Running Down (confirmed)

Table of Contents

- Understanding the Running Down Confirmed Alert

- Default Settings

- Custom Settings

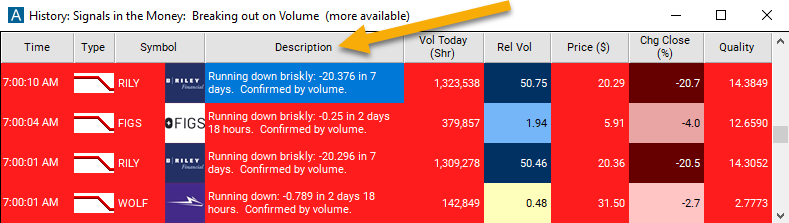

- Description Column

- Quality Column

Understanding the Running Down Confirmed Alert

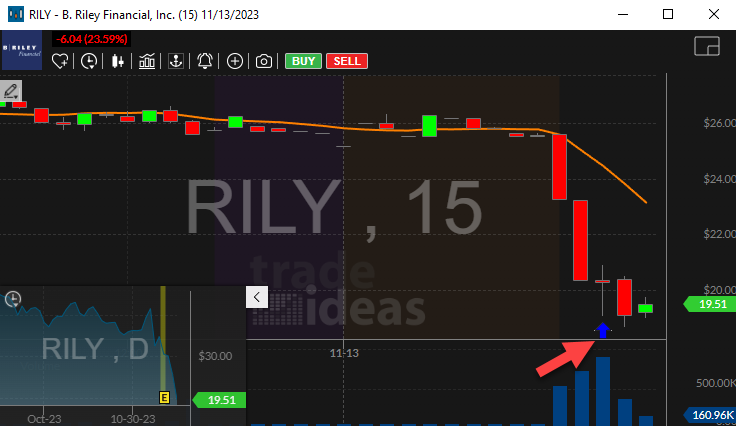

This alert is similar to its faster counterpart, but this alert works on a longer time frame and requires more volume to appear. This alert works on a minimum time frame of approximately 15 minutes. The exact time frame can change based on how quickly a stock is trading. To assist institutional traders, this alert has stricter criteria than the faster ones, so fewer of this alert appear.

There is no direct relationship between the confirmed and faster version of this alert. Neither is a subset of the other. It is analogous to the problem of drawing trendlines on graphs with two different time frames. A trend may be clear in the smaller time frame but reverse itself several times in the larger time frame. Conversely, a trend may not be considered strong to report on the smaller time frame, but in the larger time frame the trend is consistent enough to report. The confirmed version of this alert actually monitors multiple time frames, with different cutoffs for each one.

Because this alert requires statistical confirmation of a trend, the last print may not agree with the trend. Often this alert can be helpful to find tops and bottoms. During especially turbulent trading, it is even possible to see a running up alert followed almost immediately by a running down alert. This is not a mistake. In this case the VWAP graph will show a trend moving up then down, with one or more major volume spikes in the middle.

Default Settings

By default, the running down (confirmed) alert will appear if a stock price is moving down very quickly. This alert is similar to its faster counterpart, but this alert works on a longer time frame and requires more volume to appear.

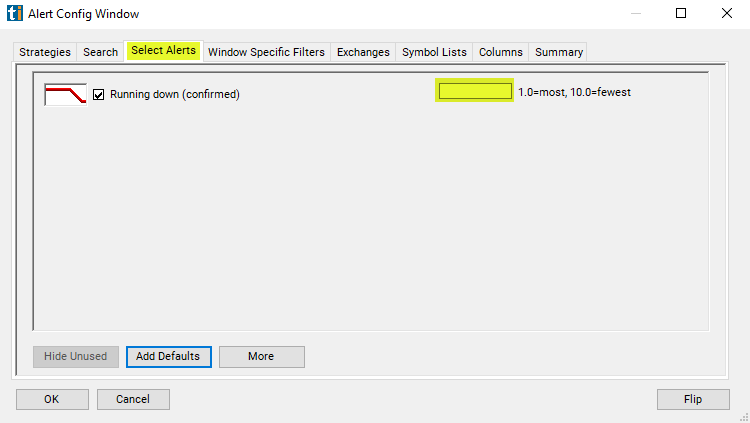

Custom Settings

For 'Running Down (confirmed)' alerts, you have the option to use an alert specific filter. This filter is located immediately to the right of the corresponding alert and is always optional. You can decide to leave it blank if you want to receive more alerts, or you can fill it in to restrict the number of alerts you receive.

This filter allows you to specify the quality of the alert. When you set a higher number for this filter, you are telling the alerts server to display only alerts that meet a higher quality standard, resulting in fewer alerts being shown.

When setting an alert for 'Running Down (confirmed)', the user can filter the volume confirmed running down alerts based on how exceptional the chart pattern is. This value is not based on the size of a price move, but the speed and consistency of the move.

A value of 1.0 is the minimum that the alerts server ever reports. Leaving this field blank, or setting it to 1.0, shows all alerts. Alerts with values of 5.0 or higher as marked as moving "briskly" in the description field. There is no upper limit to this value, but very few alerts have a value above 10.0.

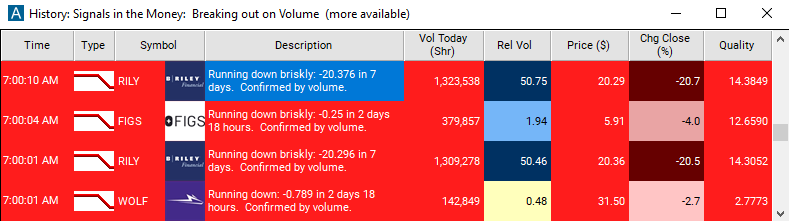

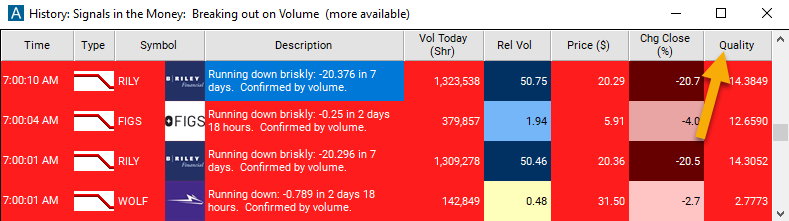

Description Column

The description of the alert will include more information:

Running down - This stock price is decreasing quickly.

Running down briskly - This stock price is decreasing even more quickly.

Quality Column

Using Trade-Ideas proprietary algorithm and referencing a stocks historical baseline for movement, the quality value can start at 1 and have no maximum value. A value of 4 shows the most extraordinary 1/3 of the alerts. A value of 10 ensures only the top 1% of the alerts will be triggered.

Alert Info for Running Down (confirmed) [RDC]

- description = Running down (confirmed)

- direction = -

- keywords = Price vs Time Volume Confirmed

- flip_code =

Running up (confirmed) [RUC]

Running up (confirmed) [RUC] - parent_code = RUC