Quarterly Earnings Growth

Table of Contents

- Understanding the Quarterly Earnings Growth Filter

- Quarterly Earnings Growth Filter Settings

- Using the Quarterly Earnings Growth Filter

- FAQs

Understanding the Quarterly Earnings Growth Filter

Quarterly Earnings Growth is a financial metric used to measure the percentage change in a company's earnings using year over year data comparing the current earnings to that of 12 months ago. It measures the percentage increase or decrease in earnings over a three-month period, providing insight into the company's performance on a quarterly basis.

Calculation: The formula for Quarterly Earnings Growth is: Current quarter earnings−Earnings from same quarter last year / earnings from the same quarter last year x 100

Interpretation: A positive QEG indicates earnings growth, meaning the company earned more in the current quarter compared to the same quarter last year. A negative QEG suggests earnings decline, indicating the company earned less in the current quarter compared to the same quarter last year. The magnitude of QEG reflects the percentage change in earnings over the year, providing insight into the company's earnings performance and growth trajectory.

Quarterly Earnings Growth Filter Settings

Configuring the "Quarterly Earnings Growth" filter is simple and can be done within the Window Specific Filters Tab of the Configuration Window in your Alert/Top List Window.

Here's how to set up the filter in your configuration window:

-

Set the minimum value to 10 to see only stocks where quarterly earnings are up at least 10% from last year.

-

Set the maximum value to -10 to see only stock where quarterly earnings are down at least 10% from last year.

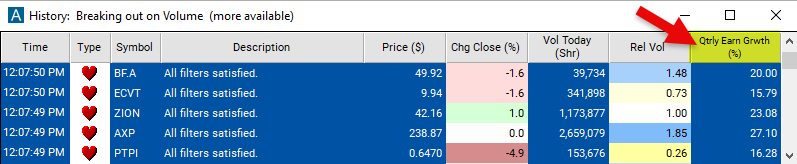

Using the Quarterly Earnings Growth Filter

The "Quarterly Earnings Growth" filter can be used in various trading strategies, including:

Momentum Trading: Identify stocks with high Quarterly Earnings Growth rates, indicating strong earnings momentum. Take long positions in these stocks to capitalize on potential price appreciation resulting from positive earnings surprises. Utilize technical analysis tools to identify trends and entry/exit points for trades.

Contrarian Strategy: Identify stocks with low Quarterly Earnings Growth rates relative to market expectations. Evaluate whether the market may be underestimating their growth potential, leading to potential buying opportunities. Take contrarian positions in stocks with favorable long-term prospects but temporarily depressed growth expectations.

Volatility Trading: Use Quarterly Earnings Growth as a volatility indicator. Stocks with high growth rates may experience greater price volatility around earnings announcements. Implement options strategies such as straddles or strangles to capitalize on potential volatility spikes.

FAQs

What is Quarterly Earnings Growth, and why is it important?

- Quarterly Earnings Growth (QEG) measures the percentage change in a company's earnings from one quarter to another, comparing the current quarter's earnings to those from the same quarter of the previous year. It is important because it reflects the company's short-term financial performance and growth trajectory, providing insights into its profitability and potential future earnings.

How is Quarterly Earnings Growth calculated?

- Quarterly Earnings Growth is calculated by subtracting the earnings from the same quarter of the previous year from the earnings of the current quarter. The difference is divided by the earnings from the same quarter last year and multiplied by 100 to express the change as a percentage.

Comparing QEG Across Companies:

- To compare QEG across different companies and industries, investors should consider factors such as market dynamics, business models, and growth prospects. They can analyze QEG trends relative to industry averages and peer performance to assess relative earnings growth potential.

Filter Info for Quarterly Earnings Growth [QEarnG]

- description = Quarterly Earnings Growth

- keywords = Fundamentals Changes Daily

- units = %

- format = 2

- toplistable = 1

- parent_code =