Position in 30 Minute Range

Table of Contents

- Understanding the Position in 30 Minute Range Filter

- Position in 30 Minute Range Filter Settings

- Using the Position in 30 Minute Range Filter

- FAQs

Understanding the Position in 30 Minute Range Filter

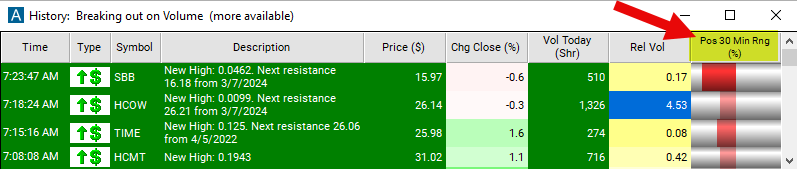

The "position in 30-minute range" filter refers to a metric used to determine where the current price of a stock falls within its 30-minute trading range.

Here's how the "position in 30-minute range" filter works:

30-Minute Trading Range: The trading range refers to the difference between the highest and lowest prices at which a stock has traded during a specific time period. In this case, the time period is 30 minutes. So, for each 30-minute interval during the trading day, a range is established based on the highest and lowest prices reached by the stock within that interval.

Position within the Range: The "position in 30-minute range" filter then determines where the current price of the stock falls within this 30-minute trading range. It quantifies this position as a percentage, where 0% represents the lowest price within the range, 50% represents the midpoint, and 100% represents the highest price within the range.

Traders use this filter to gauge the current price's relative position within the recent price action. For example, if the current price is near the high of the 30-minute range (closer to 100%), it may indicate bullish momentum or buying pressure. Conversely, if the price is near the low of the range (closer to 0%), it may suggest bearish sentiment or selling pressure.

Time is accurate to the minute.

Position in 30 Minute Range Filter Settings

The settings of each Trade Ideas filter are defined in the Window Specific Filters Tab located in the Configuration Window of your Alert/Top List Window.

Here is how to setup the filter in your configuration window:

- Set the max value to 50 to show stocks that are under the midpoint range for the last 30 minutes.

Using the Position in 30 Minute Range Filter

Several trading strategies can be employed with the Position in 30 Minute Range filter. Here are a few examples:

Breakout Trading: Traders can use the position in the 30-minute range to identify potential breakout opportunities. If the price breaks above the high of the 30-minute range, traders may consider entering long positions, anticipating further upward momentum. Conversely, if the price breaks below the low of the range, traders may consider short positions, expecting downward momentum.

Range Trading: Range-bound strategies involve buying near the low of the 30-minute range and selling near the high, or vice versa. Traders may wait for the price to approach one end of the range and then enter positions in anticipation of a reversal towards the opposite end of the range.

Trend Confirmation: Traders can use the position in the 30-minute range to confirm trends identified through other technical indicators. For example, if a stock is in an uptrend according to longer-term indicators, traders may look for buying opportunities when the price is near the high of the 30-minute range, confirming the upward momentum.

Scalping: Scalpers aim to capitalize on small price movements within short timeframes. They may use the position in the 30-minute range to identify quick entry and exit points based on short-term momentum and volatility.

FAQs

What does the "position in the 30-minute range" filter represent?

- This filter indicates the current price's position relative to the high and low prices observed within the last 30 minutes. It helps traders gauge where the price stands within the recent price range and assess short-term momentum.

How is the position in the 30-minute range calculated?

- The calculation involves determining the high and low prices of the stock within the last 30 minutes and comparing the current price to this range. The position is then expressed as a percentage or ratio to indicate how far the current price is from the high or low of the range.

What does it mean when the price is near the high or low of the 30-minute range?

- If the price is near the high of the range, it suggests bullish momentum or buying pressure, while if it's near the low, it indicates bearish sentiment or selling pressure. Traders may interpret these positions differently depending on their trading strategies.

How can traders use the "position in the 30-minute range" filter in their trading strategies?

- Traders can use this filter to identify potential entry and exit points, confirm short-term trends, assess momentum, and adjust their trading strategies accordingly. It can be particularly useful for day traders focusing on short-term price movements.

Filter Info for Position in 30 Minute Range [R30M]

- description = Position in 30 minute range

- keywords = Single Print

- units = %

- format = 1

- toplistable = 1

- parent_code = R5M