Position in 5 Minute Range

Table of Contents

- Understanding the Position in 5 Minute Range Filter

- Position in 5 Minute Range Filter Settings

- Using the Position in 5 Minute Range Filter

- FAQs

Understanding the Position in 5 Minute Range Filter

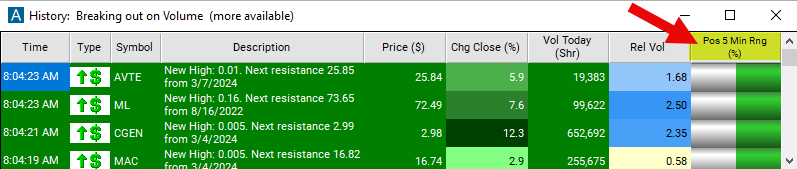

The "position in 5-minute range" filter refers to a metric used to determine where the current price of a stock falls within its 5-minute trading range. This filter is particularly relevant for intraday traders who are interested in short-term price movements.

Here's how the "position in 5-minute range" filter works:

5-Minute Trading Range: The trading range refers to the difference between the highest and lowest prices at which a stock has traded during a specific time period. In this case, the time period is 5 minutes. So, for each 5-minute interval during the trading day, a range is established based on the highest and lowest prices reached by the stock within that interval.

Position within the Range: The "position in 5-minute range" filter then determines where the current price of the stock falls within this 5-minute trading range. It quantifies this position as a percentage, where 0% represents the lowest price within the range, 50% represents the midpoint, and 100% represents the highest price within the range.

Traders use this filter to gauge the current price's relative position within the recent price action. For example, if the current price is near the high of the 5-minute range (closer to 100%), it may indicate bullish momentum or buying pressure. Conversely, if the price is near the low of the range (closer to 0%), it may suggest bearish sentiment or selling pressure.

Time is accurate to the minute.

Position in 5 Minute Range Filter Settings

The settings of each Trade Ideas filter are defined in the Window Specific Filters Tab located in the Configuration Window of your Alert/Top List Window.

Here is how to setup the filter in your configuration window:

- Set the min value to 90 to show stocks that are very close to the top of their range for the last 5 minutes.

Using the Position in 5 Minute Range Filter

Several trading strategies can be employed with the Position in 5 Minute Range filter. Here are a few examples:

Breakout Trading: Traders can use the position in the 5-minute range to identify potential breakout opportunities. If the price is near the high of the range and breaks above it, traders may consider entering long positions, anticipating further upward momentum. Conversely, if the price breaks below the low of the range, traders may consider short positions, expecting downward momentum.

Range Trading: Range-bound strategies involve buying near the low of the 5-minute range and selling near the high, or vice versa. Traders may wait for the price to approach one end of the range and then enter positions in anticipation of a reversal towards the opposite end of the range.

Trend Confirmation: Traders can use the position in the 5-minute range to confirm trends identified through other technical indicators. For example, if a stock is in an uptrend according to longer-term indicators, traders may look for buying opportunities when the price is near the high of the 5-minute range, confirming the upward momentum.

FAQs

What does the "position in 5-minute range" filter indicate?

- This filter shows where the current price of a stock lies within its price range over a specific 5-minute period. It provides insights into the current momentum and volatility of the stock within a short-term timeframe.

How is the position in the 5-minute range calculated?

- The calculation involves determining the high and low prices of the stock over the past 5 minutes and comparing the current price to this range. The position is then expressed as a percentage or ratio indicating how far the current price is from the high or low of the range.

Why is the "position in 5-minute range" filter important in trading?

- This filter helps traders assess the current market sentiment and momentum within short-term intervals. It can aid in identifying potential breakout or reversal points, as well as confirming trends or range-bound movements.

What does it mean when the price is near the high or low of the 5-minute range?

- If the price is near the high of the range, it suggests bullish momentum or buying pressure, while if it's near the low, it indicates bearish sentiment or selling pressure. Traders may interpret these positions differently depending on their trading strategies.

Filter Info for Position in 5 Minute Range [R5M]

- description = Position in 5 minute range

- keywords = Single Print

- units = %

- format = 1

- toplistable = 1

- parent_code =

Position in 15 minute range [R15M]

Position in 15 minute range [R15M] Position in 30 minute range [R30M]

Position in 30 minute range [R30M] Position in 60 minute range [R60M]

Position in 60 minute range [R60M]