serve you well to stay in the loop with other traders. Although it’s never been easier to connect with fellow traders and seek their advice via social media, finding the right people or programs to help is more difficult than ever—the internet is saturated with clickbait and bad advice. In recent years, clickbait ads like ‘The magic pill to lose 10 pounds’ or ‘How to be a millionaire in 30 days (for just $99.99),’ are everywhere. Although these ludicrous titles seem like feebleminded attempts to gain customers, they are incredibly successful given today’s consumer market.

Contradictory and confusing advice can be overwhelming. Stock trading does not have to be mystical or expensive, anyone can do it. Just as in any other venture, to succeed you must have the right tools and be willing to practice and learn as much as possible. While there are many approaches to learning how to trade stocks, everyone’s journey is unique. To get you started on your journey, I’ll outline the five truths of stock trading, curated by experienced traders. Like all traders, you will learn from your mistakes and failures, but these truths will save you time and money..

A weakness we as human beings have developed in the last century (especially the younger generations) is our impatience. We want shortcuts, we want hacks, and we want the most profitable yield for the least amount of effort. We can find answers in five seconds with a simple Google search query. This easy access contributes to shorter attention spans, so our commitment to deeper learning is becoming almost nonexistent. When our minds are focused on this immediate gratification, we are left vulnerable to believing in clickbaity shortcuts.

Truth #1: Don’t pay Gurus to do the work for you. Self-proclaimed Trading Gurus are all over the internet and social media, taking advantage of vulnerabilities to lure us in with their dangerous get-rich-quick promises. Although there are thousands of real successful traders on Tiktok or Instagram you can follow for advice, you have to be extra careful of who to trust. If it sounds too good to be true, it probably is.

Trading is something you can teach yourself with the right tools and programs. The gurus trying to take your money aren’t teaching you how to trade, they are tricking you into believing their success can be yours too. They take advantage of new traders, especially Millennials and Gen Z, enticed by their images and videos of fancy cars, mansions, and even piles of money. You invest your money and trust in them in exchange for them to do the work for you. But when the market inevitably goes the other way, it is out of your control. These gurus have a way of breaking new traders’ spirits, leaving them unaware of what went wrong and hesitant to invest in beneficial programs in the future; or even make them give up on trading altogether.

They are not real teachers and cannot provide the tools and lessons you need to learn to become a successful stock trader; if you give a man a fish, you will feed him for a day, but if you teach a man to fish, you will feed him for a lifetime. You must find a teacher, mentor, or program to learn this information for yourself, so you know how to use it, not pay just to be fed.

Truth #2: Make your mistakes cheap. Like most things in life, you will grow into a better trader if you can learn from your mistakes. This leads us to our second core truth. You will lose money at first. Every trader goes through some pain, but how much money you lose is up to you. The key is to make your mistakes early and as cheap as possible by practicing on a trading simulator (SIM). Think of money invested in trading as an initiation—we’re all aware we have to lose money to make money when first starting out. How much money you spend is known as your “tuition” period.

Truth #3: Trading is a business, not a game. Though it may seem like there are more rules than you expected, trading is not a game. You have to start treating it like a business because it is one. Create your model, the time-frame you want to trade in, and treat it like a work day to build a career from a hobby. Trading is not a system you can cheat your way through either. Stock trading can be a consistent and lucrative way to make a living, only if you do so in the right way by setting yourself up with the right tools along the way.

Truth #4: Learn how to read charts, especially candlestick charts. One of the best tools you can have under your belt is the ability to read charts. Traders have been using Candlestick charts as decision-making tools for centuries. These charts allow traders to recognize visual patterns, so they have the necessary information when predicting price movements. Candlestick Charting (Steve Nison, 2018) is a good reference when learning how to read charts. In his book, Nison explains how these charts originated in Japan. The Japanese originated the candlesticks for use in rice trading, but it became so popularized in financial markets that it carried over stocks. A stock trader is only as good as the tools they learned along the way—knowledge is power and patience is a virtue.

