Beta

Table of Contents

Understanding the Beta Filter

Beta is a measure of the volatility of a given stock relative to the overall market, usually the S&P 500. Beta describes the sensitivity of an instrument to broad market movements. A beta above 1 is more volatile than the overall market, while a beta below 1 is less volatile. Securities with betas of zero generally move independently of the overall market. And finally, stocks with negative betas tend to move in the opposite direction relative to the broader market. When the S&P tumbles, stocks with negative betas will move higher, and vice versa.

- A beta of 2.50 represents stock price movement that is 150% more volatile than the S&P 500 Index.

- A beta of 1.00 represents stock price movement that has the same volatility as the S&P 500 Index.

- A beta of 0.50 represents stock price movement that is half as volatile as the S&P 500 Index.

- A beta of -0.50 represents stock price movement that is half as volatile of the S&P 500 Index, but the stock price tends to move in the opposite direction.

Beta Filter Settings

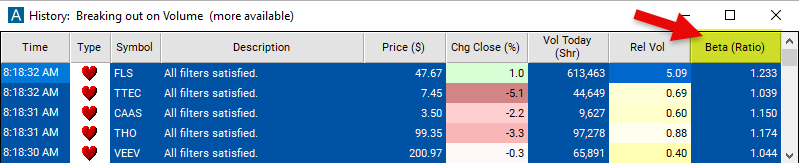

Configuring the "Beta" filter is simple and can be done within the Window Specific Filters Tab of the Configuration Window in your Alert/Top List Window.

Here's how to set up the filter in your configuration window:

- Set the minimum value to 1 and the maximum value to 1.25 to see only stocks in which the price movement has close to the same volatility as the S&P 500 Index.

Using the Beta Filter

The "Beta" filter can be used in various trading strategies, including:

High-Beta Stocks for Momentum Trading: Investors seek out stocks with high betas, indicating greater volatility, to capitalize on short-term price movements. High-beta stocks tend to exhibit stronger momentum, rising more sharply during market upswings and falling more steeply during downturns. Traders may take long positions in high-beta stocks during bullish market conditions, aiming to profit from their amplified price movements.

Low-Beta Stocks for Defensive Trading: Conversely, traders may focus on stocks with low betas, indicating lower volatility, as defensive plays during periods of market uncertainty or downturns. Low-beta stocks tend to offer more stability and may outperform high-beta stocks during market declines. Traders may take long positions in low-beta stocks as a hedge against market volatility or as a strategy to preserve capital during turbulent market conditions.

Beta-Adjusted Position Sizing: Traders adjust their position sizes based on the beta of individual stocks to manage risk exposure and portfolio volatility. Higher-beta stocks receive smaller position sizes to mitigate the impact of their greater volatility on overall portfolio risk. Conversely, lower-beta stocks may receive larger position sizes to achieve a balanced risk-return profile.

FAQs

What is beta?

- Beta is a measure of a stock's volatility relative to the broader market, usually benchmarked against an index like the S&P 500.

How should I interpret a stock's beta value?

- A beta value above 1 indicates that the stock is more volatile than the market. A beta below 1 suggests that the stock is less volatile than the market. A beta of 1 indicates that the stock's volatility matches that of the market. Negative betas imply an inverse relationship with the market, meaning the stock tends to move opposite to market movements.

What factors influence a stock's beta?

- Several factors can influence a stock's beta, including the company's industry, business model, financial leverage, growth prospects, and market capitalization. Stocks in more cyclical industries or with higher leverage may tend to have higher betas, while defensive stocks or those with stable earnings may have lower betas.

Filter Info for Beta [Beta]

- description = Beta

- keywords = Fundamentals Changes Daily

- units = Ratio

- format = 3

- toplistable = 1

- parent_code =