Cash / Debt Ratio

Table of Contents

- Understanding the Cash Debt Ratio Filter

- Cash Debt Ratio Filter Settings

- Using the Cash Debt Ratio Filter

- FAQs

Understanding the Cash Debt Ratio Filter

The cash debt ratio is a financial metric used to assess a company's liquidity and leverage by comparing its cash holdings to its total debt obligations. Here's a detailed explanation of the "Cash/Debt Ratio" filter:

Definition: The cash debt ratio is calculated by dividing a company's cash reserves by its total debt. The formula for the cash debt ratio is: Cash / Debt

This ratio provides insights into the company's ability to meet its debt obligations using its available cash resources.

Interpretation:

Larger Value: A larger cash debt ratio indicates that the company has a higher level of cash relative to its total debt. This suggests that the company has sufficient liquid assets to cover its debt obligations comfortably. Companies with larger cash debt ratios are generally considered financially stronger and less reliant on external financing to meet their debt obligations.

Smaller Value: Conversely, a smaller cash debt ratio suggests that the company has lower cash reserves relative to its total debt. This indicates higher leverage and may raise concerns about the company's ability to manage its debt payments, especially during periods of financial stress or economic downturns. Companies with smaller cash debt ratios may be perceived as more leveraged and potentially riskier investments.

Traders use the cash debt ratio as a quick measure of a company's liquidity and financial strength. A higher cash debt ratio is generally viewed positively, as it indicates that the company has more cash on hand to cover its debt obligations. However, it's essential to consider the context and industry norms when interpreting the cash debt ratio. Different industries may have varying levels of cash holdings and debt obligations, so it's crucial to compare a company's cash debt ratio to its peers within the same industry.

Cash Debt Ratio Filter Settings

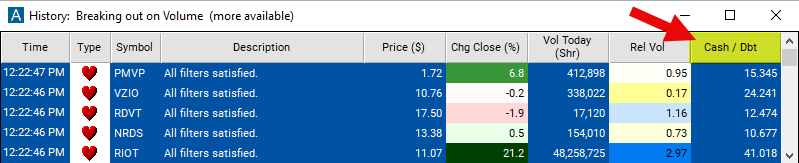

Configuring the "Cash/Debt Ratio" filter is simple and can be done within the Window Specific Filters Tab of the Configuration Window in your Alert/Top List Window.

Here's how to set up the filter in your configuration window:

- Set the minimum value to 10 to see only stocks with a strong cash/debt ratio of at least 10/1.

Using the Cash Debt Ratio Filter

The "Cash/Debt Ratio" filter can be used in various trading strategies, including:

Focus on High Cash/Debt Ratio Stocks: Screen for stocks with higher cash/debt ratios compared to their industry peers or historical averages. Companies with ample cash reserves relative to their debt obligations may be better positioned to weather economic downturns, pursue growth opportunities, and withstand financial shocks. Consider investing in companies with strong liquidity positions and favorable cash/debt ratios.

Contrarian Approach: Identify companies with relatively low cash/debt ratios compared to their peers but with strong fundamental characteristics and growth prospects. These companies may be undervalued or overlooked by the market due to concerns about their leverage. If the company's financial health and growth potential outweigh the perceived risks, consider taking a contrarian stance and investing in undervalued stocks with potential for revaluation.

Sector Rotation Strategies: Analyze cash/debt ratios across different sectors and industries to identify sector rotation opportunities. Shift focus towards sectors with higher cash/debt ratios or sectors where companies are actively reducing their debt levels. Conversely, consider reducing exposure to sectors with lower cash/debt ratios or sectors facing increased financial risk due to excessive leverage.

FAQs

What exactly does the cash/debt ratio indicate?

- The cash/debt ratio measures a company's liquidity and leverage by comparing its cash reserves to its total debt. A higher cash/debt ratio indicates stronger liquidity, as the company has more cash available relative to its debt obligations. Conversely, a lower ratio suggests higher leverage and potentially greater financial risk.

How does the cash/debt ratio impact a company's financial health?

- The cash/debt ratio is a key indicator of a company's financial strength and risk profile. A higher ratio indicates that the company has ample cash reserves to cover its debt obligations, enhancing its ability to weather economic downturns or unexpected expenses. In contrast, a lower ratio may signal liquidity constraints and increase the company's vulnerability to financial distress.

What is considered a favorable cash/debt ratio?

- There is no universal threshold for what constitutes a "good" cash/debt ratio, as it can vary depending on factors such as industry norms, business model, and market conditions. However, generally, a higher cash/debt ratio is viewed more favorably, as it indicates stronger liquidity and financial flexibility.

How do I interpret changes in a company's cash/debt ratio over time?

- Changes in a company's cash/debt ratio over time can provide insights into its evolving financial position and risk profile. An increasing ratio may suggest improving liquidity and financial health, while a decreasing ratio may raise concerns about deteriorating liquidity or increasing leverage.

Filter Info for Cash / Debt Ratio [CashDebt]

- description = Cash / Debt Ratio

- keywords = Fundamentals Changes Daily

- units = Ratio

- format = 3

- toplistable = 1

- parent_code =