Dividend

Table of Contents

Understanding the Dividend Filter

Dividends represent a portion of a company's profits that are distributed to its shareholders as a reward for their investment in the company. When a company generates earnings, it can choose to reinvest them in the business for growth or distribute them to shareholders in the form of dividends.

Most cash dividends are paid out on a quarterly basis, meaning that shareholders receive dividend payments every three months. However, some companies may pay dividends annually, semi-annually, or even monthly, depending on their dividend policy and financial situation.

This dividend value represents the last dividend paid out by the company. It indicates the amount of dividend per share that was distributed to shareholders in the most recent dividend payment.

Dividend Filter Settings

Configuring the "Dividend" filter is simple and can be done within the Window Specific Filters Tab of the Configuration Window in your Alert/Top List Window.

Here's how to set up the filter in your configuration window:

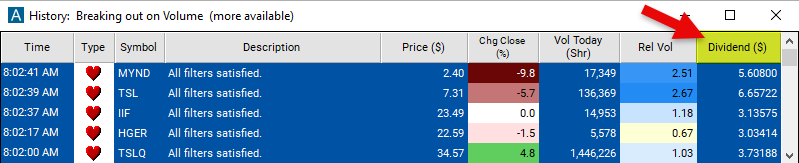

- Set the minimum value to 3 to see only stocks where the dividend is at least $3 per share.

Using the Dividend Filter

The "Dividend" filter can be used in various trading strategies, including:

Dividend Growth Investing: Investors focus on companies with a history of consistently increasing their dividend payments over time. By investing in dividend growth stocks, investors aim to benefit from both increasing income streams and potential capital appreciation as the company's dividends grow. Dividend growth investing often involves a long-term approach, emphasizing the compounding effect of reinvested dividends.

Dividend Capture Strategy: Traders aim to capture dividend payments by buying shares of a stock just before its ex-dividend date and selling shortly afterward. The ex-dividend date is the date on which the stock trades without the dividend, meaning investors who purchase shares on or after this date are not entitled to the upcoming dividend payment. Traders seek to profit from the price increase leading up to the ex-dividend date and then exit the position to avoid holding through the dividend payment.

Dividend Yield Strategy: This strategy involves selecting stocks with high dividend yields relative to their share prices. Investors seek to generate income by holding dividend-paying stocks that offer attractive yields compared to other investment options, such as bonds or savings accounts. Dividend yield is calculated by dividing the annual dividend per share by the stock price.

FAQs

What is a dividend?

- A dividend is a distribution of a portion of a company's earnings to its shareholders. It represents a reward for owning shares in the company and is typically paid out regularly, often quarterly or annually.

Why do companies pay dividends?

- Companies pay dividends to distribute profits to shareholders, provide them with income, and demonstrate financial stability and confidence in future earnings. Dividend payments can also attract investors seeking income and contribute to shareholder loyalty.

How are dividend amounts determined?

- The amount of dividends paid by a company is determined by its board of directors, taking into account various factors such as profitability, cash flow, growth prospects, and the company's dividend policy. The board may consider retaining earnings for reinvestment in the business or returning them to shareholders as dividends.

Filter Info for Dividend [Dividend]

- description = Dividend

- keywords = Fundamentals Changes Daily

- units = $

- format = 5

- toplistable = 1

- parent_code =