Income

Table of Contents

Understanding the Income Filter

Income refers to the net income or net profit generated by a company during a specific period, in this case the most recent fiscal year. Here's a detailed explanation of the "Income" filter:

Definition: Income, specifically net income, represents the amount of money remaining after deducting all costs, expenses, taxes, depreciation, and interest from a company's total sales or revenue. It is often referred to as the bottom line because it appears at the bottom of the income statement, summarizing the company's profitability.

Components of Net Income: Net income is calculated by subtracting total expenses from total revenues. The formula for net income is: Total Revenues - Total Expenses

Total revenues include all sources of income generated by the company, such as sales revenue, service revenue, and investment income. Total expenses encompass all costs incurred in the process of generating revenue, including operating expenses, cost of goods sold, depreciation, interest expenses, and taxes.

Significance of Net Income: Net income is a crucial metric for investors as it provides insights into a company's profitability and financial performance. A positive net income indicates that the company earned more revenue than it incurred expenses, resulting in a profit. Conversely, a negative net income indicates a loss.

Income Filter Settings

Configuring the "Income" filter is simple and can be done within the Window Specific Filters Tab of the Configuration Window in your Alert/Top List Window.

Here's how to set up the filter in your configuration window:

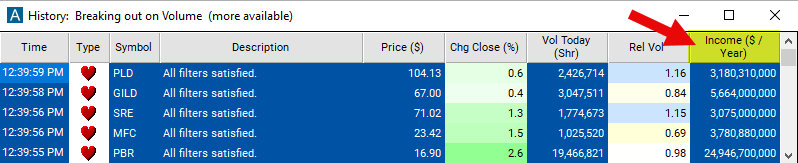

- Set the minimum value to 3,000,000,000 to see only stocks with a yearly income of at least $3 billion.

Using the Income Filter

The "Income" filter can be used in various trading strategies, including:

Earnings Momentum Trading: This strategy involves trading based on the momentum of a company's earnings growth. Traders look for companies that consistently beat earnings expectations or demonstrate accelerating earnings growth. Stocks of companies with strong income growth may experience upward price momentum, presenting buying opportunities.

Earnings Surprises: Traders focus on companies that surprise the market with better-than-expected earnings results. Stocks of companies that exceed earnings estimates often experience positive price reactions, leading to short-term trading opportunities. Conversely, stocks of companies that miss earnings estimates may experience negative price movements, offering potential short-selling opportunities.

Growth Investing: Growth investors focus on stocks of companies with strong income growth prospects. Traders look for companies that demonstrate consistent revenue and earnings growth, often investing in high-growth sectors such as technology, healthcare, or consumer discretionary. Stocks of growth companies may experience rapid price appreciation as investors anticipate future earnings growth.

FAQs

What does a company's income represent?

- A company's income, specifically its net income or net profit, represents the amount of money it earns after deducting all expenses, taxes, and other costs from its total revenues. Net income is a key indicator of a company's profitability and financial performance, providing insights into its ability to generate earnings from its core operations.

How does a company's income affect its stock price?

- A company's income can have a significant impact on its stock price. Positive income growth or better-than-expected earnings results often lead to upward movements in the stock price as investors perceive the company as financially healthy and profitable. Conversely, disappointing income results or earnings misses may lead to declines in the stock price as investors reassess the company's prospects and valuation.

What is considered a good or high income for a company?

- The definition of a "good" or "high" income for a company depends on various factors such as industry norms, market expectations, and company-specific dynamics. Generally, a company with consistently growing income, strong profit margins, and robust earnings relative to its peers may be considered to have a good income. However, what constitutes a good income can vary across industries and market conditions.

Filter Info for Income [Income]

- description = Income

- keywords = Fundamentals Changes Daily

- units = $ / Year

- format = 0

- toplistable = 1

- parent_code =