Current Debt

Table of Contents

- Understanding the Current Debt Filter

- Current Debt Filter Settings

- Using the Current Debt Filter

- FAQs

Understanding the Current Debt Filter

Debt refers to the amount of money a company owes to external parties, typically in the form of loans, bonds, or other financial obligations. It represents funds borrowed by the company that must be repaid over time, usually with interest.

Significance in Stock Trading: Debt plays a crucial role in evaluating a company's financial health and risk profile. While debt can be used to finance growth and expansion, excessive debt levels can increase financial risk and impact profitability, especially during economic downturns.

Current Debt Filter Settings

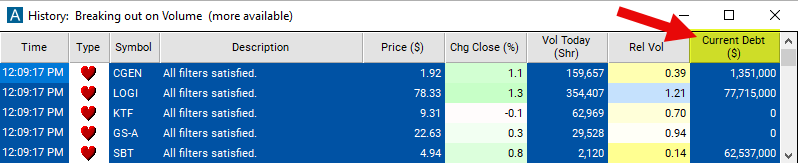

Configuring the "Current Debt" filter is simple and can be done within the Window Specific Filters Tab of the Configuration Window in your Alert/Top List Window.

Here's how to set up the filter in your configuration window:

- Set the maximum value to 100,000,000 to see only stocks with a current debt of $100,000,000 or less.

Using the Current Debt Filter

The "Current Debt" filter can be used in various trading strategies, including:

Debt-to-Equity Ratio Comparison: Compare the debt-to-equity ratios of different companies within the same industry or sector. Focus on companies with lower debt-to-equity ratios compared to their peers, as they may have stronger financial health and lower financial risk. Look for companies with manageable levels of debt relative to their equity base.

Debt-Free Investing: Screen for companies with zero or very low levels of debt using the debt filter. Debt-free companies often have more stable balance sheets, lower financial risk, and greater flexibility in managing their capital. Consider investing in debt-free companies, especially if they demonstrate consistent profitability and growth.

Debt Reduction Trends: Monitor companies that are actively reducing their debt levels over time. Look for companies that have been paying down their debt, refinancing at lower interest rates, or implementing strategies to improve their debt-to-equity ratios. Companies with improving debt metrics may be viewed favorably by investors and could experience stock price appreciation.

FAQs

Why is debt important in stock trading?

- Debt is crucial in stock trading because it directly impacts a company's financial health, risk profile, and potential for growth or distress. By analyzing a company's debt levels, traders can assess its ability to meet its debt obligations, evaluate its financial stability, and make informed investment decisions.

How does a company's debt affect its stock price?

- A company's debt can influence its stock price in various ways. High debt levels may increase financial risk and uncertainty, leading to investor concerns about the company's ability to meet its debt obligations. This can result in lower stock prices as investors demand higher returns to compensate for the increased risk. Conversely, if a company effectively manages its debt and demonstrates strong debt repayment capacity, it may enhance investor confidence and support higher stock valuations.

What are the risks associated with investing in companies with high debt levels?

- Investing in companies with high debt levels carries several risks, including heightened financial leverage, increased interest expenses, potential credit rating downgrades, and greater vulnerability to economic downturns or industry-specific challenges. High debt levels can limit financial flexibility, constrain growth opportunities, and exacerbate financial distress during adverse market conditions.

Filter Info for Current Debt [Debt]

- description = Current Debt

- keywords = Fundamentals Changes Daily

- units = $

- format = 0

- toplistable = 1

- parent_code =