Check Mark

Table of Contents

Understanding the Check Mark Alert

The check mark pattern is defined by higher highs followed by a pullback followed by even higher highs. This pattern is most commonly seen as a continuation pattern.

These patterns are based on daily highs and lows. The exchanges report highs and lows almost exclusively during market hours, so these alerts rarely if ever occur after market. We never report these alerts before the open or in the first three minutes after the open. The last part of the check mark must happen at least three minutes after the open.

Default Settings

By default, the check mark alert will be triggered when a stock exhibits a distinctive check mark continuation pattern—characterized by an initial upward surge, a subsequent pullback, and finally, a reinforced upward movement.

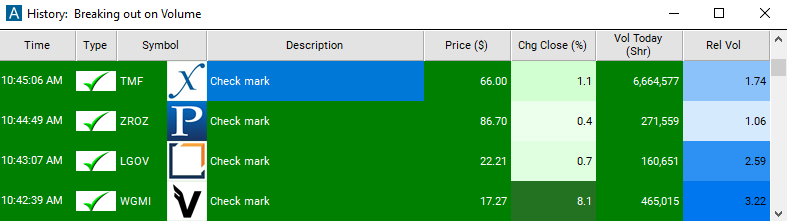

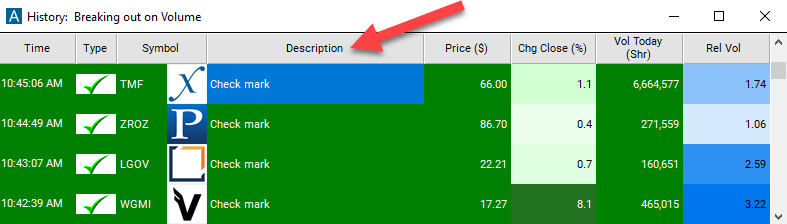

Description Column

The description column will give you more details on this alert.

Alert Info for Check Mark [CMU]

- description = Check mark

- direction = +

- keywords = Highs and Lows Single Print

- flip_code =

Inverted check mark [CMD]

Inverted check mark [CMD] - parent_code =