Interest Income

Table of Contents

- Understanding the Interest Income Filter

- Interest Income Filter Settings

- Using the Interest Income Filter

- FAQs

Understanding the Interest Income Filter

Interest income refers to the revenue generated by a company from various interest-bearing assets in its investment portfolio. Here's a detailed explanation of the "Interest Income" filter:

Definition: Interest income represents the quarterly income received from all earning assets, including loans and investment securities. It encompasses a wide range of sources, such as interest and fees on loans, interest on federal funds, interest on bank deposits, interest on municipal funds, interest on U.S. government and federal agency securities, interest on mortgage-backed securities, and more.

Components of Interest Income: Interest income comprises several components, including:

- Interest and fees on loans: Revenue generated from interest charges and fees on loans extended by the company.

- Interest on various securities: Revenue earned from interest payments on investment securities such as U.S. government bonds, corporate bonds, municipal bonds, and mortgage-backed securities.

- Dividend income: Income received from dividends paid on stocks and equity investments held by the company.

- Other interest income: Additional sources of interest income, including interest on investments, government debt securities, equity investments, and funds held at central banks.

Significance in Stock Trading: Interest income is an important source of revenue for companies, particularly financial institutions such as banks, insurance companies, and investment firms. Traders and investors analyze a company's interest income as part of their fundamental analysis to assess its revenue streams, profitability, and financial health. Higher interest income may indicate strong investment performance and contribute to a company's overall earnings.

Interest Income Filter Settings

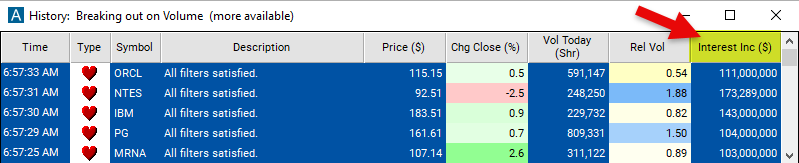

Configuring the "Interest Income" filter is simple and can be done within the Window Specific Filters Tab of the Configuration Window in your Alert/Top List Window.

Here's how to set up the filter in your configuration window:

- Set the minimum value to 100,000,000 to see only stock with an income interest of at least $100 million.

Using the Interest Income Filter

Filtering by "Interest Income" can be advantageous for many reasons, including:

Diversification: Incorporating stocks with interest income into a trading strategy can enhance portfolio diversification by adding exposure to different asset classes and income streams. By diversifying across stocks, bonds, and other interest-bearing assets, traders can reduce overall portfolio risk and potentially improve risk-adjusted returns.

Risk Management: Stocks with stable and predictable interest income may offer downside protection and serve as a hedge against market volatility and economic uncertainty. Traders may filter stocks by interest income to identify defensive assets that can help mitigate portfolio risk during periods of market turbulence.

Income Forecasting: Analyzing stocks based on interest income provides insights into a company's revenue sources, profitability, and financial health. Traders may use interest income data to forecast future earnings, assess dividend sustainability, and evaluate a company's ability to generate consistent income over time.

FAQs

What is interest income?

- Interest income refers to the revenue earned by an entity from interest-bearing assets such as bonds, loans, bank deposits, and dividend-paying stocks. It represents the interest payments received for lending their money or investing in interest-bearing securities.

What are some common sources of interest income?

- Common sources of interest income include interest on fees and loans, interest on various securities, dividend income and other interest income.

What factors can affect interest income?

- Several factors can impact interest income, including changes in interest rates, credit risk, inflation, economic conditions, and market volatility. Fluctuations in interest rates can affect the yield on fixed-income securities and the interest earned on bank deposits, influencing overall interest income.

Filter Info for Interest Income [Interest]

- description = Interest Income

- keywords = Fundamentals Changes Daily

- units = $

- format = 0

- toplistable = 1

- parent_code =