Yearly Standard Deviation

Table of Contents

- Understanding the Yearly Standard Deviation Filter

- Yearly Standard Deviation Filter Settings

- Using Yearly Standard Deviation in Trading

- FAQs about Yearly Standard Deviation

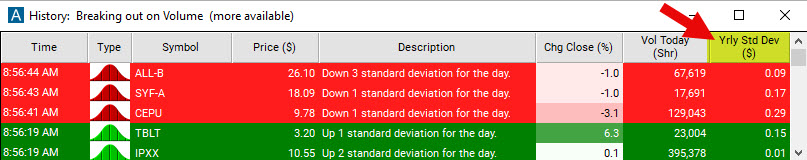

Understanding the Yearly Standard Deviation Filter

A stock’s standard deviation is similar to its Average True Range or its Volatility. Standard deviation represents the average amount the stock's price deviates from the mean price over the year. Therefore, it gives you an idea of how much you might expect the price to fluctuate on a typical day based on past performance. For example, a standard deviation of $5 means that, based on historical data, the stock's price typically moves up or down by about $5 a day.

Our Yearly Standard Deviation Filter is based on the standard formula for standard deviation, but it gives more weight to recent values than to older values, whilst looking at one year’s worth of daily candles. Giving more weight to recent data points means the calculated volatility is more responsive to recent price changes, thus providing a more current representation of the stock's price volatility.

Yearly Standard Deviation Filter Settings

Activating the Yearly Standard Deviation Filter is straightforward. You'll find its settings under the Window Specific Filters Tab in your Alert/Top List Window's Configuration Window.

You can set a minimum and/or maximum value, and stocks that don't fit within your parameters are automatically excluded from your scan results.

-

To find stocks that are moving at least $4 on a typical day in terms of yearly standard deviations, add the Yearly Standard Deviation Filter to your scan and enter 4 in the minimum field in the Windows Specific Filters Tab.

-

To find stocks that are moving no more than $3 in terms of yearly standard deviations, add the Yearly Standard Deviation Filter to your scan and enter 3 in the maximum field in the Windows Specific Filters Tab.

Using Yearly Standard Deviation in Trading

Trading decisions often hinge upon understanding the volatility of a stock. The Yearly Standard Deviation Filter provides traders with a key measure of such volatility, helping them comprehend the average degree to which a stock's price deviates from its mean price over a one-year period. By using this filter, traders can gauge the typical daily price fluctuation based on historical data, making it an essential tool for risk management and trading strategy development.

- Identifying Volatile Stocks: The Yearly Standard Deviation Filter can help traders identify particularly volatile stocks. For instance, by setting a high minimum value in the filter, traders can discover stocks that typically experience significant daily price movements. These stocks might be more suitable for short-term trading strategies where profit is made from sizable price swings within a short time frame.

Understanding a stock's volatility is crucial for traders in managing risk, as it provides insights into the price fluctuations that a stock might experience. There are several ways in which volatility can be used for risk management:

- Setting Stop-Loss and Take-Profit Levels: Volatility can greatly influence where traders set their stop-loss and take-profit levels. For stocks with high volatility, traders might set wider stop-loss and take-profit levels to avoid being prematurely stopped out of a position due to the stock's large price swings. On the contrary, for low volatility stocks, traders might set narrower stop-loss and take-profit levels since these stocks are less likely to have large price movements.

- Position Sizing: Traders often adjust the size of their position based on a stock's volatility. If a stock has high volatility, they might choose to invest a smaller portion of their portfolio to limit potential losses if the stock's price moves unfavorably. Conversely, they might invest a larger portion of their portfolio in low volatility stocks, which are generally seen as safer investments.

- Diversification: Volatility information can also help traders diversify their portfolio. By investing in a mix of high and low volatility stocks, they can potentially improve their portfolio's risk-to-reward ratio. High volatility stocks offer the potential for large gains but also carry higher risk, while low volatility stocks generally offer more steady returns.

- Risk-Reward Ratio: Understanding a stock's volatility can help traders determine the potential risk versus reward of a trade. If a stock has high volatility, the potential for both gains and losses can be significant. If a trader is risk-averse, they might prefer to trade stocks with lower volatility, even though the potential gains might also be lower.

Remember, while understanding and managing volatility can help mitigate risk, it doesn't eliminate it entirely. Traders must employ a comprehensive risk management strategy that suits their individual trading goals, risk tolerance, and market outlook.