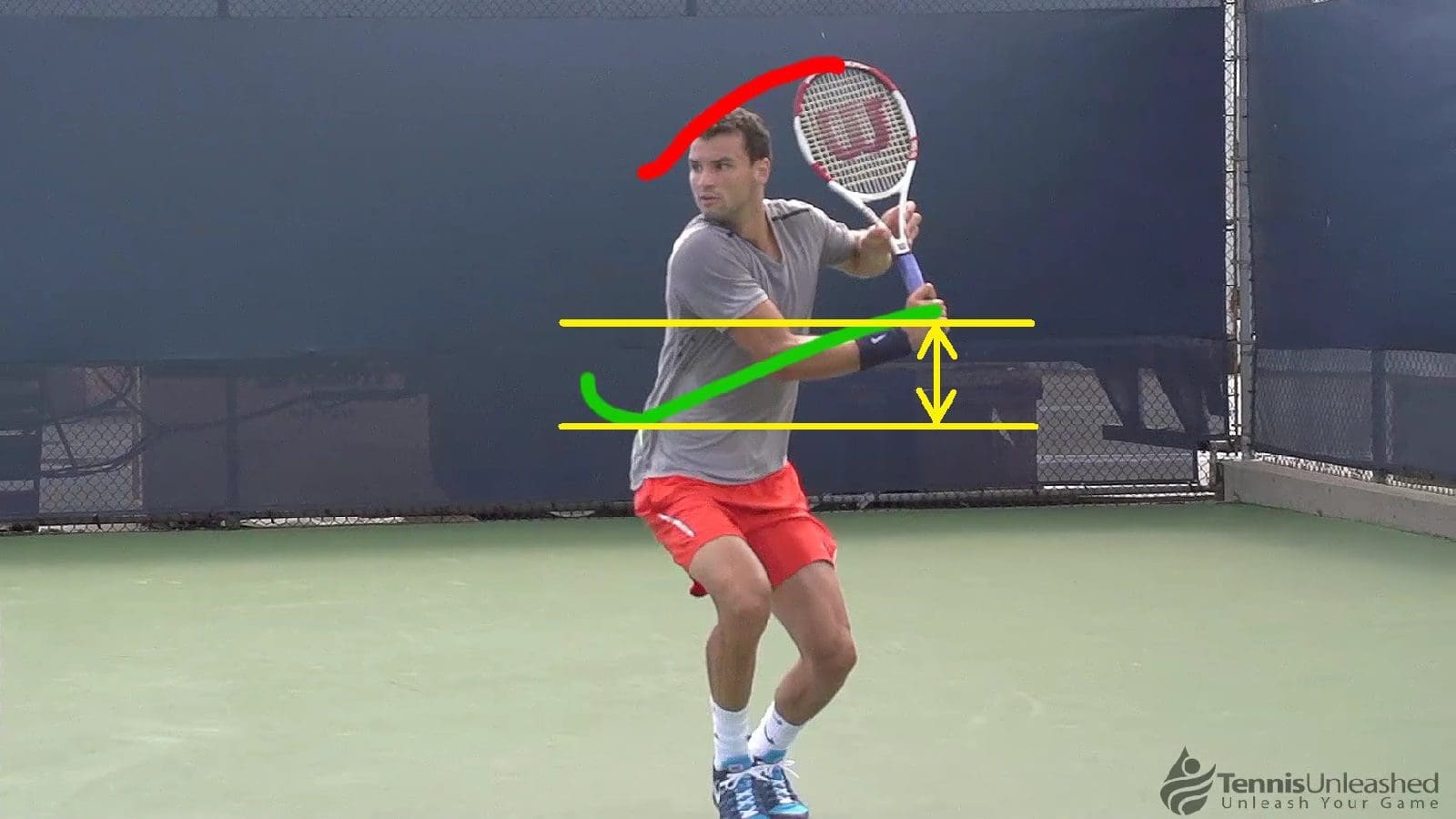

Truth #5: You must learn how to short sell in addition to just buying long. This tactic is our final truth because it is a tool you must add to your toolset to succeed. Surprisingly, many stock traders overlook the importance of shorting. The way to make money by short selling is to sell falling shares your broker lends you, then buy back when the price rises again. You need this new approach to level up your trading skills and make money in a bear market. It’s similar to learning a backhand stroke in tennis to complement your forehand. According to trader Eric Chang’s panel regression from 2014, the data revealed that intensified short-selling activities are associated with improved price efficiency. “Short sellers trade to eliminate overpricing by selling stocks with higher contemporaneous returns following a downward trend, and their trades predict future returns” (Chang, 2014) . Not to bore you with another platitude, but the journey truly is the destination. If you are serious about becoming a trader, you must be willing to dedicate the time and energy. Start thinking long term. And, avoid the temptation of “get rich quick” schemes along the way. Hopefully, these tools and warnings that make up the five truths of trading will help guide you to become the lucrative full-time stock trader you aspire to be. I will leave you with one last piece of advice that sums up these five truths well: you get out exactly what you put in!