Change in 20 Days

Table of Contents

- Understanding the Change in 20 Days Percent Filter

- Change in 20 Days Percent Filter Settings

- Using the Change in 20 Days Percent Filter

- FAQs

Understanding the Change in 20 Days Percent Filter

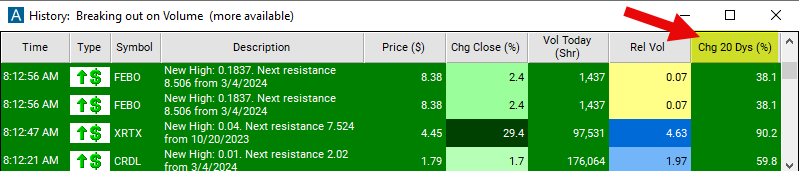

The "change in 20 days (%)" filter compares the current price to the price 20 days ago, measured in percentage. These are trading days, not calendar days. So this filter looks at changes in the last month.

The formula for the % version is (new value – old value) / old value * 100.

The current price is based on the last print. There is no smoothing or averaging. This updates before, during, and after market hours.

The old price is always based on the close. If you are look at the Up in 20 Days filter, then you are comparing the current price to the close 21 days ago. If you are looking at this filter at the open, then you will see the price change for exactly 20 days. If you are looking at this filter one hour after the open, then you will see the change for 20 days and one hour. At lunch time you will see the change for 20½ days. At the close you will see the change for 21 days.

Change in 20 Days Percent Filter Settings

The settings of each Trade Ideas filter are defined in the Window Specific Filters Tab located in the Configuration Window of your Alert/Top List Window.

Here is how to setup the filter in your configuration window:

- Set the min value to 25 to see stocks which are up at least 25% from 20 days ago.

Using the Change in 20 Days Percent Filter

Several trading strategies can be employed with the Change in 20 Days Percent filter. Here are a few examples:

Trend Following: Traders aim to capitalize on the continuation of existing price trends. If the change in the stock's price over the past twenty days indicates a consistent upward or downward trend, traders may consider entering positions in the direction of the trend. For example, if the stock has experienced a significant positive change over the twenty-day period, it may signal an uptrend, prompting traders to enter long positions. Conversely, if there's a significant negative change, it may indicate a downtrend, leading traders to consider short positions.

Reversal Trading: Traders aim to identify potential reversal points in the price movement. If the change in the stock's price over the past twenty days suggests that the price has moved significantly in one direction and may be nearing exhaustion, traders may look for signs of a reversal. For example, if the stock has experienced a strong uptrend over the past twenty days and the change is showing signs of slowing down or reversing, traders may anticipate a potential reversal and adjust their positions accordingly.

Volatility Trading: Traders aim to profit from short-term price fluctuations and increased volatility. If the change in the stock's price over the past twenty days indicates increased volatility, traders may look for opportunities to enter short-term trades to capitalize on price movements. They may employ strategies such as scalping or day trading to take advantage of short-term price fluctuations.

FAQs

What does "change in 20 days (%)" mean?

- "Change in 20 days (%)" refers to the difference in the stock's price between the current trading day and the closing price twenty trading days ago, measured in percentage. It indicates how much the stock's price has changed over the twenty-day period.

What does a positive/negative "change in 20 days (%)" indicate?

- A positive "change in 20 days (%)" denotes a percentage increase in the stock's price over the twenty-day period, while a negative change indicates a percentage decrease. The magnitude of the percentage change reflects the extent of the price movement.

How is the "change in 20 days (%)" calculated?

- The calculation involves subtracting the stock's price from twenty trading days ago from the current price to determine the difference in price over the twenty-day period. This difference is then divided by the price from twenty days ago and multiplied by 100 to express the change as a percentage.

Filter Info for Change in 20 Days [U20DP]

- description = Change in 20 Days

- keywords = Single Print

- units = %

- format = 1

- toplistable = 1

- parent_code = U5DD