Cash

Table of Contents

Understanding the Cash Filter

The "cash" filter in stock trading is a tool used to identify stocks based on the total cash and short-term investments reported on a company's balance sheet as of the most recent quarter. Cash and short-term investments represent liquid assets that a company holds, which can include cash reserves, treasury bills, money market funds, and other highly liquid securities.

Here's a detailed explanation of the "cash" filter:

Definition of Cash: Cash refers to the funds held by a company in the form of physical currency, bank deposits, and other liquid assets that can be readily accessed for operating expenses, investments, or other financial obligations.

Calculation of Cash Filter: The "cash" filter calculates the total cash and short-term investments reported on a company's balance sheet as of the most recent quarter. This information is typically disclosed in the company's quarterly financial statements, including the balance sheet or statement of financial position.

Significance in Trading: The cash filter provides insights into a company's liquidity position and financial strength. Companies with ample cash reserves and short-term investments may have greater flexibility to fund operations, pursue growth opportunities, pay dividends, or weather economic downturns. Traders may use the cash filter to identify stocks of companies with strong balance sheets and robust cash positions, which may be more resilient during market volatility or economic uncertainties.

Cash Filter Settings

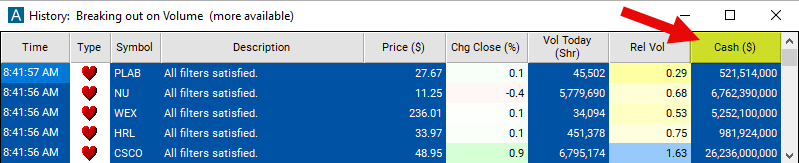

Configuring the "Cash" filter is simple and can be done within the Window Specific Filters Tab of the Configuration Window in your Alert/Top List Window.

Here's how to set up the filter in your configuration window:

- Set the minimum value to $500,000,000 to filter for stocks reporting a cash balance of $500,000,000 or higher on their most recent quarterly balance sheet.

Using the Cash Filter

The "Cash" filter can be used in various trading strategies, including:

Quality Investing: Quality investing focuses on identifying fundamentally strong companies with solid financials. Traders using the cash filter can look for stocks with substantial cash reserves relative to their market capitalization or liabilities. This strategy seeks to invest in companies with strong balance sheets, which may be better positioned to weather economic downturns or pursue growth opportunities.

Value Investing: Value investors seek to identify undervalued stocks trading below their intrinsic value. Traders using the cash filter can screen for stocks with high cash levels relative to their current stock price. A company with a significant cash pile that is trading at a discount to its cash value may represent a value investment opportunity.

Safety Investing: Safety investing prioritizes capital preservation and downside protection. Traders using the cash filter can focus on stocks with ample cash reserves, which provide a buffer against financial distress and bankruptcy risk. This strategy aims to invest in companies with a strong financial foundation and lower risk of default.

FAQs

What exactly does the cash filter measure?

- The cash filter measures the total amount of cash and cash equivalents reported on a company's balance sheet as of the most recent quarter. It provides insights into a company's liquidity position and financial strength.

Why is the cash filter important for traders?

- The cash filter is important for traders as it helps assess a company's ability to meet its short-term obligations, pursue growth opportunities, and withstand financial challenges. Companies with substantial cash reserves may be better positioned to navigate market volatility and capitalize on strategic opportunities.

What is considered a high amount of total cash?

- The significance of total cash depends on various factors such as the size and industry of the company, as well as its strategic priorities and growth prospects. Generally, a high amount of total cash is relative to the company's market capitalization, liabilities, and operating expenses.

Filter Info for Cash [Cash]

- description = Cash

- keywords = Fundamentals Changes Daily

- units = $

- format = 0

- toplistable = 1

- parent_code =