FAQs about Yearly Standard Deviation

Is there a recommended minimum and maximum value range for the Yearly Standard Deviation Filter?

The minimum and maximum values for the Yearly Standard Deviation Filter should be set according to an individual's trading strategy and risk tolerance. There's no universally recommended range because it depends on your trading objectives, your willingness to assume risk, and the specific market conditions. For instance, a day trader might look for high volatility stocks and set a higher minimum value, while a long-term investor might prefer lower volatility stocks.

How does the Yearly Standard Deviation Filter compare with other measures of volatility, such as the Average True Range or Bollinger Bands?

The Yearly Standard Deviation Filter, Average True Range (ATR), and Bollinger Bands are all measures of volatility, but they highlight different aspects. The Yearly Standard Deviation Filter provides a sense of how much a stock's price deviates from the mean price over a year, with recent data having more weight.

ATR, on the other hand, measures the average range between the high and low prices over a certain period, providing a sense of recent price volatility. Bollinger Bands use standard deviation to plot an envelope around a moving average, providing visual insights into whether current prices are relatively high or low.

How effective is the Yearly Standard Deviation Filter for different types of trading strategies, such as day trading, swing trading, or long-term investing?

The Yearly Standard Deviation Filter can be useful for all types of trading strategies as it gives a measure of the stock's historical volatility. However, its use might be more pronounced in shorter-term strategies like day or swing trading, where understanding daily price fluctuations is crucial. For long-term investing, while understanding volatility is still important, other factors like company fundamentals might be more relevant.

How can a trader use the Yearly Standard Deviation Filter to set more effective stop-loss and take-profit levels?

A trader can use the typical daily price movement (derived from the Yearly Standard Deviation Filter) to set stop-loss and take-profit levels. If a stock typically moves $5 a day, a trader might set their stop loss or take profit beyond this range to avoid being prematurely stopped out of a trade. The specific levels would also depend on the trader's risk tolerance and trading strategy.

What is the significance of using one year’s worth of daily candles in the Yearly Standard Deviation Filter?

A one-year period is used as it provides a balance between relevance and statistical reliability. It ensures that the measure of volatility is based on a significant amount of data, thus providing a more reliable figure, while also ensuring that the data is recent enough to still be relevant to the current market conditions.

Does the Yearly Standard Deviation Filter account for changes in the stock's volatility throughout the year?

The Yearly Standard Deviation Filter gives more weight to recent price movements, which means it does account for changes in volatility to some extent. However, it is always important to consider other factors that might affect volatility, such as earnings releases, market news, or changes in market sentiment.

How effective is the Yearly Standard Deviation Filter in a trending market versus a ranging market?

The Yearly Standard Deviation Filter measures volatility, not the direction of price movements. Therefore, it can be effective in both trending and ranging markets. In a trending market, a high standard deviation might confirm the strength of the trend. In a ranging market, a lower standard deviation might confirm the lack of momentum.

What happens if a stock has insufficient historical data for a full year? Can the Yearly Standard Deviation Filter still be applied?

If a stock has insufficient historical data for a full year, the Yearly Standard Deviation Filter might not provide a reliable measure of volatility and display a blank data column.

Does the Yearly Standard Deviation Filter provide any indication of the likelihood of extreme price movements or "black swan" events?

The standard deviation, by definition, measures the average deviation of price movements from the mean. While it can help to gauge the typical level of volatility, it does not specifically predict the likelihood of extreme price movements or "black swan" events.

What are the limitations or drawbacks of the Yearly Standard Deviation Filter?

One of the main limitations of the Yearly Standard Deviation Filter is that it's a measure of past volatility and does not predict future price movements. Additionally, it does not provide any information about the direction of price movements. Lastly, while the filter gives more weight to recent data, it still uses a full year's worth of data, which means it may not be as responsive to sudden changes in volatility.

Can the Yearly Standard Deviation Filter be used to identify potential breakout stocks?

While the Yearly Standard Deviation Filter can help identify stocks with higher volatility, it does not specifically predict breakouts. Traders looking for breakout stocks might want to combine the standard deviation filter with other technical analysis tools that can help identify potential breakouts, such as trend lines, price patterns, or volume indicators.

Filter Info for Yearly Standard Deviation [YSD]

- description = Yearly Standard Deviation

- keywords = Changes Daily

- units = $

- format = p

- toplistable = 1

- parent_code =