Short Growth

Table of Contents

- Understanding the Short Growth Filter

- Short Growth Filter Settings

- Using the Short Growth Filter

- FAQs

Understanding the Short Growth Filter

The "short growth" filter focuses on changes in short interest over time. Short interest refers to the total number of shares of a particular stock that have been sold short by investors, indicating their belief that the stock's price will decline.

Let's break down the definition and explain how this filter works:

Short Interest Comparison: The filter compares the current number of shares that have been sold short to the number of shares sold short in the prior month. This comparison allows traders to gauge the change in short interest over time.

Percentage Calculation: The short growth is expressed as a percentage, indicating the magnitude of the change in short interest relative to the prior month. A positive percentage suggests an increase in short interest, while a negative percentage indicates a decrease.

Interpretation: A high short growth percentage implies a significant increase in short interest, which could indicate growing bearish sentiment or anticipation of a price decline among investors. Conversely, a low or negative short growth percentage may suggest waning bearish sentiment or even potential bullish sentiment.

Application: Traders use the short growth filter as a tool to identify stocks that are experiencing notable changes in short interest. Stocks with high short growth percentages may be subjected to increased volatility or downside risk, while those with low or negative short growth percentages may be perceived as having less downside pressure.

Short Growth Filter Settings

Configuring the "Short Growth" filter is simple and can be done within the Window Specific Filters Tab of the Configuration Window in your Alert/Top List Window.

Here's how to set up the filter in your configuration window:

-

Adjust the minimum value to 15 to see only stocks with at least a 15% increase in short interest over the last month.

-

Adjust the maximum value to -10 to see only stocks with at least a 10% decrease in short interest over the last month.

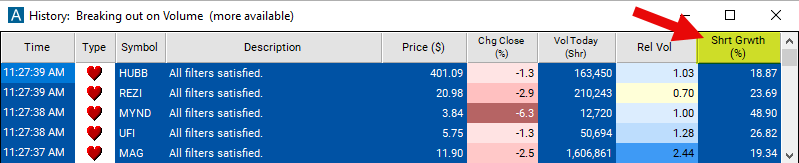

Using the Short Growth Filter

The "Short Growth" filter can be used in various trading strategies, including:

Contrarian Strategy: This strategy involves taking positions opposite to prevailing market sentiment. If there's a significant increase in short interest (high short growth percentage), indicating bearish sentiment, a contrarian trader might consider taking a long position, anticipating a potential short squeeze or a reversal in the stock's price direction. Conversely, if there's a notable decrease in short interest (low short growth or negative percentage), indicating bullish sentiment, the trader might consider shorting the stock, expecting a potential price decline.

Confirmation Strategy: This strategy involves using changes in short interest as confirmation of existing trading signals or trends. For example, if a stock has been trending upward, and there's a notable increase in short interest (high short growth percentage), it could confirm the bullish trend, providing additional conviction to stay long or even add to the position. Conversely, if a stock has been trending downward, and there's a significant decrease in short interest (low short growth or negative percentage), it could confirm the bearish trend, providing further justification for maintaining or adding to short positions.

Volatility Strategy: Changes in short interest can influence stock volatility. Traders might employ volatility-based strategies, such as straddle or strangle options strategies, to capitalize on potential price swings resulting from shifts in short interest. For instance, if there's a high short growth percentage indicating increased bearish sentiment, traders might expect heightened volatility and could use options strategies to profit from potential price fluctuations.

FAQs

What exactly does the short growth filter measure?

- The short growth filter quantifies the percentage change in short interest for a specific stock relative to the previous month.

What does a high short growth percentage indicate?

- A high short growth percentage indicates a significant increase in short interest, suggesting heightened bearish sentiment or negative market expectations regarding the stock. It could imply potential downside pressure or increased volatility.

What does a low or negative short growth percentage indicate?

- A low or negative short growth percentage indicates a decrease in short interest, suggesting a potential shift in sentiment towards the stock. It could imply reduced downside pressure or even bullish sentiment, depending on other market factors.

Filter Info for Short Growth [ShortG]

- description = Short Growth

- keywords = Fundamentals Changes Daily

- units = %

- format = 2

- toplistable = 1

- parent_code =