Gap

Table of Contents

- Understanding the Gap in Dollars Filter

- Gap in Dollars Filter Settings

- Using Gap in Dollars in Trading

- FAQs about Gap in Dollars

Understanding the Gap in Dollars Filter

The Gap $ Filter enables traders to scans for stocks based on the size and direction of the stock’s gap.

The formula for the Gap $ calculation is expected_open - last_price

-

expected_openis the today’s official open price, or the most recent print if the stock has not opened yet. -

last_priceis the official closing price for the previous day.

Depending on the trading session, the gap is therefore defined as follows:

During Market Hours

During the trading day, the gap is defined as the difference between the open price and the previous close price.

If a stock closes at 14.50, and opens the next trading day at 14.75, then the stock gapped up 0.25.

If a stock closes at 50.10, then opens the next day at 50.03, the stock gapped down 0.07, or it gapped up -0.07.

The official open price is the price of the first print after the trading day starts. The exchange can correct this value, but normally the open price and the gap do not change after the first print.

During the Premarket and Afterhours

During the premarket session, so before the start of the market at 9:30 am Est, the gap is defined as the difference between the current stock price and the previous close price. This gives us a continuously improving approximation of what the gap will be.

This approximation is updated on each print until the exchange reports the official value of the opening print.

We start using this approximation of the gap already shortly after the close at 4 pm Est. For example, if the last official print today is at $12.94, and the first after hours print is also at $12.94, this print will reset the gap to zero.

If the next print is 12.96, then the stock has gapped up $0.02.

For most actively traded stocks, the gap will not be reliable for the first 90 seconds after the market closes; it takes about that long for the exchange to report the last official trades of the day and transition into after market mode. For more thinly traded stocks, the gap will change with the first after market print, whenever that happens.

Note that these are not the only definition of gap. See the Position of Open Filter for another definition.

Gap in Dollars Filter Settings

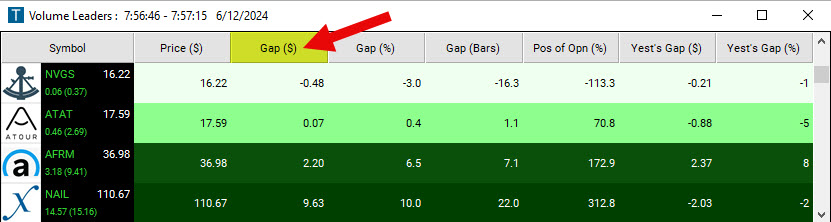

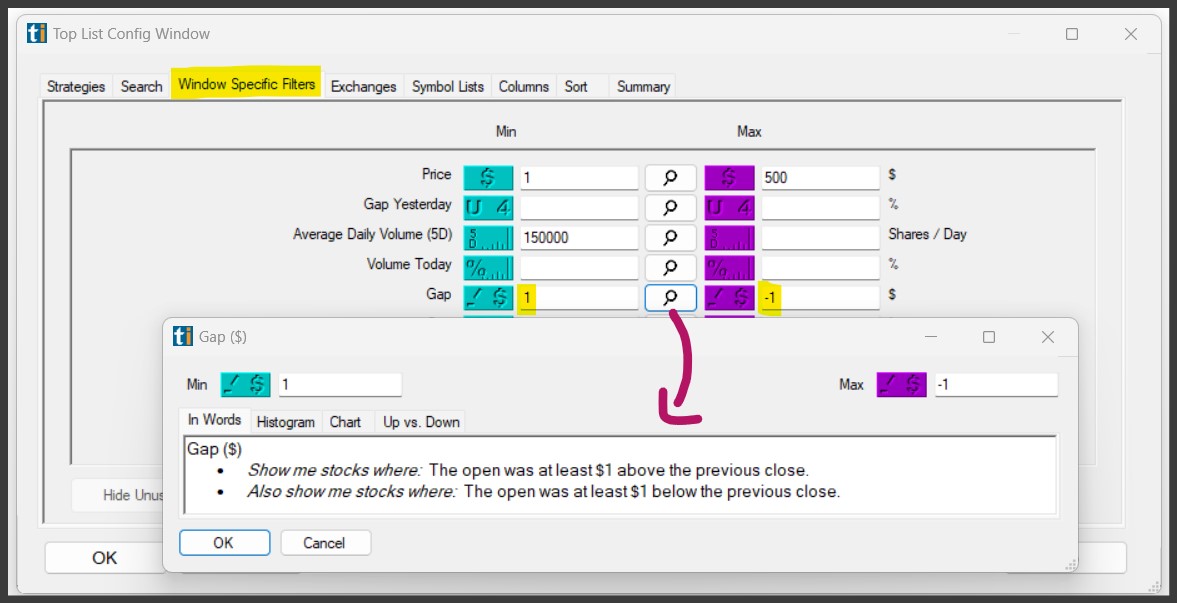

Activating the Gap $ Filter is straightforward. You'll find its settings under the Window Specific Filters Tab in your Alert/Top List Window's Configuration Window.

You can set a minimum and/or maximum value, and stocks that don't fit within your parameters are automatically excluded from your scan results.

