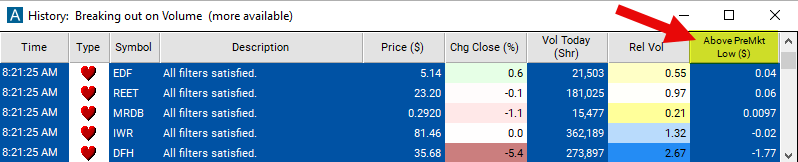

Above Pre-Market Low

Table of Contents

- Understanding the Above Premarket Low Filter

- Above Premarket Low Filter Settings

- Using the Above Premarket Low Filter

- FAQs

Understanding the Above Premarket Low Filter

The "above premarket low" filter is used to identify stocks whose current price is trading above the lowest price reached during premarket trading hours. Premarket trading occurs before the official opening of the regular trading session and allows traders to react to news and events before the market opens.

Here's how the "above premarket low" filter works:

Identification of Premarket Low: The filter first identifies the lowest price reached by a stock during the premarket trading session. This includes trading that occurs before the official market open.

Comparison with Current Price: The filter then compares the current price of the stock to the premarket low. If the current price is above the premarket low, the stock meets the criteria of being "above premarket low."

This filter is available before the market is open, while the market is open and during the post market session.

Above Premarket Low Filter Settings

The settings of each Trade Ideas filter are defined in the Window Specific Filters Tab located in the Configuration Window of your Alert/Top List Window.

Here is how to setup the filter in your configuration window:

- Use negative numbers to find stocks trading below the pre-market low of the day.

- Set the max above pre-market low filter to a small number to find stocks which are current trading close to the pre-market low of the day.

For example, set the max above pre-market low filter to 0.08 to find stocks which are trading no more than 8 cents above the low of the day.

Using the Above Premarket Low Filter

Several trading strategies can be employed with the Above Premarket Low filter. Here are a few examples:

Breakout Trading: Traders may consider entering long positions when a stock breaks out above its premarket low during the regular trading session. This strategy assumes that the breakout above the premarket low could signal the start of an upward trend continuation.

Support Level Bounce: Traders may enter long positions when a stock bounces off its premarket low, considering it a support level. They may anticipate that the stock will rebound from the premarket low and continue to move higher during the regular trading session.

Intraday Momentum: Traders may look for stocks trading above their premarket lows with increasing volume and momentum during the regular trading session. They may enter long positions to ride the intraday momentum and capture short-term gains.

FAQs

What does the "above premarket low" filter indicate?

- This filter identifies stocks whose current price is trading above the lowest price reached during premarket trading hours. It suggests that the stock has found support at the premarket low and may have further upside potential during the regular trading session.

How is the premarket low determined?

- The premarket low is typically the lowest price a stock reaches during premarket trading hours, which occur before the official market open.

Can the "above premarket low" filter be used for both long and short trading strategies?

- While the filter primarily identifies potential buying opportunities, it can also be used to avoid short selling at discounted prices. Traders may consider entering long positions based on stocks trading above their premarket lows, or they may avoid short selling if a stock rebounds from its premarket low.

What other factors should traders consider when using the "above premarket low" filter?

- Traders should consider other factors such as volume trends, price patterns, support and resistance levels, and overall market sentiment before making trading decisions based solely on the "above premarket low" filter.

Filter Info for Above Pre-Market Low [AboveLowPre]

- description = Above Pre-Market Low

- keywords = Highs and Lows Single Print

- units = $

- format = p

- toplistable = 1

- parent_code =