Block Traders – A Spur to Action

Block Traders – A Spur to Action

Oct 19, 2005

The Block Trading services like POSIT and Liquidnet seek to minimize the market impact of their clients’ (i.e., portfolio managers’) large, institutional orders. Successful matches get printed on the tape as they happen but no one sees the activity leading up to the trade on a Level 2 market depth screen. These services only send the transaction to the tape after a buyer and seller are completely matched.

In a recent informal focus group several portfolio managers of funds large and small discussed with us how they use Trade-Ideas. One PM described a typical situation in which she has not yet placed her ‘name’ to trade on one of the Block Trading services (e.g., POSIT or Liquidnet), sees block trades going off in DELL, for example, and realizes its a good time to put the trade through. Trade-Ideas helps her filter out the noise of the overall market and concentrate on the institutional activity within the market.

How? Trade-Ideas has a specific alert to identify large blocks of stock being traded. The idea is to give Portfolio Managers more information on the likelihood of getting business executed. Here is a link that defines this alert. https://trade-ideas.54solutions.com/Help.html#BP

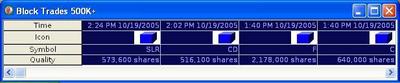

Trade-Ideas offers the ability to customize an alert window to look at minimum (or maximum) size for block trades (i.e., anything over 500,000 shares as in the figure above) as well as specific U.S. exchanges.

Below is a preconfigured strategy looking at block trades over 500,000 shares for all U.S. exchanges

Block Trades 500K

An alert window like the one above helps these Block Trading services because it’s like a reminder to a PM that s/he may want to place their block through as well. Like the dinner bell calling everyone to the table – a spur to action.