-

To find stocks which gapped up at least $1.25, add the Gap $ Filter Filter to your scan and enter 1.25 in the minimum field in the Windows Specific Filters Tab.

-

To find stocks with a gap smaller than or equal to $2.50, add the Gap $ Filter Filter to your scan and enter 2.50 in the maximum field in the Windows Specific Filters Tab.

-

To see all stocks with no gap or only a small gap up or down, add the Gap $ Filter Filter to your scan and enter -0.25 in the minimum field and 0.25 in the maximum field in the Windows Specific Filters Tab. This will show you stocks with a gap in either direction of no more than 25 cents.

-

To see all stocks with a large gap in either direction (up or down), add the Gap $ Filter Filter to your scan and enter 1 in the minimum field and -1 in the maximum field. This will show you all stocks that have a positive or negative gap of at least $1.

Using Gap in Dollars in Trading

Gap trading is a fascinating area in the stock market and offers a variety of strategic approaches. Here are some gap trading strategies to consider:

- Gap and Go Strategy: This strategy is based on the principle that if a stock gaps up or down, it'll continue in that direction throughout the day. Traders, right after spotting the gap, quickly jump into the trade expecting the momentum to carry forward.

Example: If a stock with strong technicals and positive news releases gaps up at the open, traders buy the stock early, anticipating further upward movement.

- Partial Gap Fill Strategy:

Sometimes, a stock that has gapped at the opening might try to "fill the gap" before resuming its original direction. In such cases, traders can trade the reversal, aiming to profit from this short retracement.

Example: If a stock gapped up at the opening, wait for it to decline as sellers come in. Buy it when it starts rebounding, hoping to profit from its movement back up.

- Gap Continuation Strategy: This strategy focuses on trading stocks that have not only gapped but also show signs of continuing their movement from the previous day. It's especially beneficial for swing traders.

Example: If a stock showed a strong uptrend yesterday and gapped up today, one might buy it, expecting that the upward trend will continue for several more days.

- Exhaustion Gap Strategy: Sometimes a gap may indicate the end of a trend. This strategy is based on identifying such gaps. They are typically accompanied by high volume and occur after a significant price move. Trading an exhaustion gap involves betting against the current trend, anticipating a reversal.

Example: After a long bullish trend, a stock gaps up significantly but on very high volume. This might be a sign that the stock has peaked, and an astute trader might consider taking a short position, anticipating a downturn.

- Breakaway Gap Strategy: A breakaway gap signifies the beginning of a new trend, breaking away from a consolidation or trading range. Such gaps are usually backed by significant news or events affecting the company.

Example: If a stock was trading sideways for weeks and suddenly gapped up on news of a significant merger, traders might buy the stock, expecting the start of a new bullish trend.

- Common Gap Strategy: These are small gaps that occur frequently. They're not caused by significant news events and are generally filled quickly. The strategy here is to trade expecting the gap to close.

Example: If a stock typically moves forth and back between $50-$51 and one day opens at $51.20 without any significant news, a trader might expect it to revert back to its usual range, thereby betting on the price moving back down.

- Island Reversal Strategy: This is a situation where a stock gaps in the direction of the prevailing trend, trades for a few days, and then gaps back the other way, leaving a price "island" behind. It's a strong reversal signal.

Example: A stock in a downtrend gaps down, trades in a narrow range for a few days, and then gaps up, leaving behind an "island" of prices. This would be a strong indication of a potential trend reversal to the upside.

Each gap trading strategy requires a proper risk management strategy. Stop-loss orders are essential, as gaps can sometimes reverse direction quickly, leading to significant losses. As always, backtesting any strategy on historical data before deploying real capital is a good practice.

FAQs about Gap in Dollars

What's the significance of trading gaps? Why are they important?

Gaps represent significant price jumps, which often result from major news events, shifts in market sentiment, or large institutional trading. They indicate strong interest or disinterest in a stock and, as such, are valuable for predicting short-term movements and potential longer-term trends.

Are all gaps tradable, or should I focus on specific ones?

Not all gaps are created equal. While the Gap in Dollars Filter can help identify gaps, it's essential to determine the reason behind the gap. Earnings releases, news announcements, or macroeconomic events can lead to gaps. You should ideally focus on gaps backed by strong volume and other technical indicators.

How do I differentiate between a "false" gap and a genuine one?

A genuine gap typically occurs with substantial trading volume and is often accompanied by significant news or events related to the stock. A "false" gap might occur due to thin trading volume, perhaps at the start of the premarket session, and may not hold once regular trading commences.

What's the significance of volume in gap trading?

Volume confirms the strength and validity of a gap. A gap on high volume suggests strong institutional interest and a higher likelihood the gap will sustain, while a low-volume gap might be less reliable and more prone to being filled.

Can the Gap in Dollars Filter be combined with other indicators for more robust signals?

Absolutely. Combining the Gap in Dollars Filter with other technical indicators, like RSI, MACD, or Moving Averages, can offer more reliable trade signals. For instance, a bullish gap combined with an RSI below 30 might suggest a strong buy opportunity.

