Change From 20 Period SMA (60m)

Table of Contents

- Understanding the Change From 20 Period SMA 60 Minute Filter

- Change From 20 Period SMA 60 Minute Filter Settings

- Using the Change From 20 Period SMA 60 Minute Filter

- FAQs

Understanding the Change From 20 Period SMA 60 Minute Filter

The "Change From 20 Period SMA 60 Minute Filter" is a valuable tool for traders focusing on longer-term intraday trading strategies. By comparing the current price of a stock to its 20-period Simple Moving Average (SMA) on a 60-minute chart, this filter provides insights into the stock's momentum over the last 20 hours. It helps traders identify potential entry and exit points based on changes in momentum within a single trading session.

Here’s an in-depth look at how this filter operates:

Simple Moving Average (SMA)

20-Period SMA on a 60-Minute Chart: Calculates the average of the closing prices for the last 20 sixty-minute periods, smoothing out price data over approximately the last 20 hours of trading to identify longer-term trends.

Calculation: The filter expresses its values in percentage (%), following the formula: Percent Change = ((Last Price - SMA) / SMA) * 100.

A positive result suggests that the stock's current price is above its 20-period SMA, indicating a potential uptrend. Conversely, a negative result indicates that the current price is below the SMA, suggesting a potential downtrend.

Change From 20 Period SMA 60 Minute Filter Settings

Configuring the "Change From 20 Period SMA 60 Minute Filter" is simple and can be done within the Window Specific Filters Tab of the Configuration Window in your Alert/Top List Window.

Here's how to set up the filter in your configuration window:

-

Adjust the minimum value to 1 to filter for stocks currently positioned above their 20-period SMA on a 60-minute chart.

-

Set the maximum value to -1 to focus on stocks currently below their 20-period SMA on a 60-minute chart.

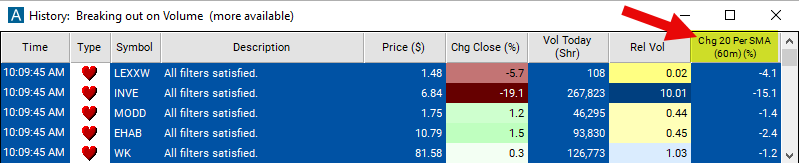

Using the Change From 20 Period SMA 60 Minute Filter

The "Change From 20 Period SMA 60 Minute Filter" can be used in various trading strategies, including:

Long-Term Trend Following Strategy: Identify potential long-term trend opportunities based on the relationship between the current price and the 20-period SMA. Enter trades when the price remains consistently above the SMA for an extended period, indicating a strong uptrend, and sell when the price remains consistently below the SMA, indicating a strong downtrend.

Position Trading Strategy: Use the 20-period SMA as a reference point for establishing long-term positions in alignment with the prevailing trend. Enter trades when the price retraces back to the SMA during an uptrend or bounces off the SMA during a downtrend, anticipating a continuation of the trend.

Breakout Trading Strategy: Identify potential breakout opportunities when the price breaks decisively above or below the 20-period SMA after a period of consolidation. Enter trades when the price breaks above the SMA during an uptrend or below the SMA during a downtrend, anticipating a continuation of the breakout momentum.

FAQs

How does the "Change From 20 Period SMA (60m)" filter differ from shorter or longer timeframe versions?

- The 60-minute version provides insights into longer-term intraday momentum, whereas shorter timeframe versions offer perspectives on shorter-term trends, and longer timeframe versions provide insights into trends over extended periods.

Is the "Change From 20 Period SMA (60m)" filter suitable for all traders?

- This filter is most suitable for traders focusing on longer-term intraday trading strategies. Traders with shorter-term trading horizons may find shorter timeframe versions more relevant, while those focused on longer-term investments may prefer longer timeframe versions.

How should I interpret significant positive or negative changes from the 20-period SMA on a 60-minute chart?

- Significant positive changes suggest upward momentum and potential buying opportunities, while significant negative changes indicate downward momentum and potential selling opportunities. However, always use additional indicators for confirmation.

Can I use the "Change From 20 Period SMA (60m)" filter for swing trading?

- Yes, the filter can be used for swing trading by identifying potential entry and exit points based on changes in momentum relative to the 20-period SMA on a 60-minute chart. Look for opportunities to enter trades in the direction of the prevailing trend indicated by the SMA.

Filter Info for Change From 20 Period SMA (60m) [60SmaLa20]

- description = Change from 20 Period SMA (60m)

- keywords = Fixed Time Frame Moving Average

- units = %

- format = 1

- toplistable = 1

- parent_code = 2SmaLa20