Held By Institutions

Table of Contents

- Understanding the Held By Institutions Filter

- Held By Institutions Filter Settings

- Using the Held By Institutions Filter

- FAQs

Understanding the Held By Institutions Filter

The "held by institutions" filter in stock trading is a tool used to identify stocks based on the percentage of shares held by institutional investors within a company. Institutional investors include entities such as mutual funds, hedge funds, pension funds, and investment firms, which manage large pools of capital on behalf of their clients.

Here's a detailed explanation of the "held by institutions" filter:

Definition of Institutional Investors: Institutional investors are professional investors that manage large sums of money on behalf of institutions or individual clients. They often have significant resources and expertise to conduct thorough research and analysis when making investment decisions.

Calculation of Institutional Holdings: The "held by institutions" filter calculates the percentage of shares held by institutional investors relative to the total outstanding shares of a company. It provides insights into the level of institutional ownership and their potential influence on the stock's trading dynamics and price movements.

Significance in Trading: Institutional ownership is an important metric for traders and investors as it can reflect professional investors' sentiment and confidence in a company's prospects. Higher levels of institutional ownership may suggest institutional endorsement and positive outlook for the company's future performance.

Held By Institutions Filter Settings

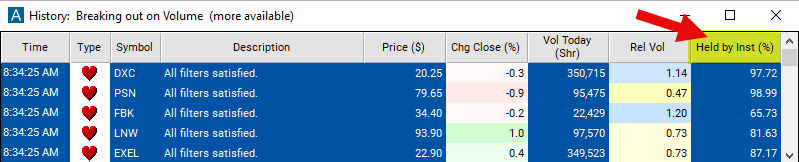

Configuring the "Held By Institutions" filter is simple and can be done within the Window Specific Filters Tab of the Configuration Window in your Alert/Top List Window.

Here's how to set up the filter in your configuration window:

- Adjust the minimum value to 50 to see only stocks where at least 50% of its shares are held by institutional investors.

Using the Held By Institutions Filter

The "Held By Institutions" filter can be used in various trading strategies, including:

Follow the Institutions: Traders may adopt a strategy of following institutional buying or selling activity to identify potential trading opportunities. If institutions are accumulating shares of a company's stock (institutional buying), it may signal confidence in the company's future prospects. Conversely, significant institutional selling activity may suggest concerns about the company's performance or outlook.

Institutional Buying Signals: Traders may interpret institutional buying as a bullish signal and consider initiating long positions in the stock. Institutional buying can be seen as a vote of confidence from professional investors, potentially signaling undervaluation or positive developments on the horizon.

Institutional Selling Signals: Conversely, traders may interpret significant institutional selling as a bearish signal and consider short-selling or avoiding long positions in the stock. Institutional selling could indicate institutional pessimism or concerns about the company's future performance, prompting traders to reevaluate their bullish outlook.

FAQs

What exactly does the "held by institutions" filter measure?

- The "held by institutions" filter measures the percentage of a company's outstanding shares that are held by institutional investors, such as mutual funds, hedge funds, pension funds, and investment firms. It provides insights into the level of institutional ownership and their potential influence on the stock's trading dynamics and price movements.

How is institutional ownership calculated, and where can I find this information?

- Institutional ownership is calculated by dividing the total number of shares held by institutional investors by the company's total outstanding shares and expressing the result as a percentage.

What is considered a high percentage of shares held by institutions, and why is it important?

- The threshold for what is considered a high percentage of shares held by institutions can vary depending on industry norms, company size, and investor preferences. Generally, institutional ownership percentages above 50% are considered substantial. High institutional ownership levels may indicate professional investors' confidence in the company's prospects and their endorsement of the stock.

Filter Info for Held By Institutions [Institution]

- description = Held by Institutions

- keywords = Fundamentals Changes Daily

- units = %

- format = 2

- toplistable = 1

- parent_code =