Channel Breakdown (confirmed)

Table of Contents

- Understanding the Channel Breakdown Confirmed Alert

- Default Settings

- Custom Settings

- Description Column

- Quality Column

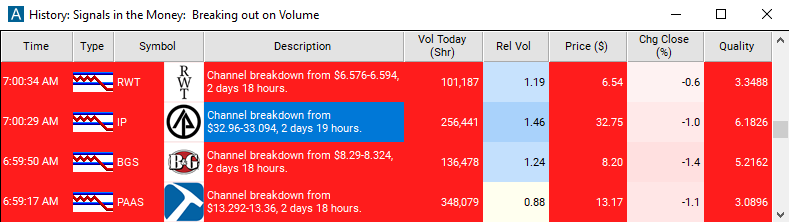

Understanding the Channel Breakdown Confirmed Alert

A volume confirmed channel breakdown alert occurs when a stock transitions directly from a consolidating state to a running state. See the definitions of the consolidation alert, and the running down (confirmed) alert for more details. A consolidation does not always end in a channel breakdown alert. If the stock price moves just slightly outside of the range of the consolidation, the software may just increase the size of the channel. In this case another consolidation alert will eventually occur, but it will be labeled as "decaying". Alternatively, the stock price can move far enough outside of the channel that the stock in no longer consolidating. If it does so slowly enough, no alerts will occur. These alerts only occur when the stock price moves quickly enough to be interesting. These alerts require a certain combination of volume and price action for confirmation. This is required by the way we report consolidations. The top and the bottom of the channel are based on the price of most of the prints, but some prints will be outside of the channel. Therefore, an alert does not occur every time a single print is outside of the channel. An alert only occurs when there is a recognizable pattern of price, time, and volume. In the past, "channel breakdown" appeared in the description of running down (confirmed) alerts. Now this alert has its own alert type, so a user may enable or disable these separately from the running alerts.

Default Settings

By default, the channel breakdown (confirmed) alert will appear when a stock transitions directly from a consolidating state to a running down state. These alerts require a certain combination of volume and price action for confirmation.

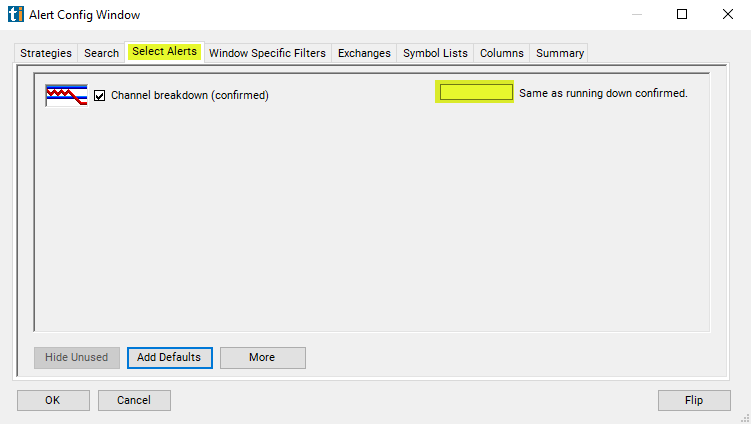

Custom Settings

For 'Channel Breakdown (confirmed)' alerts, you have the option to use an alert specific filter. This filter is located immediately to the right of the corresponding alert and is always optional. You can decide to leave it blank if you want to receive more alerts, or you can fill it in to restrict the number of alerts you receive.

This filter allows you to specify the quality of the alert. When you set a higher number for this filter, you are telling the alerts server to display only alerts that meet a higher quality standard, resulting in fewer alerts being shown.

A volume confirmed channel breakdown is a special case of a volume confirmed running down alert. This filter applies the same to a channel breakdown as it does to any other running alert. When setting an alert for 'Channel Breakdown (confirmed)', the user can filter the alerts based on how exceptional the chart pattern is. This value is not based on the size of a price move, but the speed and consistency of the move.

A value of 1.0 is the minimum that the alerts server ever reports. Leaving this field blank, or setting it to 1.0, shows all alerts. Alerts with values of 5.0 or higher as marked as moving "briskly" in the description field. There is no upper limit to this value, but very few alerts have a value above 10.0.

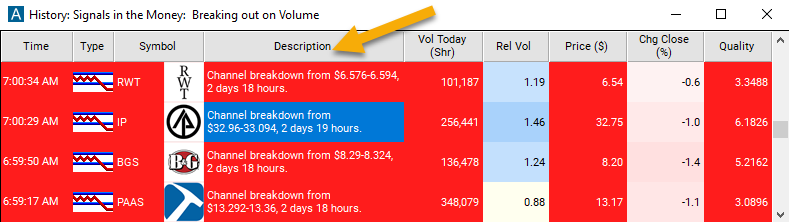

Description Column

The description of your scan will tell you at what price the breakdown occured.

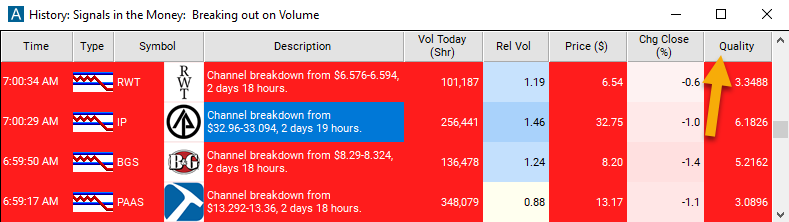

Quality Column

Using Trade-Ideas proprietary algorithm and referencing a stocks historical baseline for movement, the quality value can start at 1 and have no maximum value. A value of 4 shows the most extraordinary 1/3 of the alerts. A value of 10 ensures only the top 1% of the alerts will be triggered.

Alert Info for Channel Breakdown (confirmed) [CHBDC]

- description = Channel breakdown (confirmed)

- direction = -

- keywords = Volume Confirmed

- flip_code =

Channel breakout (confirmed) [CHBOC]

Channel breakout (confirmed) [CHBOC] - parent_code = CHBOC