Are there other ways to measure a gap?

There are three primary methods of measuring the size of a stock's gap:

-

The Gap $ Filter is measuring the size of the gap in dollars.

-

The Gap % Filter is measuring the size of the gap as a percentage.

-

The Gap in Bars Filter scales the gap based on a stock’s volatility. This method filters out the usual stock behavior to highlight more significant gaps relative to a stock's typical movement.

If I'm interested in tracking unusual stock behavior, which method is most effective for setting a gap filter?

The most powerful way to track stocks showing atypical behavior is by using the noise filtering mode (Gap Filter in Bars). This mode scales the gap according to a stock’s volatility. For instance, while a $0.10 gap might be substantial for certain stocks, it could be just background noise for others. The Gap in Bars Filter helps to focus on those showing significant deviations, filtering out stocks that are acting like they usually do. Head here to learn more about this filter.

What is the difference between the Change from Close Filter and the Gap Filter?

The Difference:

"Gap" primarily refers to the difference in a stock's price between its previous close and the next open.

The Change from Close Filter looks at the difference between the current stock price at any given moment during the trading day and the stock's closing price from the previous day. It essentially gives you a real-time or intra-day perspective on how a stock is performing relative to its last closing price.

Use the Gap Filter when you're keen on trading stocks that have exhibited significant price movement outside regular trading hours. This is often triggered by after-hours news, earnings reports, or other significant events. For example, catching stocks that have gapped up might indicate bullish sentiment, and if combined with other technical indicators or news, could present a trading opportunity. However, always be wary of "gap fills" where stocks might revert to their pre-gap levels.

The Change from Close Filter is your intra-day tool. It's essential when you want to capture stocks that are on the move during trading hours and gauge their momentum compared to the previous close. Day traders, especially, would find this useful to pinpoint stocks that are breaking out or breaking down within the trading day.

Is there a filter for Gap Yesterday?

To scan for stocks based on yesterday's gap, you can create a custom filter with the help of our Formula Editor

The formula you will need for Yesterday's Gap ($) is:

open_p - close_p

The formula you will need for Yesterday's Gap (%) is:

((open_p - close_p) / close_p) * 100

You can use these two custom filters just like their pre-built Gap Filter counterparts.

Here are two examples:

-

To see stocks that have gapped up by a minimum of 10% yesterday, add the Yesterday Gap % custom filter to your scan and enter 10 in the minimum field of the Windows Specific Filters Tab.

-

To see stocks that have gapped down at least 5% yesterday, add the Yesterday Gap % custom filter to your scan and enter -5 in the minimum field of the Windows Specific Filters Tab.

Does the Gap in Dollars Filter work effectively across all market sectors?

Gaps might be more common in certain sectors due to specific industry trends, news, or events. While the filter works across all sectors, understanding the context of the gap in relation to its sector can provide additional insight.

What timeframes work best when trading gaps?

While gaps are most commonly associated with daily charts, they can appear on any timeframe. However, daily gaps offer the most substantial trading opportunities since they reflect overnight changes in market sentiment.

Should I be concerned about stocks that continuously show gaps over a short period?

Frequent gaps in a stock's price can indicate high volatility or significant news/events concerning that stock. While they can provide trading opportunities, they also come with increased risk. Ensure you have a proper risk management strategy in place when trading such stocks.

How long should I hold onto a stock after identifying a gap?

Gaps can offer both short-term and long-term trading opportunities. The hold period depends on the type of gap, its underlying cause, and the stock's post-gap behavior. Day traders might capitalize on a gap and sell within the same trading session, whereas swing traders might hold for days or weeks to capitalize on a potential trend.

Can I use the Gap in Dollars Filter for stocks in all price ranges?

Yes, you can. However, it's essential to note that a gap of, say, $1 in a $10 stock has a different impact compared to a $1 gap in a $100 stock. Adjust your settings and expectations accordingly based on stock prices.

How do I use the Gap in Dollars Filter during earnings season?

Earnings season can lead to increased volatility and more gaps. During this period, focus on companies about to release their earnings. Using the filter, you can identify potential gapping stocks post-earnings release and trade based on the outcome and market reaction.

Are there specific days of the week when gaps are more prevalent?

Gaps can occur any day, but Monday often sees more gaps since it accounts for news and events over the weekend. Being vigilant at the start of the trading week can yield fruitful gap trading opportunities.

Do gaps always get filled?

It's a common belief in trading that "gaps always get filled." While many gaps do get filled eventually, there's no guarantee. Each gap should be evaluated based on its context, the stock's momentum, and market conditions.

How does market sentiment affect gap trading?

Market sentiment plays a pivotal role. Bullish sentiment can lead to upward gaps, while bearish sentiment can cause downward gaps. Monitoring broader market sentiment and news can provide insights into whether a gap might continue in its direction or reverse.

Filter Info for Gap [GUD]

- description = Gap

- keywords =

- units = $

- format = p

- toplistable = 1

- parent_code =

Gap [GUP]

Gap [GUP] Gap [GUR]

Gap [GUR]